In this Blog we will explore the top 6 Direct Tax Types in India are financial charges levied directly on the income or property of individuals and institutions, where the taxpayer bears the burden of payment. Unlike indirect taxes, which are collected through middlemen, direct taxes are assessed based on the taxpayer’s ability to pay. In many countries, including India, direct taxes are essential for funding government programs and services. The primary types of direct taxes include income tax, which is imposed on individual income; corporate tax, which is levied on business profits; Capital gains tax, which is imposed on profits made from the sale of property; and wealth tax, which targets the net worth of individuals or institutions.

- What is the Direct Tax?

- What are the Top 6 Direct Tax Types in India?

- 1. Capital Gains Tax

- 2. Corporate Tax

- 3. Income Tax

- 4. Securities Transaction Tax

- 5. Wealth Tax

- 6. Gift tax

- Conclusion

- FAQs

- How many types of taxes are there?

- What is the direct and indirect tax classification?

- Is TDS a direct or indirect tax?

- What was the direct tax?

- What is the full form of TDS?

- What are the merits of direct tax?

- Is estate duty a direct tax?

- Is VAT a direct tax?

- What are the types of direct and indirect taxes?

- Which is not Direct tax?

What is the Direct Tax?

Direct tax of tax that an individual or system pays directly to the government, and the burden of repayment falls on the person or group being taxed. It is levied on income, wealth or property, unlike an indirect tax such as sales tax, collected from consumers by intermediaries.

Direct tax types in India are managed by the Central Board of Direct Taxes (CBDT) under the Department of Finance, which implements and oversees direct tax policies.

