Property tax is a very important and major source of revenue for all local governments and municipalities in India. Surat Municipal Corporation (SMC) of Surat is fully in charge of levying and collecting property tax from all citizens, businesses and institutions.

Every single penny raised from these taxes is used to build and maintain critical infrastructure and services like water supply, roads, sanitation, public health and education.

In this blog post, we will provide you with all the information about Surat Municipal Corporation property tax, calculation technique, payment process, exemptions, penalties and its role in urban development, which no one else has been able to provide you till now.

- What is the Surat Municipal Corporation (SMC)?

- What is the Importance of Property Tax?

- Which Type of Properties are taxed by SMC?

- What are the Benefits of Surat Municipal Corporation Property Tax?

- How do you Calculate Surat Municipal Corporation Property Tax?

- What is the Surat Municipal Corporation Property Tax Bill?

- How To Pay Surat Municipal Corporation Property Tax Payment?

- What is the Due Date of the Surat Municipal Corporation Property Tax?

- How to Change Name in Property Tax?

- How to Search the Property Tax by Name?

- What is the Age Factor in Property Tax?

- What is SUC in Surat Municipal Corporation Property Tax?

- What are the Tax Rate sand Slabs of Surat Municipal Corporation Property Tax?

- What is the Surat Municipal Corporation Zone List?

- What are the Exemptions and Rebates in Surat Municipal Corporation Property Tax?

- What is the Future of Property Tax of Surat?

- In Conclusion

- FAQs

- 1. What documents are needed to pay Surat property tax?

- 2. How can I check my property tax dues in Surat?

- 3. Is there a deadline for paying property tax in Surat?

- 4. Can I get a refund if I overpay property tax?

- 5. What are the consequences of not paying property tax?

- 6. Are there any tax rebates for environmentally friendly buildings?

- 7. Can I transfer property tax to a new owner if I sell my property?

- 8. Is there a difference in tax rates between self-occupied and rented properties?

- 9. What should I do if I believe my property tax is too high?

- 10. Can property tax be paid in installments?

What is the Surat Municipal Corporation (SMC)?

Surat Municipal Corporation Property Tax, established in 1966 by the Indian government of our country, has been largely in charge of the governance of Surat, one of the fastest growing cities of India.

Surat Municipal Corporation Property Tax has always been responsible for various services including water supply, sewage treatment, road maintenance, waste management and all other public health. It is also solely responsible for urban planning, building standards and collection of all property taxes.

Surat, a state that has long been a hub of textile, diamond and chemical industries, plays a vital role in boosting the overall prosperity of the city by investing in infrastructure and services paid for by property taxes.

What is the Importance of Property Tax?

Property taxes are seen as a very important source of revenue for the Surat Municipal Corporation, as they go a long way in enabling every city to fully meet its overall infrastructure and development needs.

All the money from the right kind of property tax is used to fund a variety of municipal services that significantly improve the quality of life of all citizens and also help sequester carbon while contributing to the economic development of your city. These include:

- Water Supply: Ensuring clean and reliable water distribution to residents and businesses.

- Waste Management: Efficient garbage collection and disposal.

- Roads and Infrastructure: Building and maintaining roads, bridges, and public spaces.

- Public Health: Operating hospitals, clinics, and public health initiatives.

- Education: Supporting municipal schools and libraries.

Without all the Surat Municipal Corporation Property Tax would be unable to fund the most critical services, resulting in a significant decline in the municipal infrastructure and public amenities of the local state.

Which Type of Properties are taxed by SMC?

The Surat Municipal Corporation levies property tax on various types of properties, including:

- Residential Properties: Houses, apartments, and any other residential buildings.

- Commercial Properties: Shops, offices, malls, and other commercial establishments.

- Industrial Properties: Factories, warehouses, and industrial units.

- Vacancy Lands: Unused plots of land that have development potential.

Each type of property is taxed differently based on its size, location, and purpose.

What are the Benefits of Surat Municipal Corporation Property Tax?

