UMC Property Tax is a local tax levied by the Ulhasnagar Municipal Corporation (UMC) on property owners to raise funds for economic services and infrastructure. It is calculated based on the taxable value of the property and the applicable tax rates, with surpluses for water, sewerage, and waste management.

- What is (Ulhasnagar) UMC Property Tax?

- What is UMC Tax?

- What are the Benefits of Ulhasnagar Property Tax?

- How to Calculate Ulhasnagar Property Tax?

- UMC Property Tax 2024-25?

- How To Pay UMC Property Tax Online Payment?

- How to Pay UMC Property Tax Offline Payment?

- UMC Tax Bill?

- UMC Property Tax View Bill?

- UMC Property Tax Receipt?

- What are the Late Payment Penalties of Ulhasnagar Property Tax?

- Ulhasnagar Property Tax By Name?

- Ulhasnagar Property Tax Name Change?

- What is the Age Factor in Property Tax?

- What is SUC in Property Tax?

- Conclusion

- FAQ’s

- 1. What is Ulhasnagar Property Tax?

- 2. How is Ulhasnagar Property Tax calculated?

- 3. What are the benefits of paying Ulhasnagar Property Tax?

- 4. How can I pay Ulhasnagar Property Tax online?

- 5. How can I pay Ulhasnagar Property Tax offline?

- 6. How can I view my UMC Property Tax bill online?

- 7. How can I obtain a UMC Property Tax receipt?

- 8. How do I download my UMC Property Tax bill?

- 9. What are the late payment penalties for Ulhasnagar Property Tax?

- 10. What is the age factor in property tax?

What is (Ulhasnagar) UMC Property Tax?

(UMC) Property Tax Ulhasnagar Municipal Corporation is a local tax levied by the Ulhasnagar Municipal Corporation on property owners within its jurisdiction. Property tax is a primary source of revenue for municipal corporations in India. It is used for the maintenance of basic services such as infrastructure development, maintenance of roads, common parks, water supply, sanitation and other civic amenities.

What is UMC Tax?

UMC Tax refers to various taxes levied by the Ulhasnagar Municipal Corporation (UMC) to generate revenue to provide common services and maintain civic infrastructure in Ulhasnagar. The taxes collected by the UMC generally exist.

1. Property Tax: Levied on property owners for infrastructure and ongoing services.

2. Water Tax: Tax levied for water supply services.

3. Sewerage Tax: To maintain the sewer system.

4. Conservation Tax: For waste management and garbage disposal.

5. Professional Tax: This tax is levied on persons engaged in various professions.

6. Entertainment Tax: Levied on entertainment activities like movies and events.

What are the Benefits of Ulhasnagar Property Tax?

Paying Ulhasnagar property tax offers several benefits to both property owners and society. These include:

1. Better civic services: Tax revenue funds essential services such as road maintenance, street lighting, garbage collection, water supply, and purification, thereby ensuring a higher standard of living.

2. Infrastructure Development: Property tax contributes towards the construction and maintenance of infrastructure such as parks, water supply systems and existing buildings.

3. Legal Ownership Check: The normal payment of property tax serves as a form of record of ownership and can be used as a check on the legal ownership of the property in case of a dispute.

4. Loan Eligibility: A clean property tax record can help property owners obtain loans or mortgages from financial institutions more easily.

5. Avoid penalties: Timely repayment helps avoid late fees or interest charges, thereby saving money in the long run.

6. Contribution to local advancement: This amount helps improve local amenities, making the area more desirable to live or work in, thereby increasing property values.

7. Community Benefits: By paying taxes, property owners contribute to the overall well-being of society, and enhance amenities and services available to all residents.

How to Calculate Ulhasnagar Property Tax?

To calculate Ulhasnagar property tax, the Ulhasnagar Municipal Corporation (UMC) generally uses a formula based on the size, type, use and condition of the property. While the exact formula may vary, the simple process of calculating property tax involves the following steps.

General Formula

Property Tax = Tax Rate × Rateable Value of the Property

1. Rateable value of the property: This is the value of the property as determined by the UMC. It depends on the usual factors.

Size of the Property (in square feet or meters).

Location (properties in prime areas are valued higher).

Type of Property (residential, commercial, or industrial).

Age of the Property (older properties may receive some depreciation).

Usage of the Property (owner-occupied or rented out).

