VVMC Property Tax refers to property tax levied by the Vasai-Virar Municipal Corporation VVMC. The VVMC is the governing body responsible for managing the Vasai-Virar Municipal Corporation in Maharashtra, India. Property tax is a type of tax that property owners must pay as an annual subscription to the municipal corporation for their properties in the corporation’s jurisdiction. The Vasai Virar City Municipal Corporation (VVMC) website is a platform where residents can easily pay property tax. Additionally, customers can use it to submit a variety of service requests. You can quickly pay VVMC property tax in the Vasai-Virar area by following the procedures explained by 99acres. Real estate under the jurisdiction of the Vasai Virar Municipal Corporation (VVMC) is subject to taxation.

- What is VVMC Property Tax Full Form?

- What are the Benefits of Vasai Virar Municipal Corporation Property Tax?

- How to Calculate VVMC Property Tax?

- VVMC Property Tax Bill?

- How To Pay VVMC Property Tax Online Payment?

- How To Pay VVMC Property Tax Offline Payment?

- VVMC Property Tax Receipt Download?

- What is the Due Date of VVMC Property Tax?

- What are the Late Payment Penalties of VVMC Property Tax?

- How to Change Name in Property Tax?

- How to Change Name in Property Tax Online?

- How to Search Property Tax by Name?

- What is the Age Factor in Property Tax?

- What is SUC in Property Tax?

- Vasai Virar Municipal Corporation Zone List?

- Key Terms Related To Vasai Virar Municipal Corporation Property Tax?

- Conclusion

- FAQ’s

- 1. What is VVMC Property Tax?

- 2. What is the complete form of VVMC?

- 3. What are the benefits of paying VVMC property tax?

- 4. How is VVMC property tax calculated?

- 5. How can I get my VVMC property tax bill?

- 6. How do I pay VVMC property tax online?

- 7. How do I pay VVMC property tax offline?

- 8. How can I download my VVMC property tax receipt?

- 9. What is the due date of VVMC property tax?

- 10. What is SUC in property tax?

What is VVMC Property Tax Full Form?

The complete form of VVMC in “VVMC property tax” is Vasai-Virar Municipal Corporation. Therefore, VVMC property tax refers to the luxury tax levied by the Vasai-Virar Municipal Corporation.

What are the Benefits of Vasai Virar Municipal Corporation Property Tax?

Paying the Vasai Virar Municipal Corporation (VVMC) luxury tax brings many benefits, from the revenue earned to the development of the residents and the area. Here are the main benefits:

1. Provides nourishment for infrastructure growth: systems, bridges, and public relations development.

2. Public services: contributes to waste management, water supply, and system lighting management.

3. National Amenities: Maintains gardens, book collections, and recreation centers.

4. Health and Purity: The Agya method, promoted through the luxury tax, ensures the purity and impurity of the environment, contributing to a healthier and cleaner living space.

5. Education and Wellbeing: Helps with schools, welfare schemes and social services.

6. Urban Planning: Enables efficient urban planning and sustainable development.

7. Law and Order: Assists police, fire services, and emergency response.

8. City Maintenance: Performs real-time repairs and maintenance.

9. Discounts & Rebates: Offering instant settlement, saving money possible on settlement.

10. Legal Compliance: Avoids penalties and ensures compliance with regulations.

How to Calculate VVMC Property Tax?

To calculate VVMC (Vasai Virar Municipal Corporation) property tax, it is important to understand the meaning and condition of the property being availed from the municipal corporation. Here is a simplified guide:

Step 1: Know the Formula VVMC property tax is generally calculated using the following formula

Property Tax = Rate of Tax × Property Area × Usage Factor × Age Factor

Step 2: Components Explained:

Rate of Tax: The tax rate is determined by the VVMC and may vary depending on the type of property (residential, commercial, industrial)

Property Area: This states the area of growth of the property. The larger the area, the higher the tax will be.

Utilisation: This depends on how the property is exploited (self-occupied, rented, commercial use). Different usage types have different rates.