The benefits of paying the Surat Municipal Corporation property tax are numerous, and they contribute to the overall development and maintenance of the city. Here are some key benefits:

- Urban Infrastructure Development: Surat Municipal Corporation collects a hefty amount of property tax to build and maintain all the municipal infrastructure such as roads, drainage system, public parks and street lighting. All residents also benefit from better living conditions and a higher quality of life throughout their lives.

- Public Amenities and Services: Tax revenues go a long way in providing essential public services including waste management, water supply, sewage treatment and public health services. Regular payment of property taxes essentially ensures the smooth functioning of these services.

- Legal Protection for Property Owners: To be a legally certified owner it is very important that the property holder has to pay the property tax basically. Surat Municipal Corporation They assist property owners in preventing disputes of property ownership and as legal aid in any case where there are lawsuits regarding the property.

- Development of Public Welfare Facilities: The money collected from property tax is sometimes used to build welfare buildings, including community halls, libraries, schools and health facilities. This is in a way conducive to the general welfare of the community.

- Eligibility for Government Schemes: People who have the habit of paying their taxes conscientiously are provided with many concessions by the government in its supplementary schemes or subsidies. This can include everything related to welfare ranging from shelter, sanitation and other civic infrastructure.

- Discounts and Rebates: Surat Municipal Corporation may also seek a reduction in property tax for a certain period or for certain categories such as senior citizen properties. This is because if the payment is made on time, it also brings financial benefits.

- Better Civic Management: Property tax helps the municipal corporation to properly formulate and implement city management strategies. These areas include infrastructure development, construction, slum clearance and traffic control, with the general aim of improving Surat’s physical infrastructure and thus increasing its sustainability.

- Support for Emergency Services: This form of taxation includes property taxes, some of which is used to fund emergency service providers such as fire brigades and management of disasters. This helps the city to be more prepared for emergencies.

How do you Calculate Surat Municipal Corporation Property Tax?

To calculate the Surat Municipal Corporation property tax, you need to understand the formula and the components that affect the tax amount. Here is a step-by-step guide:

Understand the Property Tax Formula

It is important to note that Surat Municipal Corporation Property Tax is usually levied on the current market value or annual rental value (ARV) of the property concerned. Its formula is:

Property Tax = Tax Rate × Annual Rental Value (ARV)

Determine the Annual Rental Value (ARV)

ARV is probably an estimated amount of monetary value that the property can fetch per year if it is rented out for use. It depends on several factors:

- Property Type: In homes, businesses, or industries.

- Location: Sometimes it could be true that the prime location associated with the particular store has its ARV higher.

- Property Size: As a rule, larger properties can boast higher ARV than the smaller ones, yet it depends on the area’s characteristics.

- Age and Condition: Generally, properties that are newly constructed or those which are well maintained can have a higher ARV.

- Usage: Irrespective of whether the property is owner-occupied or the property which has been rented out.

Know the Applicable Tax Rates

Surat Municipal Corporation Property Tax applies different tax rates to the type of properties in operation. These are the rates for residential, commercial and industrial buildings. These are available on the SMC website and also on local tax offices if you wish to check them out.

Calculate Additional Charges and Rebates

- Water Tax: Surat Municipal Corporation Property Tax may add a water tax to the property tax bill.

- Sewerage Tax: There could be an additional sewerage tax.

- Rebates: Some rebates may be available for senior citizens, early payment, or properties used for specific purposes.

Calculate the Total Property Tax

Add any additional charges (like water or sewerage tax) to the base property tax calculated using the ARV. Subtract any eligible rebates.

Total Property Tax = (Tax Rate × ARV) + Additional Charges – Rebates

Example Calculation

If the ARV of residential property is ₹ 50000 and the tax rate is 0. 5%, the calculation would be:

- Base Tax: 0.5% of ₹50,000 = ₹250

- Water Tax: ₹100 (example)

- Sewerage Tax: ₹50 (example)

- Rebate: ₹50 for early payment

Total Property Tax = ₹250 + ₹100 + ₹50 – ₹50 = ₹350

Use the SMC Online Calculator

For quick property tax calculation, you can use the property calculator tax, which is provided by Surat Municipal Corporation Property Tax on their official website, and it is enough to input the property details.

