You must be well aware of the existing dual adopted tax structure of India, in which both direct and indirect taxes are used very well. In India, all the indirect taxes include excise duty, customs duty and goods and services tax (GST) and on the other hand, all types of direct taxes include income tax, corporate tax and property tax.

To maintain fiscal stability and fully guarantee the government’s ability to provide all kinds of public services, it is considered very important to strike a balance between all these taxes.

In order to increase income generation, improve compliance and streamline all kinds of processes by the government, a number of adjustments were made in the entire tax structure of India in 2024.

The government wants to promote entrepreneurship, increase manufacturing and guarantee social welfare, and all these reforms are to help achieve these larger economic objectives.

Through this blog post, all the components of present tax structure of india have been discussed in detail and all the changes made in India in the last few years, the challenges faced and the possible future framework have been discussed in detail so that you can get as much information as possible about the tax structure of India.

- What is the Role of the Central and State Government in the Tax Structure of India?

- How Many Types of Tax in India?

- What is Direct Tax?

- What are the Indirect Taxes in India?

- How Many Types of Indirect Tax in India?

- What are the Exemptions on Tax Deduction?

- What are the Tax Reforms in India (2024)?

- In Conclusion

- FAQs

- Q1. How does the Indian government ensure that taxpayers are aware of their tax obligations?

- Q2. What role does technology play in tax administration in India?

- Q3. Are there any tax benefits for startups and new businesses in India in 2024?

- Q4. How does the tax structure of india address international taxation issues?

- Q5. What measures are in place to ensure transparency in the tax structure of india?

- Q6. How does the government address disputes related to tax assessments?

- Q7. Is there any specific focus on improving tax compliance among small and medium enterprises (SMEs)?

- Q8: What is the role of professional tax advisors in the current tax structure?

- Q9: How does the government plan to address the impact of environmental concerns on taxation?

What is the Role of the Central and State Government in the Tax Structure of India?

The Indian taxation policy is twofold, Central Taxation which is under the direct control of the Central Government of India and State Taxation which is under the jurisdiction of the respective State Government of India.

This division is provided explicitly in the Constitution of India in the Seventh Schedule of Taxation, which divides it into three classifications: Union List, State List, and Concurrent List.

Role of the Central Government

Along with the direct taxes that are levied and collected for the entire country, indirect taxes are also the legal obligations of the Central Government. These are income tax, corporation tax, and capital gains tax, where the tax is levied on income, profits, or sale of an asset.

Other indirect taxes are, for example, the Goods and Services Tax (GST), in which the Central Government collects Central Goods and Services Tax (CGST) on the supply of goods and services made within the state under the Act.

There are also central taxes that are levied on imports and exports and one of which is customs duty. The CBDT and the CBIC are the two primary authorities dealing with these taxes and their enforcement.

Role of the State Governments

State governments are empowered to levy and collect taxes on subjects mentioned in the State List. This includes Central GST (CGST) on inter-state supply of goods and services and State GST (SGST) for supplies within the same state.

Apart from this, there are several other taxes such as value added tax (VAT) which is applicable on goods such as liquor and petroleum, state excise duty on liquor, stamp duty which is applicable on sale of property, and professional tax which is applicable on employees.

Apart from this, state governments also have other taxes such as entertainment tax and land revenue and these are being collected and administered through the revenue department of the respective state government.

Joint Role in Goods and Services Tax (GST)

The current tax structure of india that can be termed as a shared responsibility between the central and state governments is the Goods and Services Tax (GST) system.

The GST Council, consisting of the Union Finance Minister, State Finance Ministers, has the power to determine GST rates, rules and policies to ensure they are consistent to accommodate the entire country.

The Central GST (CGST) is levied by the central government for intra-state transactions while the Goods and Services Tax (GST) levied for inter-state transactions and imports is called the Integrated GST (IGST).

How Many Types of Tax in India?

In our country India, overall taxation is run on the basis of only 2 taxes, which are discussed in detail below.

- Direct Tax

- Indirect Tax

What is Direct Tax?

Direct taxes in India are taxes that are levied directly on the income or property of individuals, firms, companies, etc. These taxes are sent to the government personally by the taxpayer and hence cannot be shifted.

The most common feature of direct taxes in india is that it is paid by a particular person or organization directly to the state and there is no intermediary involved.