2. Tax rates: UMC determines tax rates, which may vary depending on the type of property and its use. Rates usually vary for residential, commercial and commercial properties.

3. Additional Charges:

- Water Tax

- Sewerage Tax

- Conservancy Tax

- Education Cess (if applicable)

These taxes are usually added to the base property tax amount to get the total amount payable.

Example Calculation

If the rated value of a residential property is ₹50,000, and the rate of property tax is 1%, then the calculation will be like this.

Property Tax = ₹50,000 × 1% = ₹500.

Online Calculator

The UMC also offers an online property tax calculator on its official website, where property owners can enter the appropriate details (such as property size, type, and location) to get accurate property tax figures.

UMC Property Tax 2024-25?

For UMC property tax 2024-25, you need to refer to the latest rates and guidelines provided by the Ulhasnagar Municipal Corporation (UMC). Generally, tax rates and clarifications for an unusual financial year are updated annually and can be found on the official website of UMC or by contacting their office directly.

1. Visit the official website of UMC: Visit the official website of Ulhasnagar Municipal Corporation for the latest tax values and guidelines for 2024-25.

2. Contact UMC Office: For detailed information or any tax rate and calculation-related queries, contact the Municipal Corporation Office.

3. Use an online calculator: UMC can provide you with an online property tax calculator to help you estimate your tax based on the latest rates.

Review the latest notifications or circulars issued by UMC for any changes or updates for the financial year 2024-25.

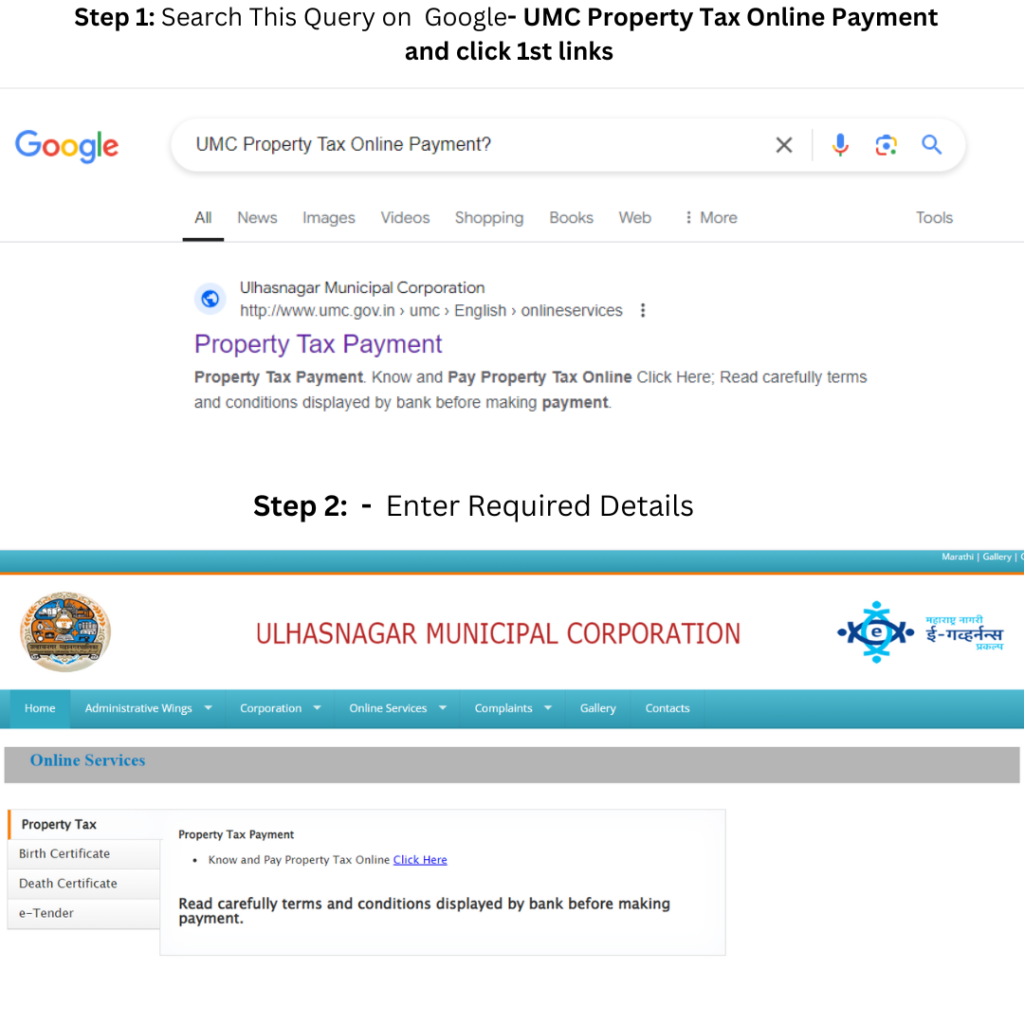

How To Pay UMC Property Tax Online Payment?