Age factor: Depreciation on aging value may reduce tax due to favorable circumstances.

Step 3: Steps to Calculate

1. Determine the property’s surface area: Measure the entire constructed surface of your property in square meters or square feet.

2. Compare Tax Rates: Compare the applicable tax rates given by VVMC for your nature of property (Residential, Commercial).

3. Determine Utilization: Find out the factor applicable based on the utilization of the property (self-occupied, rented, etc.).

4. Consider wear factor: Apply wear-and-tear depreciation, if appropriate.

5. Multiply the values: Multiply the tax rate by the property’s surface, then by the use factor, and finally by the age factor to calculate the timely property tax accumulation.

Step 4: Example Calculation

If you have a residential property with:

- Area: 100 sq. meters

- Tax Rate: ₹10 per sq. meter

- Usage Factor: 1.0 (self-occupied)

- Age Factor: 0.8 (older property)

The calculation would be:

Property Tax = ₹10 × 100 × 1.0 × 0.8 = ₹800 annually

Step 5: Check VVMC Resources You can also use the online property tax calculator provided by VVMC on their official website for more accurate and personalized estimations.

VVMC Property Tax Bill?

The VVMC property tax bill is a letter issued by the Vasai-Virar Municipal Corporation containing the details of the property tax payable for a particular property. It contains several important details:

1. Property details: Address and identification of the property.

2. Owner details: Owner’s name and contact information.

3. Tax details: Assessment year, tax rate, property area, total amount, and any exemptions.

4. Payment details: This section outlines the due date, various payment methods, and the penalties for late payment.

5. Instructions: How to pay and contact information for questions.

How to get:

Online: Through the VVMC website.

Physical: The bill will be sent to your registered address or can be collected from the VVMC office.

Mobile app: Check if VVMC provides an app for access.