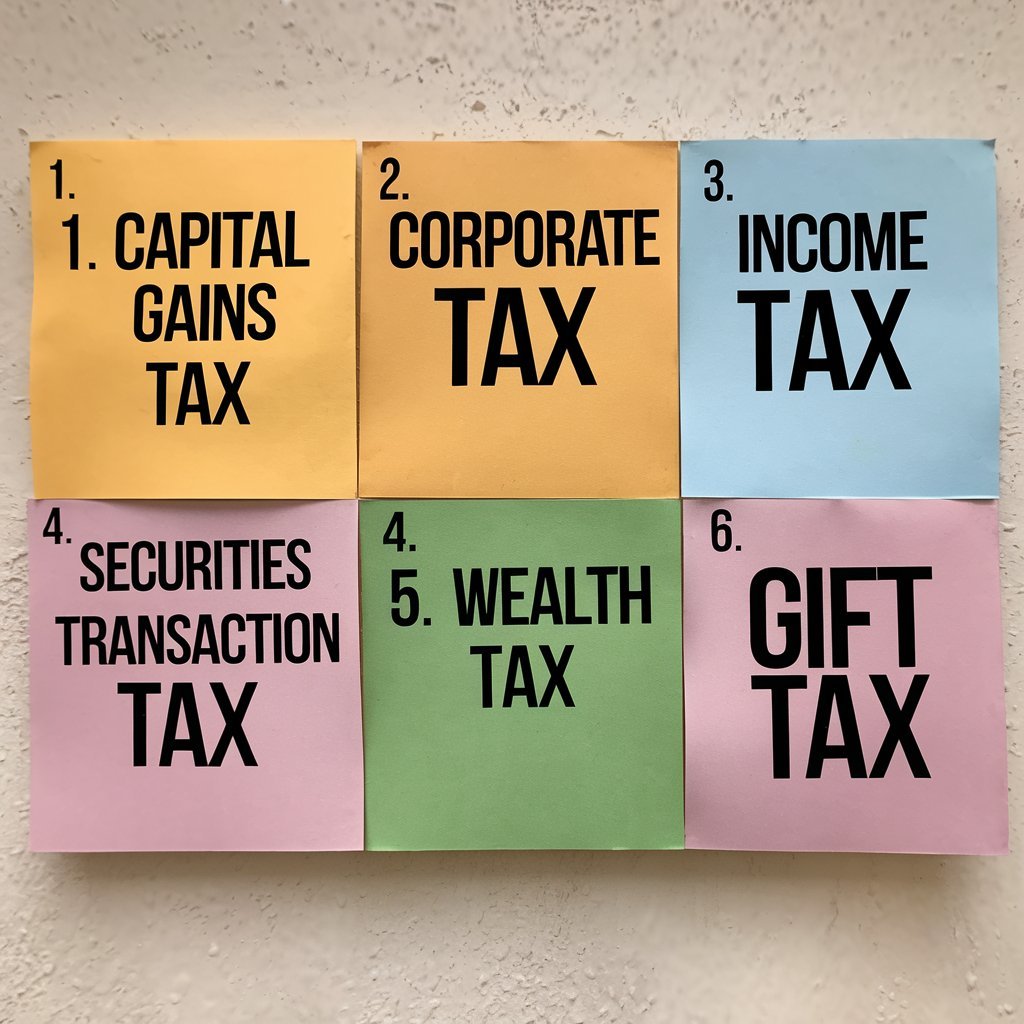

What are the Top 6 Direct Tax Types in India?

1. Capital gains tax

2. Corporate tax

3. Income tax

4. Securities transaction tax

5. Wealth tax

6. Gift tax

To File Your Income Tax Contact Our Expert Legal Adviser

1. Capital Gains Tax

Capital gains tax is a direct tax types indirect tax levied on the profit or gain arising from the sale of a capital asset. In India, a capital asset consists of any asset held by an individual, such as real estate, stocks, bonds, jewelry and patents, but does not include goods for personal use, agricultural land or certain government bonds.

Indexation benefits are available for long-term capital assets, which allow taxpayers to offset the purchase price of the asset for inflation. This allows reducing taxable profits and thus minimizing tax liability.

Types of Capital Gains

Short-term capital gains (STCG): Profit from assets held for a short period (up to 36 months, some assets have a holding period limit of 12 months or 24 months). STCG is generally taxed at the individual’s applicable income tax rate.

Long-term capital gains (LTCG): Profits from assets held for a long period (generally more than 36 months, but it can be 24 months for certain assets like real estate and 12 months for listed equity shares and certain securities). LTCG is often taxed at a lower rate than STCG.

2. Corporate Tax

Corporate tax is an indirect tax levied by the government on the income or profits of corporations and other business entities. In India, corporate tax rates and related rules are governed by the Income Tax Act, of 1961, which is monitored by the Central Board of Direct Taxes (CBDT) under the Ministry of Finance.

Corporate taxes can be reduced by claiming exemptions or incentives available for activities such as investment in R&D, infrastructure development and backward expansion. However, companies opting for a flexible tax rate of 22% (for example) will have to forgo these exemptions.

In India, corporate tax rates vary depending on the type of company (domestic or foreign), income bracket and nature of income.

Domestic companies: Subject to a base rate of 25% if their turnover is less than Rs 400 crore; otherwise, they are taxed at 30%.

Foreign companies: Taxed at a base rate of 40%.

In addition to the base tax, companies must pay surcharge and cess, which may increase the effective tax rate.

3. Income Tax

Income tax is an indirect tax levied by the government on income received by individuals, Hindu Undivided Families (HUFs) and corporations. The tax is levied on a progressive structure, which means that the tax rate increases as the income increases. In India, the Income Tax Act 1961 governs the rules and regulations of income tax, which is managed by the Central Board of Direct Taxes (CBDT) under the Ministry of Finance.

The income tax structure generally has multiple slabs, with rates starting from 5% for the highest income bracket to 30% under the old tax system. The new tax regime, introduced in Budget 2020, offers lower tax rates for specific slabs but eliminates most deductions and exemptions.

4. Securities Transaction Tax

Securities Transaction Tax (STT) is a tax levied on the trading of securities, such as stocks and derivatives, listed on recognized stock exchanges in India. It is designed to simplify tax collection and development on financial transactions and applies to both buyers and sellers depending on the type of security being dealt with.

The introduction of STT has simplified tax treatment in securities dealings by directly levying tax on the securities transaction, making it easier for the Government to collect revenue and for investors to be tax compliant.

1. Who pays: STT applies to both buyers and sellers in intraday trades, but only sellers in delivery-based transactions.

2. Rates: STT rates vary based on the type of transaction – delivery, intraday or derivatives.

3. Purpose: STT simplifies taxation on securities and curbs speculative trading by adding transaction costs.

4. Tax Treatment: It is not a deductible expense for income tax, but enjoys preferential tax rates on capital gains.

5. Wealth Tax

Wealth tax was a form of indirect tax in India that was levied on the unencumbered properties of individuals, Hindu Undivided Families (HUFs) and companies. The tax was levied on the market value of the owned property, including real estate, luxury cars, yachts, cash and even jewelry, above a specified limit. It was intended to reduce the inequality of wealth distribution by taxing individuals or entities with large holdings of unproductive assets.