With such above steps, you will be in a position to get the correct Surat Municipal Corporation property tax.

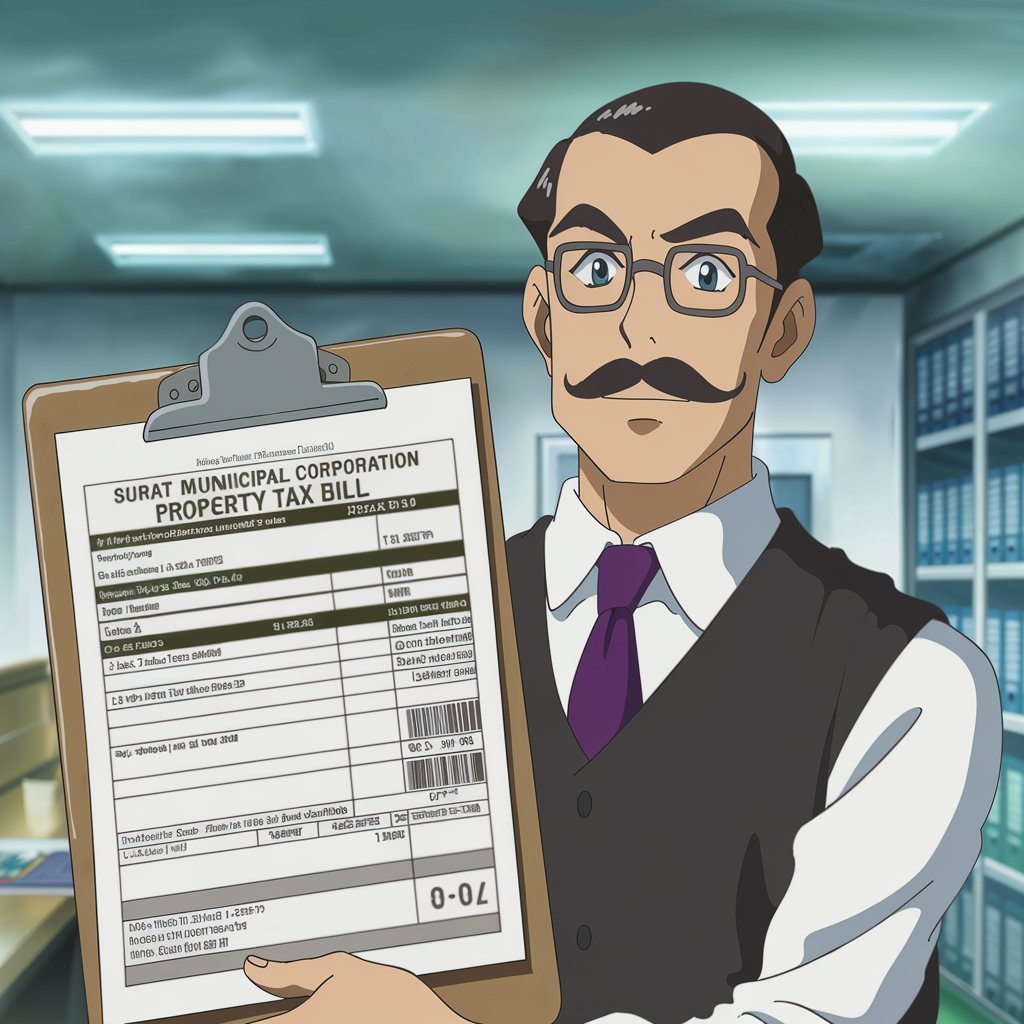

What is the Surat Municipal Corporation Property Tax Bill?