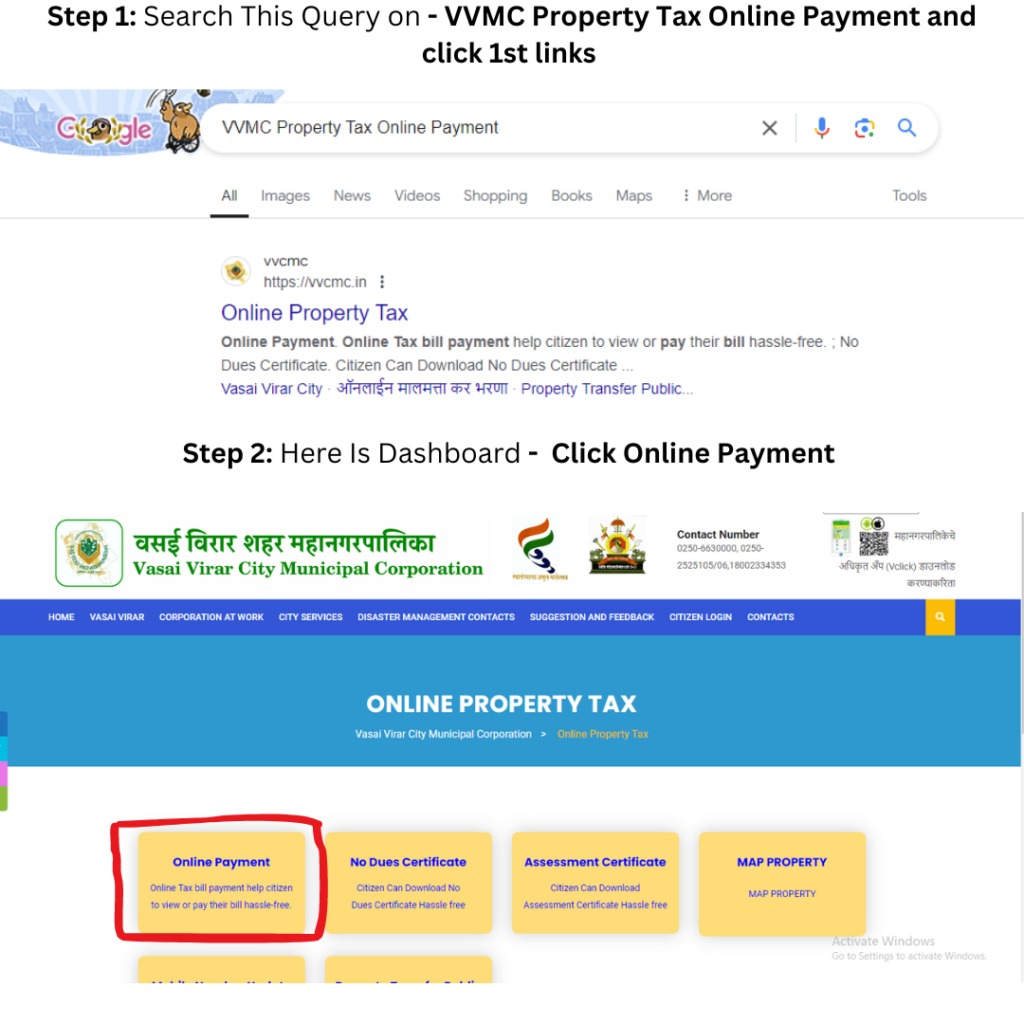

How To Pay VVMC Property Tax Online Payment?