In 2015, the wealth tax was abolished in India to reduce the administrative burden and enhance tax compliance. To compensate for the loss of revenue, the government imposed an additional surcharge on the income of the rich, to make tax collection simpler and more efficient through income tax rather than a separate wealth tax.

1. Rate and Range: Wealth tax was imposed at the rate of 1% on net worth above Rs 30 lakh.

2. Covered assets: This included non-productive assets such as real estate (not used for business), luxury goods, cars, boats and certain types of cash.

3. Exemption: Shares, securities, commercial property and productive assets such as gold under specified limits were often exempt.

4. Reason for abolition: The tax was abolished to simplify the tax structure, as it was challenging to administer, and had relatively low revenue generation. Instead, the government imposed a surtax on the super-rich to raise revenue.

6. Gift tax

A gift tax is a federal tax in many countries, including the US and India, imposed on certain transfers of property or cash where the recipient (or “donor”) receives something of value without giving equal or greater compensation. Here are some key points about gift tax, focused on the US and India.

Understanding these nuances helps with legal compliance and avoids unnecessary tax liabilities, especially if large transfers are involved.

1. Taxability: Gifts are taxable under the Income Tax Act, 1961. If the total value of gifts received by an individual in a financial year exceeds ₹50,000, the total amount may be taxable as “Income from other sources”, subject to Income Tax Department.

2. Exemption: Gifts received from relatives (as defined under section 56(2) of the Act), during marriage, under a will or inheritance, or from registered charitable trusts and institutions are exempt from tax.

3. Documentation: For large gifts or claimed exemptions, documentation proving the nature of the relationship or the purpose of the gift is often required.

Conclusion

Direct Tax Types play a vital role in the fiscal framework of any economy, serving as the primary source of revenue for governments. Various types of direct taxes such as income tax, corporate tax, capital gains tax and wealth tax are designed to ensure that individuals and businesses make a fair contribution to public finances based on their financial capacity. Each type of direct tax has its unique features, implications and rates, reflecting the socio-economic priorities of a nation. As tax laws evolve and adapt to the changing economic landscape, it becomes increasingly important for taxpayers to understand these direct tax types to ensure compliance, optimize their tax liabilities and contribute to sustainable economic growth. Ultimately, a well-structured direct tax system can promote equity, enhance public welfare and support essential government initiatives.

FAQs

How many types of taxes are there?

Taxes in India are classified into two categories: direct taxes, which include income tax, gift tax, and capital gains tax, and indirect taxes, which include value added tax, services tax, goods and services tax, and customs duty.

What is the direct and indirect tax classification?

Direct taxes, such as income tax, are levied on income, while indirect taxes, such as goods and services tax (GST), are levied on goods and services. Both types have their own advantages and disadvantages.

Is TDS a direct or indirect tax?

TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) are types of indirect taxes levied by the government.

What was the direct tax?

Direct taxes are paid by the individual or organization directly to the tax authority. Examples include income taxes, property taxes, and wealth taxes. In contrast, indirect taxes such as sales taxes are levied on sellers but are ultimately paid by the buyer.

What is the full form of TDS?

TDS (Tax Deducted at Source) is tax deducted from the employee’s income by the employer, which is deposited to the Income Tax Department on behalf of the taxpayer. It is a percentage deducted from the monthly income at the time of payment.

What are the merits of direct tax?

Direct taxes go directly to the government, eliminating middlemen and delays in filing returns. They are also generally easier to calculate, leading to less ambiguity and higher compliance rates.

Is estate duty a direct tax?

Inheritance tax, also known as estate tax or estate duty, was levied on property at the time of inheritance. It no longer exists in India and comes under direct tax.

Is VAT a direct tax?

Value Added Tax (VAT) is an indirect tax levied on goods and services, paid by producers to the government at every stage of the supply chain.

What are the types of direct and indirect taxes?

Direct taxes, such as income tax and corporate tax, are essential for both individuals and corporations. Indirect taxes include GST, customs duty, central excise duty, service tax, and sales tax. GST eliminates the cascading tax effect, benefiting consumers and consists of CGST, SGST, UTGST, and IGST.

Which is not Direct tax?

Sales Tax is not a Direct Tax.

Add a Comment