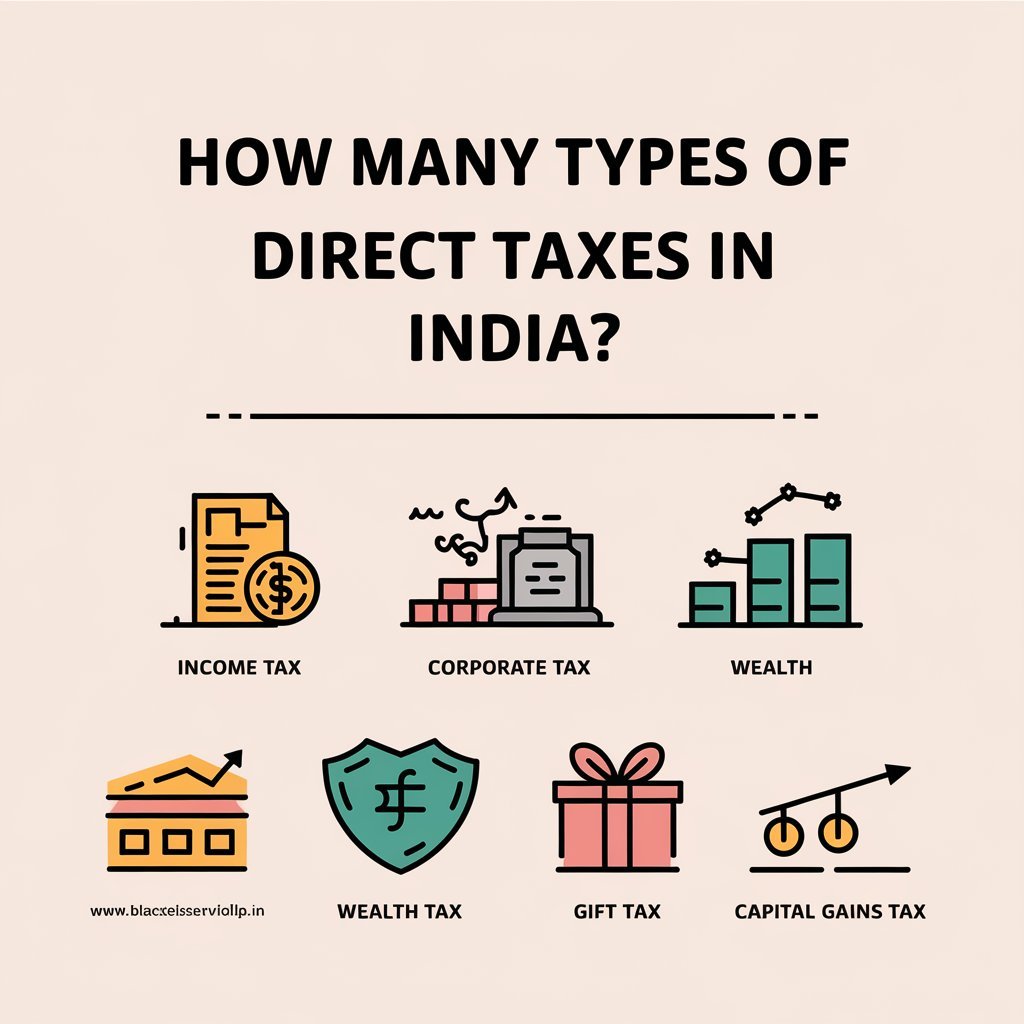

How Many Types of Direct Taxes in India?

It is levied on income earned by individuals, HUFs, firms, companies and other legal structures. It is determined as per the income bands provided by the government and must be paid on an annual basis.

Corporate Tax

Applicable to net income or profits earned by corporations and businesses. Certain tax regulations apply to business entities, including taxes applicable to their profits, with rates depending on whether the business entities are Indian-based or foreign investments established in India.

Capital Gains Tax

Taxed on revenue or income derived from the sale of immovable assets such as land, building, shares or debentures. Capital gains are of two types; short term and long term and the tax charges differ depending on the time period.

Wealth Tax (abolished in 2015)

Wealth Tax Was earlier levied on the net wealth of individuals, HUFs and Companies. They are now in existence under income tax where the government has introduced a surcharge on the super-rich.

Securities Transaction Tax (STT)

It refers to the buying and selling of securities such as shares, mutual funds and derivatives that are traded on recognised stock markets.

Estate Duty (abolished)

This was a type of direct tax structure of india, specifically on property that someone inherited. Although it has not existed since 1985, it used to be a direct tax.

What are the Indirect Taxes in India?

The Indirect taxes in India are taxes that are levied on an individual or company as taxes on goods and services rather than on income and profits.

These taxes are paid to the government through other parties through whom the final consumer purchases goods and services, businesses, or other entities.

In this case, while the direct responsibility for collecting and paying indirect taxes lies with the seller, the burden still falls on the consumer.

How Many Types of Indirect Tax in India?

There are lots of indirect taxes in india, which we have explained very well below:

Goods and Services Tax (GST)

GST is the largest indirect tax in India. It was implemented in 2017 as a replacement for taxes such as Value-Added Tax (VAT), service tax, excise duty, and many others.