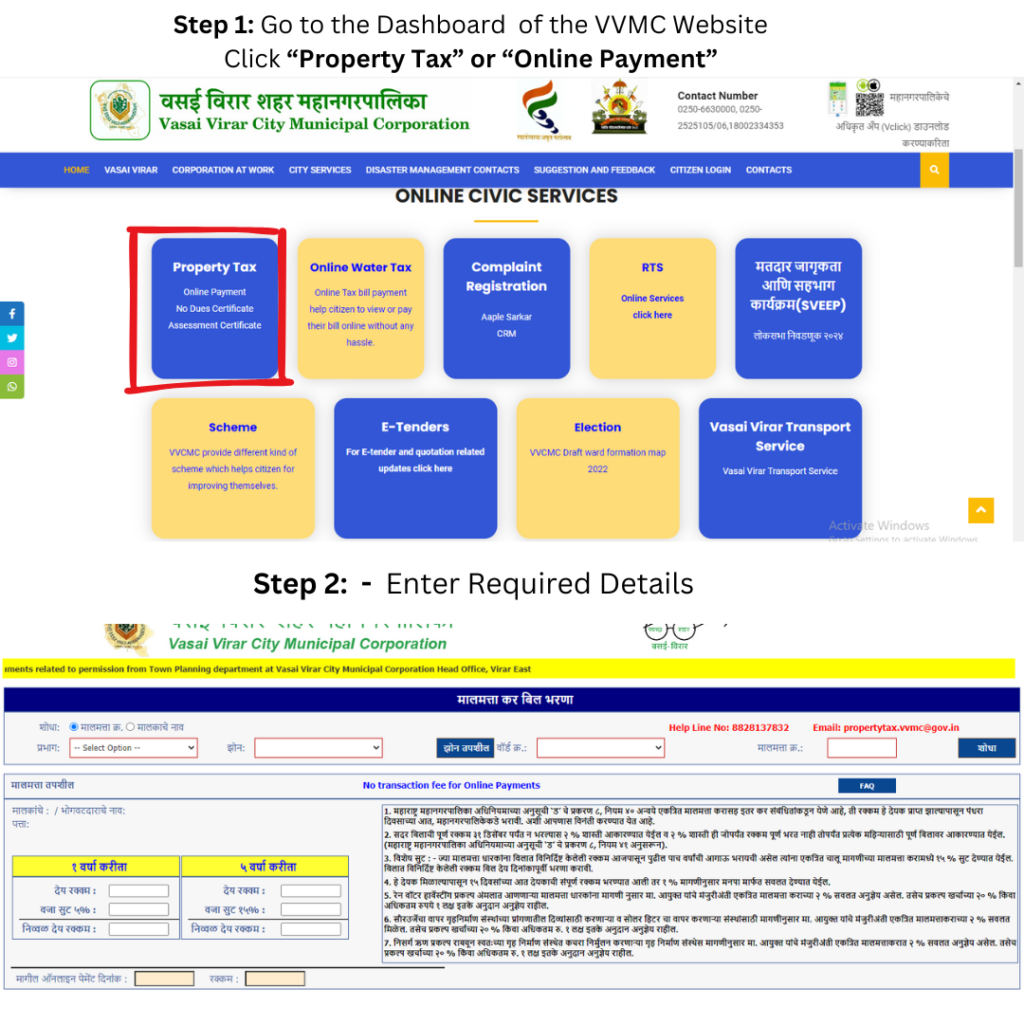

Step 1: Go to the official website of VVMC. Visit the official website of Vasai-Virar Municipal Corporation.

Step 2: Go to Property Tax Section: Find the “Property Tax” or “Online Payment” section on the homepage or under the Services menu.

Step 3: Enter Property Details: Enter your Property ID, Lagai Number or various mandatory details to get your property tax bill.

Step 4: Verify details: Verify the accuracy of the property tax bill, including the amount payable and applicable discounts or concessions.

Step 5: Choose the payment method: Select your preferred payment method (Credit/Debit Card, Net Banking, etc.).

Step 6: Make the payment: Follow the instructions to complete the payment You may be required to enter a payment history and document the transaction.

Step 7: Download Receipt: After the successful membership fee, download or print the payment receipt for your records.

Step 8: Follow-up: Unambiguous, meaning that you will receive a follow-up email or SMS (if available) as proof of payment.

How To Pay VVMC Property Tax Offline Payment?

To make offline payment of VVMC property tax, follow these steps:

Step 1: Visit V.V.M.C. Office: Visit the nearest V.V.M.C. office or collection center.

Step 2: Get Bill: Get your property tax bill if not already received.

Step 3: Fill Form: Complete the payment form with property details.

Step 4: Make Payment: Use cash or cheque (payable to Vasai-Virar Municipal Corporation).

Step 5: Get Receipt: Take the receipt as proof of payment.

VVMC Property Tax Receipt Download?

To download your VVMC property tax receipt online, complete these steps:

Step 1: Visit the official website of VVMC: Visit the official website of Vasai-Virar Municipal Corporation.

Step 2: Access the Property Tax section: Find the “Property Tax” or “Online Payment” paragraph and click on it.

Step 3: Submit Property Report: Enter your property ID, representation shape, or other required details to receive your subscription report.

Step 4: Find the receipt: Find the payment you need a receipt for and choose the option to view or download the receipt.

Step 5: Download or Print: Download the receipt in PDF format or print it directly from the website.

What is the Due Date of VVMC Property Tax?

The due date of VVMC property tax is generally on March 31 every year. However, the due dates may vary from year to year, and it is advisable to check the bill itself or the VVMC website for the exact due date for the current year.

What are the Late Payment Penalties of VVMC Property Tax?

The penalties for late payment of VVMC property tax usually include the following:

1. Interest Charged: A percentage of the unpaid tax amount is charged as interest for each subscription month, usually about 2% per month.

2. Penalty charges: A specific penalty amount may be added if payment is not made by the due date.

3. Legal action: Continued non-payment may lead to legal action, including sealing property or recovery proceedings you can also Contact Our Expert Legal Adviser.

How to Change Name in Property Tax?

To exchange names in property tax records of Vasai-Virar Municipal Corporation (VVMC), follow these steps immediately:

Step 1: Get the Application Form: Visit the VVMC office or download the Name Change Application Form from the VVMC website.

Step 2: Fill the form: Fill out the form with accurate property details and the new name to be updated.

Step 3: Providing the necessary documents:

Proof of ownership: Sale deed, donation document, or other incidental documents.

Recognition support: A copy of the identity proof of the new owner (Aadhaar, PAN, etc.).

NOC: No objection document from the subsequent owner (if applicable).

Death certificate: If the conversion is due to succession.

Mutation deed: If applicable.

Step 4: Submit Application: Submit the completed form along with the required documents to the VVMC office.