The Surat Municipal Corporation Property Tax Bill is an official statement containing the details of the property tax to be paid by the property owner in Surat Municipal Corporation Property Tax. It includes:

- Property Details: Property identification, owner’s name, location and type of residential premises.

- Annual Rental Value (ARV): The annual rental value used for assessing taxes.

- Tax Calculation: This shows the amount calculated as per ARV, along with the tax rate.

- Additional Charges: This includes water tax, sewerage tax, etc.

- Discounts and Concessions: Any concessions applicable are deducted.

- Total Amount Payable: Displays the actual payment to be made along with the date of payment.

- Payment Methods: You can pay online through the SMC website, through a bank or offline at Surat Municipal Corporation Property Tax offices.

How do I pay the Surat Municipal Corporation Property Tax Bill?

- Online Payment: Open the official website of Surat Municipal Corporation and find the Property Tax tab on the homepage. Fetch the property details or specific bill number, view the bill, and proceed with payment through net banking, debit/credit card or any other digital wallet.

- Offline Payment: Bills can be paid at authorised banks, Surat Municipal Corporation Property Tax ward offices and municipal corporation head office. This is usually accompanied by a bill which serves as the only proof that something was delivered to the customer and for identification purposes in the authenticity of the payment.

- Mobile App: It is also possible that Surat Municipal Corporation Property Tax has its own mobile app for paying property tax and checking the status of your bill.

How To Pay Surat Municipal Corporation Property Tax Payment?

Surat Municipal Corporation property tax bill can be paid either online or offline; we have provided you step-by-step guidance for both:

Online Method

- Visit the SMC website: The easiest way to get information about Surat Municipal Corporation is to visit the company’s official website.

- Visit the Property Tax Section: When searching for property tax information, search for “Property Tax” or “Online Services” on the homepage.

- Enter Property Details: You need to type in your property ID or property owner’s name or your bill number to get the details.

- View Your Bill: View information about the property tax bill, such as cost and other charges.

- Choose Payment Method: Choose your desired mode of payment through Net Banking, Credit/Debit Card or United Payment Interface.

- Make Payment: Visit the link given below and complete the payment process by filling in the required information and proceed to make the payment.

- Receipt Generation: In case of a successful transaction, the payment receipt will be generated. You can also save this receipt so that you have a hard copy of this receipt for future use.

Offline Method

- Visit a designated SMC office: You can pay property tax at the authorized bank in Surat Municipal Corporation Property Tax ward offices and Shimla Municipal Corporation head office.

- Get Challan Form: You can quickly get the property tax challan form from the respective bank or office.

- Fill Property Details: Fill in the property ID, owner name and any other information that needs to be filled there.

- Submit Form and Pay: The paid form has to be submitted along with the filled form at the counter in the form of cash, cheque or demand draft.

- Get Payment Receipt: After the payment, an official receipt is given from the bank or Surat Municipal Corporation Property Tax office. Synchronize this receipt online or anywhere else for record keeping purposes.

What is the Due Date of the Surat Municipal Corporation Property Tax?

The generally prescribed deadline for depositing Surat Municipal Corporation Property Tax is March 31st in each financial year. This is the date by which property owners are expected to pay their property tax for the entire financial year, which means that any payment made after this date will attract a penalty and/or other charges.

Important Points to Note:

- Discount on early payment: In many cases, the Surat Municipal Corporation Property Tax may decide to offer a variety of incentives such as discounts or rebates for making early payments on property tax. To know the current offers made by the Surat Municipal Corporation Property Tax company, one can visit the firm’s website or call the office.

- Penalties on late payment: It is easy to add a penalty or interest charge if the tax is not paid by the due date. It is better to pay on time so that no additional charges are added to the account.

- Notification: It is also common for the Surat Municipal Corporation Property Tax to send messages containing information about the due date to owners via phone or post.

How to Change Name in Property Tax?