To pay UMC property tax online, follow these steps:

Step 1: Visit the UMC official website: Visit the official website of Ulhasnagar Municipal Corporation.

Step 2: Go to the Property Tax section: Look for the Property Tax or Municipal Services section on the homepage or under the Services menu.

Step 3: Enter property details: Enter your property details, such as Property Identification Number (PIN), which is typically found on your property tax bill.

Step 4: Calculate Tax: The system will display the amount of tax payable based on the property details entered.

Step 5: Make Payment: Complete the transaction by choosing your payment method (Credit/Debit Card, Net Banking, etc.).

Step 6: Get confirmation: After payment, you should receive a confirmation receipt or acknowledgement. Save or print it for your records.

Step 7: Check Status: You can also check the status of your redemption or download the redemption receipt from the same section on the website.

How to Pay UMC Property Tax Offline Payment?

To pay UMC property tax offline, follow these steps:

Step 1: Visit the nearest UMC office: Visit the nearest Ulhasnagar Municipal Corporation office or designated property tax collection centre.

Step 2: Collect Property Tax Bill: If you do not have a bill, you can request one from the UMC office by providing your Property Equality Number (PIN) or property explanation.

Step 3: Fill out the rectification form: Fill out the rectification form or clarification required for processing.

Step 4: Make payment: Pay the property tax through cash, cheque, or demand draft, as accepted by UMC.

Step 5: Get a receipt: After the redemption, make sure to get an authorized receipt as proof of redemption.

Step 6: Check due dates: Check due dates to avoid late fees or penalties.

UMC Tax Bill?

UMC Tax Bill is an official document issued by the Ulhasnagar Municipal Corporation (UMC) specifying the property tax payable by the property owner. It usually contains the following information.

1. Property details: Information about the property, including property identification number (PIN), address, property type (residential, commercial), and size.

2. Owner Information: Name and contact details of the property owner.

3. Tax Assessment: A breakdown of the tax calculation,

including the rateable Value of the property.

Applicable tax rates (property, water, sewerage, etc.).

Total tax due for the financial year.

4. Due Date: The date within which tax must be paid to avoid penalty or interest.

5. Payment Methods: Instructions for online or offline tax payment.

6. Penalty information: Details of any penalty or interest applicable if tax is not paid by the due date.

UMC Property Tax View Bill?

To view your UMC property tax bill online, follow these steps

Step 1: Visit UMC’s official website: Visit the official website of Ulhasnagar Municipal Corporation.

Step 2: Go to the Property Tax section: Look for the “Property Tax” or “Tax Services” section on the homepage or under the Services menu.

Step 3: Enter Property Details: Provide your Property Identification Number (PIN) or property details like address, owner name or bill number.

Step 4: View Tax Bill: Once your property is reported, you can view an explanation of the tax bill, including the amount payable, details of charges and the due date.

Step 5: Download/Print: You can download or print the bill for your records.

UMC Property Tax Receipt?

UMC property tax receipt is an official letter that Ulhasnagar Municipal Corporation (UMC) provides to you after you pay your property tax. It establishes that your property tax dues for a certain period have been paid. The receipt usually includes.

1. Receipt Number: A unique transaction ID or receipt number.

2. Property details: Property Identification Number (PIN), Address and Type of property.

3. Owner Name: Name of the property owner.

4. Tax payment details: Amount paid, date of payment, and details of taxes (property tax, water tax, sewerage tax, etc.).

5. Payment Method: Mode of payment (online, cash, check, etc.).

6. Financial Year: The tax period for which the payment was made.

What are the Late Payment Penalties of Ulhasnagar Property Tax?