Step 5: Clear the Fees: Pay the processing fee, if applicable, at the VVMC office or through their payment portal.

Step 6: Verification Procedure: VVMC will verify the device and process the rename request.

Step 7: Collect updated records: Once the transfer is approved, you will receive the updated property tax record with the new name.

How to Change Name in Property Tax Online?

To change the name in VVMC property tax records online, please fulfill these steps:

Step 1: Visit VVMC website: Visit the official website of Vasai-Virar Municipal Corporation.

Step 2: Go to the Property Tax section: Find the “Property Tax” section, where services such as name change may be listed.

Step 3: Look for name change options: Find options like “Name Change” or “Property Mutation” under Property Tax Services.

Step 4: Fill online application: Complete the online form with the required details, including your new name.

Step 5: Upload required documents:

- Scan and upload the necessary documents, such as:

- Proof of ownership (e.g., sale deed).

- Identity proof of the new owner.

- NOC from the previous owner (if applicable).

- Death certificate (if applicable for inheritance).

Step 6: Pay Processing Fee: Pay any applicable fees online through the payment gateway provided.

Step 7: Submit Application: Submit the form and documents online.

Step 8: Verification: VVMC will review your application and verify the documents.

Step 9: Receive confirmation: After approval, you will receive a confirmation, and the name change will be updated in the property tax records.

How to Search Property Tax by Name?

To check property tax clarification by name in Vasai Virar Municipal Corporation (VVMC), please fulfill these conditions:

Step 1: Visit VVMC website: Visit the official website of Vasai-Virar Municipal Corporation.

Step 2: Access the Property Tax Section: Go to the “Property Tax” section on the website.

Step 3: View Search Options: Find the Property Tax Record Search option. It can be selected in the form of “Search by Name” or “Property Tax Search.

Step 4: Enter your name: Enter the name of the property owner in the search field. The name must be entered exactly as it appears in the records.

Step 5: Filter or Select Properties: If more than one result is displayed, use additional filters like Property Address, Ward Number, or Property ID to find unusual properties.

Step 6: View Property Tax Details: Once you have listed a property, you can view the tax details including outstanding balance, due dates and payment history.

Step 7: Download or Print: You can download or print the Property Tax Explanation for your records.

Note:

- Availability: Searching by name may not be available on all municipal websites. If the option is unavailable online, you may need to visit the VVMC office or contact their customer service for assistance.

- Accuracy: Ensure the name is entered correctly, as it appears in the official records, to get accurate results.

What is the Age Factor in Property Tax?

The age factor in property tax refers to the consideration that municipal authorities use to adjust the tax amount based on the property’s age. Here’s how it usually works.

1. Depreciation Effect:

Old properties: As a property gets older, its value decreases. The condition allows the property tax rate or tax rate to reflect this depreciation and the reduction in value.

New properties: Newly constructed or recently renovated properties generally have a higher taxable value, as they have not depreciated as much.

2. Assessment: The Municipal Corporation may apply a percentage reduction in the tax rate or taxable value based on the property’s age. For example, a 20-year-old property may be eligible for a 10% reduction based on age.

3. Objective: The age factor makes it reasonable to assume that older properties may have a lower market value and thus should be subjected to lower property taxes than newer, more valuable possessions.

Example:

If the property tax rate for a new property is ₹10 per sq m, then for an old property (say 20 years old) the adjustment rate may be ₹8 per sq m after applying age condition.

What is SUC in Property Tax?

SUC in property tax usually stands for Sewerage and Municipal Revenue. It is an additional fee levied on property tax bills by municipal corporations to generate funds for the maintenance and improvement of sewerage systems and other urban infrastructure services.

1. Purpose: SUC is collected to defray the costs associated with the maintenance, renovation and improvement of the sewerage system and urban infrastructure within a municipal area.

2. Calculation: SUC is usually calculated as a percentage of the property tax or as a fixed amount based on the size, use, or condition of the property.

3. Including it in the property tax bill: SUC is usually included as a separate line item in the property tax bill along with other fees like water tax, education octroi, or street light tax.