If someone wants to change the name in the property tax register with Surat Municipal Corporation Property Tax, then the person has to go through some legal process for it. Here is a step-by-step guide:

Steps to Change Name in Property Tax Records

Get the application form: Visit the official website of Surat Municipal Corporation Property Tax or the respective local ward office to download the “Name Change Application Form” for property tax records.

Fill the application form: Fill in all the required information in the form including the full name of the current property owner, property number/ID, property address and the new name to be entered.

Attach Required Documents

- Proof of ownership of the property: Photocopy of the sale deed, gift deed or any other document which proves the title of the property.

- Latest property tax receipt: Photocopy of the payment stub of the latest assessed property tax.

- Identity proof: Photocopy of the identity proof of the new owner/self-attested copy of 12 digit Aadhaar card/voter ID card/passport etc.

- No objection certificate (NOC): If required, irrespective of the NOC of the previous owner.

- Mutation deed or affidavit: A mutation deed or affidavit in original in change of ownership.

Submit application: Submit the duly filled application form along with all the documents attached to the SMC ward office in which such property is situated.

Pay processing fees: Submit the required fees for the name change as per the law. The charges for the fees may also vary and can be confirmed from the Surat Municipal Corporation Property Tax office in this regard.

Verification Process: After that, the municipal officials will ensure that all the submitted documents are authentic. They may also visit the site to assess the actual situation.

Get confirmation: In this aspect, the name prepared by the Surat Municipal Corporation Property Tax after the verification is complete will be included in their property tax records. You will be informed of the change through a letter or a new property tax bill reflecting your new name.

Check status online: On the SMC website, one is able to track the status of the name change request using the property details.

How to Search the Property Tax by Name?

To find Surat Municipal Corporation Property Tax by name, follow these steps:

- Visit SMC Website: Visit the official web page of ‘Surat Municipal Corporation’.

- Visit Property Tax Section: For details, check the “Property Tax” or “Online Services” tab on the website.

- Select Search by Name option: Select the option to enter property tax information by owner’s name.

- Enter Required Details: The full name of the property owner must be provided along with other details like zone/ward number to make the search more specific.

- View Property Tax Details: On accessing the system, property tax details such as tax amount due, past payment records and more will be shown.

- Download or Print: One can download or print the property tax details for further use.

What is the Age Factor in Property Tax?

Age factor under property tax means exemption or reduction in taxes based on the age of the owner of the home or building. It works like this:

- Age of the owner: Many cities offer exemptions or rebates in property tax to senior citizens, who are usually 60 years of age or older. This will help ease the financial burden of elderly individuals, especially those who are still paying for their homes.

- Age of the property: In some cases, age is also another characteristic that is used to determine property taxes, including the age of the property. Some of them may have different depreciation rates or have a lower ARV than existing structures due to their age, this will reduce the tax amount.

- Applicable rates: For exemption or rebate attributed to the age factor, the percentage may vary from one municipality to another. Please refer to the Surat Municipal Corporation Property Tax for more information.

What is SUC in Surat Municipal Corporation Property Tax?

SUC in property tax usually stands for Service Usage Charges. These are additional charges levied by municipal corporations for the usage of various civic services, such as:

- Water Supply: Charges for water consumption provided by the municipality.

- Sewerage and Drainage: Charges for maintaining and delivering sewerage and drainage services.

- Sanitation: Costs associated with waste collection, street cleaning, and other sanitation services.

The SUC is typically added to the base property tax amount and is reflected in the final property tax bill. These charges help the municipal corporation maintain and improve civic services for the residents.

What are the Tax Rate sand Slabs of Surat Municipal Corporation Property Tax?