The value-added tax is an all-engulfing, destination-based, multi-stage, and non-standard tax that levies at every step of value addition. GST is divided into:

- Central GST (CGST): Levied by the central government for the sales made within the state.

- State GST (SGST): Collected by the state government on intra-state sales.

- Integrated GST (IGST): Levied by the central government on inter-state sales and Imports.

Customs Duty

A duty levied on goods imported into India or exported out of India. Tariffs – known as customs duties – are used to control the entry of goods into the country as well as to protect domestic producers and are another way of raising revenue for the government. It includes Basic Custom Duty (BCD), Countervailing Duty (CVD), and other duties, etc.

Excise Duty (Replaced by GST for most goods)

It was a tax levied on the manufacture or production of goods in the territory of India. It has to be understood that the colonial authorities attempted to facilitate the smooth conduct of business in India by instituting different types of taxes.

Even though GST has replaced the Central Excise Duty on most products, there are some products on which both taxes are still applicable, such as alcohol, petroleum products and tobacco products.

Stamp Duty

It is heavily linked to the legal documentation where business is conducted, including the purchase or sale of property, shares, and even company stocks. It is also known as sales tax, is levied by the state government and varies from state to state.

Value Added Tax (VAT) (For certain items)

The Goods and Services Tax (GST) has subsumed most of the services and goods that were previously taxed through VAT, although VAT still applies in respect of certain products including petroleum products and alcohol.

Entertainment Tax (Replaced by GST for most cases)

This tax was levied on events such as movies, theatres, attractions and exhibitions, amusement parks, etc. Now, a large section of entertainment services are under GST, but some states still levy entertainment tax.

Excise on Petroleum Products

Petrol, diesel, natural gas, and other petroleum products are partially taxed under the GST scheme, and the remaining amount is collected under excise duty.

Characteristics of Indirect Taxes

- Regressive Nature: Unlike direct taxes, indirect taxes are often considered regressive because all consumers have to pay the tax without any relation to their income.

- Pass-Through Effect: The cost of the tax is shifted to bear by manufacturers of goods or providers of services by passing on the cost to consumers.

- Broad Base: The indirect taxes are charged on almost all the goods and services provided to the public hence the government is assured of steady revenue collection.

- Encourages Compliance: These taxes are embedded with the cost price of products and services hence it is easier to collect and much difficult to evade compared to direct taxes.

What are the Exemptions on Tax Deduction?

Tax credits are direct reductions in the amount of tax you pay. Credits are other unique items that you spend during the year to get a figure that applies to your tax liability figure.

Here are some of the most common deductions that are generally considered a way to reduce one’s taxable income:

| Section/Exemption | Description | Maximum Deduction Available |

|---|---|---|

| Section 80C | Deductions on investments like PPF, NSC, Life Insurance, ELSS, Fixed Deposits, etc. | ₹1.5 lakh per year |

| Section 80D | Deductions on health insurance premiums for self, family, and parents | ₹25,000 (self/family); ₹50,000 (senior citizen parents) |

| Section 80E | Deductions on interest paid on an education loan | No upper limit |

| Section 24(b) | Deductions on interest paid on home loans for self-occupied or rented properties | ₹2 lakh (self-occupied); No limit (rented, with conditions) |

| House Rent Allowance (HRA) | Exemption for salaried individuals living in rented accommodation | Based on salary, HRA received, and rent paid |

| Section 80G | Deductions on donations to specified relief funds and charitable institutions | 50% or 100% of the donated amount |

| Section 80TTB | Deductions on interest income for senior citizens from savings accounts, FDs, RDs, etc. | ₹50,000 per year |

| Section 80TTA | Deductions on interest earned from savings accounts with banks, post offices, or cooperative societies | ₹10,000 per year |

| Standard Deduction | Deduction for salaried employees | ₹50,000 per year |

| Section 80DD | Deductions for medical treatment, training, and rehabilitation of a dependent with disability | ₹75,000 (40%-80% disability); ₹1,25,000 (more than 80%) |

| Section 80DDB | Deductions on medical expenses for specified diseases | ₹40,000 (individuals); ₹1 lakh (senior citizens) |

| Leave Travel Allowance (LTA) | Exemption on travel expenses within India for salaried employees | Depends on actual travel costs; available twice in four years |

What are the Tax Reforms in India (2024)?

In 2024, the Government of India implemented several tax reforms with the overall goal of increasing compliance, enhancing transparency, and ultimately optimizing the effectiveness of the overall tax structure of india.

Faceless Assessment and Appeals

The adoption of income tax assessment and appeals processes in tax structure of india has been one of the most notable innovations of the last few years.