For Ulhasnagar property tax, if the tax is not cleared by the due date, late clearance penalties are levied by the Ulhasnagar Municipal Corporation (UMC). These penalties generally include:

1. Interest: Charged on the outstanding tax amount.

2. Fixed penalty: A fixed charge may be levied for delay.

3. Legal action: Prolonged non-payment may lead to legal consequences.

4. Loss of Discount: Discount given for timely payment may be cancelled.

Ulhasnagar Property Tax By Name?

To search Ulhasnagar property tax by name, follow these steps.

Step 1: Visit UMC’s official website: Visit the Ulhasnagar Municipal Corporation website.

Step 2: Go to Property Tax Search: Look for the “Property Tax” section or “Search by Name” option under the Online Services or Property Tax section.

Step 3: Enter Owner’s Name: Enter the property owner’s name and other details, such as location or ward number (if required).

Step 4: View tax details: Once the system acquires the data, you can view the property tax details and any outstanding amount.

Ulhasnagar Property Tax Name Change?

Follow these steps to apply for a name change in Ulhasnagar property tax records.

Step 1: Get the form: Visit the UMC office or download it from their website.

Step 2: Submit Documents:

- Ownership proof (sale deed, etc.).

- Previous tax receipts.

- NOC (if needed).

- ID proof (Aadhaar, PAN).

- Affidavit for name change.

Step 3: Submit Application: Submit the form and documents to the UMC office.

Step 4: Verification: UMC will verify the documents and may inspect the property.

Step 5: Make Fee Payment: Pay the required fees.

Step 6: Confirmation: Wait for UMC to update the record.

What is the Age Factor in Property Tax?

Condition in estate tax refers to how the age of a property affects its assessed value and, consequently, the tax payable. Here’s a brief overview.

1. Depreciation: Older assets may be valued lower due to depreciation.

2. Condition: Physical condition can further affect value.

3. Tax implications: Tax implications on old properties may be lower due to these factors.

What is SUC in Property Tax?

SUC stands for Stamp Duty and Registration Fees (Stamp Duty and Registration Fees), which are charges associated with validating documentation and property transactions. Although not a direct property tax, SUC is essential in property acquisition and can impact every cost of property ownership.

1. Stamp Duty: A tax levied on a legal instrument relating to a property transaction, such as a sale deed, which must be paid to validate the transaction.

2. Registration Fee: Fee charged to officially register the property transaction with the local authorities.

Conclusion

Ulhasnagar property tax is an essential component of national governance, providing essential revenue for civic services and infrastructure. Understanding the various aspects, including redemption methods, penalties for late payment, and the impact of factors such as the age of the property, helps property owners govern their tax responsibilities effectively. For accurate information and updates, regularly refer to the official resources of the Ulhasnagar Municipal Corporation or contact their office directly.

FAQ’s

1. What is Ulhasnagar Property Tax?

Ulhasnagar property tax is a national tax levied on property owners by the Ulhasnagar Municipal Corporation (UMC) to maintain civic services and infrastructure.

2. How is Ulhasnagar Property Tax calculated?

Property tax is calculated based on the taxable value of the property and the applicable tax rate determined by the UMC. Additional charges such as water tax, sewerage tax and maintenance tax may also be applicable.

3. What are the benefits of paying Ulhasnagar Property Tax?

Benefits include improved civic services, infrastructure enhancement, legal verification of ownership, eligibility for credit, and contribution to local ethnic development.

4. How can I pay Ulhasnagar Property Tax online?

Visit the UMC official website, navigate to the property tax section, enter property details, and make the payment using available online payment methods.

5. How can I pay Ulhasnagar Property Tax offline?

Visit the nearest UMC office or designated collection center, submit the property tax bill, and make the payment via cash, cheque, or demand draft.

6. How can I view my UMC Property Tax bill online?

Access the UMC official website, go to the property tax section, enter the required property details, and view or download your tax bill.

7. How can I obtain a UMC Property Tax receipt?

After paying online, you can download or print the receipt from the UMC website. For offline payments, request a printed receipt at the UMC office.

8. How do I download my UMC Property Tax bill?

Visit the UMC website, navigate to the property tax section, enter your property details, and use the download or print options to save the bill.

9. What are the late payment penalties for Ulhasnagar Property Tax?

Penalties include interest on the outstanding amount, fixed penalties, potential legal action, and loss of rebates for late payments.

10. What is the age factor in property tax?

The age factor affects the property’s assessed value. Older properties may be depreciated, leading to a lower tax bill based on their condition and market value.

Add a Comment