4. Compulsory Payment: Like normal property tax, SUC is compulsory and must be paid within the due date to avoid penalty or interest charges.

Vasai Virar Municipal Corporation Zone List?

Vasai Virar Municipal Corporation (VVMC) zones are administrative divisions within the Vasai-Virar Regional Corporation used for property tax collection and municipal management. These zones help in cleaning and providing services efficiently.

Typical Zones in VVMC:

- Vasai East

- Vasai West

- Virar East

- Virar West

- Nalasopara East

- Nalasopara West

- Palghar

Key Terms Related To Vasai Virar Municipal Corporation Property Tax?

Here are some of the critical conditions related to Vasai Virar Municipal Corporation (VVMC) property tax:

1. Property Tax: Annual tax levied on the property possessor by the VVMC on the basis of value, area, and utilization of the property.

The Assessment Year, the financial year for which wealth tax is calculated and levied, is an important concept for property owners to grasp.

3. Property ID: A unique identification number assigned to each property by VVMC for tax purposes.

4. Tax rate: The rate at which property tax is calculated, which varies depending on the type and use of the property.

5. Usage Factor: A multiplier based on the use of the property (residential, commercial, etc.), which affects the tax calculation.

6. Age factor: Consideration of the property’s age, which may affect the amount of tax due to depreciation.

7. SUC (Sewerage and Urban Cess): Additional charges for the maintenance of sewerage and urban infrastructure are included in the property tax bill.

8. Penalty: Charges levied for late payment of property tax, which may include interest and a fixed penalty.

9. NOC (No Objection Certificate): Document required for a name change or property transaction, which indicates that there is no objection from the previous owner or authorities.

10. Mutation: Process of updating property ownership details in the municipal records.

Conclusion

Understanding Vasai Virar Municipal Corporation (VVMC) Property Tax involves following the basic concepts and processes required for permission and critical management. Property tax is an important component of municipal revenue that finances essential services like infrastructure, sanitation, and urban growth. Key terms like property ID, tax rate, SUC (sewerage and urban cess), and age status significantly determine tax collection.

Property owners should be aware of due dates, penalties for late membership fees and procedures for changing name or membership fees online and offline. Using the VVMC website or office resources for accurate information with details up to property tax bills and burpee is essential to maintain up-to-date records.

FAQ’s

1. What is VVMC Property Tax?

Answer. VVMC Property Tax is an annual tax levied by Vasai Virar Municipal Corporation on property owners based on the value, area, and usage of the property.

2. What is the complete form of VVMC?

Answer. The complete form of VVMC is Vasai Virar Municipal Corporation.

3. What are the benefits of paying VVMC property tax?

Answer. Paying VVMC property tax helps infrastructure development, public services, community amenities, health and hygiene, education, urban planning, law and order, civic maintenance, and legal compliance.

4. How is VVMC property tax calculated?

Answer. Property tax is calculated using the following formula: Property tax = Tax rate × Property area × Usage factor × Age factor.

5. How can I get my VVMC property tax bill?

Answer. You can get your property tax bill online through the VVMC website, receive it by mail, or collect it from the VVMC office.

6. How do I pay VVMC property tax online?

Answer. To pay online, visit the VVMC website, access the Property Tax section, enter your property details, choose your payment method, and complete the payment.

7. How do I pay VVMC property tax offline?

Answer. To pay offline, visit the VVMC office, get your property tax bill, fill out the payment form, and pay via cash or cheque. Take your receipt as proof of payment.

8. How can I download my VVMC property tax receipt?

Answer. Visit the VVMC website, go to the Property Tax section, enter your property ID, locate the payment, and download or print the receipt.

9. What is the due date of VVMC property tax?

Answer. The due date of VVMC property tax is usually March 31st each year. Check your bill or the VVMC website for the specific deadline.

10. What is SUC in property tax?

Answer. SUC stands for Sewerage and Urban Cess, an additional charge for maintaining sewerage systems and urban infrastructure.

Add a Comment