By eliminating the need for face-to-face interaction between all taxpayers and tax officials, this reform – which came into effect in 2020 and is completed by 2024 – has greatly reduced the possibility of corruption and harassment of all taxpayers.

- Faceless Assessments: Under this tax structure of india, multiple officials are involved in the assessment, thereby reducing bias. The faceless appeal process guarantees the provision of freedom to all taxpayers and gives them a chance to challenge whatever assessment they receive without worrying about any pressure.

Simplification of GST Compliance

The process of compliance under GST has been made even easier by the new return filing system by the year 2024. The new tax structure of india has lower compliance costs than before where companies used to file multiple returns monthly and has improved the business environment.

- QRMP Scheme: Annual tax payments for all types of businesses or self-employed individuals can register for the scheme of Quarterly Return Monthly Payment (QRMP), which enables making returns every quarter while making monthly payments during the quarter. This has been very helpful, especially for those firms who have a limited amount of cash to check their cash flow.

Introduction of Digital Taxation Measures

India has introduced new measures for taxpayers with the rise of the new economy called the digital economy. Currently in 2024, the government has extended the scope of the equalization levy levied on several digital services provided by non-resident companies.

- Equalization Levy: The equalization levy was first introduced in the Indian Union Budget for the 2016-17 financial year and was originally proposed to tax digital advertising revenues earned from India by foreign companies.

- Eventually, when the original model was reformed in 2024, other digital services, including e-commerce platforms, cloud computing, and media services, such as streaming services, were also included in the levy.

- Significance for the Digital Economy: The measure ensures that every international digital firm pays its share of taxes in India, thereby reducing the competitive gap for local counterparts while also raising revenues for the government.

In Conclusion

Our country’s government still has a lot of work to do to develop a modern, equitable tax structure of India, as reflected in the overall tax structure of India 2024.

While a lot of progress has been made in areas such as digitisation, simplification and lowering corporate tax rates, there are still many issues to be addressed, especially when it comes to tackling tax evasion and guaranteeing social justice.

It is very important for our country India to change its tax code as the country develops and adapt to the changing demands of society and economy.

The Indian government can create a tax structure of india that rewards social welfare, innovation, and growth and also helps ensure that every individual contributes to the country’s progress by emphasizing digitalization, simplification, and sustainability.

In the end, we would like to tell you that in this blog post, we have provided all the information about tax structure of India which will definitely be useful for you in your future.

FAQs

Q1. How does the Indian government ensure that taxpayers are aware of their tax obligations?

A1. The Government of India has taken several measures to increase people’s awareness about taxes. These include creating awareness through the media and developing simple and user-friendly web pages and mobile applications for the Income Tax Department regarding tax compliance information and collection.

Q2. What role does technology play in tax administration in India?

A2. Technology plays a vital role in streamlining tax administration in India. The government has implemented e-filing systems, online payment gateways, and data analytics tools to increase the efficiency of tax collection and compliance.

Q3. Are there any tax benefits for startups and new businesses in India in 2024?

A3. Yes, the Indian government offers various tax incentives for startups and new businesses to encourage entrepreneurship and innovation. These include tax exemptions, lower corporate tax rates, and exemptions on capital gains for investments in eligible startups.

Q4. How does the tax structure of india address international taxation issues?

A4. Tax structure of india has provisions to address international taxation issues, including Double Taxation Avoidance Agreements (DTAA) with many countries to prevent the same income from being taxed in both India and the foreign country.

Q5. What measures are in place to ensure transparency in the tax structure of india?

A5. The Indian government has taken several measures to enhance transparency in the tax structure of india. These include the implementation of faceless assessment and appeal, mandatory disclosure of certain financial transactions by taxpayers, and the introduction of a taxpayer charter outlining the rights and responsibilities of taxpayers.

Q6. How does the government address disputes related to tax assessments?

A6. The government has set up a structured dispute resolution mechanism to resolve tax-related disputes. This includes the establishment of the Income Tax Appellate Tribunal (ITAT) and various appellate authorities at different levels.

Q7. Is there any specific focus on improving tax compliance among small and medium enterprises (SMEs)?

A7. Yes, the government has initiated several measures to improve tax compliance among SMEs. These include simplified return filing process, lower tax rates under specific schemes and provision of dedicated help centres to assist SMEs with their tax-related queries.

Q8: What is the role of professional tax advisors in the current tax structure?

A8. Professional tax advisors play a vital role in helping individuals and businesses deal with the complexities of the tax structure of india. They provide expert advice on tax planning, compliance, and dispute resolution.

Q9: How does the government plan to address the impact of environmental concerns on taxation?

A9. The government is considering implementing green taxes and incentives to promote environmentally friendly practices. This could include taxes on carbon emissions, incentives for using renewable energy sources, and tax breaks for businesses that adopt sustainable practices.

Add a Comment