Here are the the overall tax rates and slabs of surat municipal corporation property tax in table:

| Property Type | Annual Rental Value (ARV) Slabs | Tax Rate |

|---|---|---|

| Residential Property | Up to ₹5,000 | 3% of ARV |

| ₹5,001 – ₹20,000 | 5% of ARV | |

| Above ₹20,000 | 7% of ARV | |

| Commercial Property | Up to ₹5,000 | 4% of ARV |

| ₹5,001 – ₹20,000 | 8% of ARV | |

| Above ₹20,000 | 12% of ARV | |

| Industrial Property | Up to ₹10,000 | 5% of ARV |

| ₹10,001 – ₹50,000 | 10% of ARV | |

| Above ₹50,000 | 15% of ARV | |

| Vacant Land | Fixed rate | ₹0.10 per sq. meter |

| Mixed-Use Property | Based on usage percentage | Combination of rates |

What is the Surat Municipal Corporation Zone List?

In order to more effectively manage and administer civic services, the Surat Municipal Corporation Property Tax divides the entire city into several zones.

These zones aid in effective resource allocation, infrastructure maintenance, and governance. As per the latest division, the organization of Surat consists of the following zones:

- Central Zone

- East Zone

- West Zone

- South Zone-A

- South Zone-B

- South East Zone

- South West Zone

- North Zone

Wards are created from the further division of each zone to provide more granular control over municipal services like water supply, public health, sanitation, and property tax collection.

What are the Exemptions and Rebates in Surat Municipal Corporation Property Tax?

There are certain exemptions and rebates that may be offered to property owners in Surat Municipal Corporation. These include:

- Senior citizens: Sometimes, property tax exemptions or waivers are available.

- Government buildings: Those that are recognized as belonging to the government or a body of public welfare are exempted from paying property tax.

- Charitable institutions: Those properties that are employed in charitable organizations will either be exempted from taxes or get tax exemptions.

What is the Future of Property Tax of Surat?

As Surat is expanding its area and transforming into one of the urban cities, the importance of property tax as a source of funds for the city’s development will become even more important.

It was anticipated that the Surat Municipal Corporation is bound to incorporate better technology than GIS mapping to improve the assessment and collection of property tax. Also, the payment digitization process will have better compliance and transparency than the current traditional method.

In the future the SMC may also review property taxes to make them in line with property values and inflation levels. This will ensure that property tax remains one of the sustainable sources of income for the city.

In Conclusion

Property tax is collected by Surat Municipal Corporation for the management of all its properties and is used for the development, provision of services and growth of Surat.

This makes it important for property owners to know how the tax is calculated, the methods and ways to pay it as well as possible exemptions. Therefore, citizens and companies pay property taxes. In addition to fulfilling their civic responsibility, contributing to the success of the city.

It is, therefore, essential to have an efficient property tax system as it adapts to the future with the growing city of Surat for the upliftment of current and future generations of residents.

In the end, we hope that you all do not have to face any kind of complexity regarding this Surat Municipal Corporation Property Tax blog post and you would have got to see all kinds of information about this topic which no one else has been able to provide you till now, which will definitely be useful for you sometime in the future.

FAQs

1. What documents are needed to pay Surat property tax?

A1. Other things you may typically need include; property identification number, latest tax statement or demand note, and identification details such as proof of address or ownership documents. These documents help lend credibility to your property as well as ensure that payments made are correct.

2. How can I check my property tax dues in Surat?

A2. It is advised that one tries to log in to the Surat Municipal Corporation website or reach out to the Surat Municipal Corporation offices. The kind of property details one should enter to check the dues include the property ID.

3. Is there a deadline for paying property tax in Surat?

A3. Actually, property tax in Surat must be paid to the SMC by the due dates set by the local authorities and they can be annual or half-yearly. Often there are consequences like penalties or interest charges for delay in payment.

4. Can I get a refund if I overpay property tax?

A4. For any overpayment made by the contractor, Surat Municipal Corporation allows the contractor to apply with the required documents and evidence of overpayment and get his amount back. SMC can use the excess amount to offset future tax obligations.

5. What are the consequences of not paying property tax?

A5. Delay in payment or non-payment of property tax is charged by Surat Municipal Corporation in the form of penalties or additional interest in addition to legal procedures. The worst form of penalty can be that the policyholder loses his property through attachment or sale to recover the dues.

6. Are there any tax rebates for environmentally friendly buildings?

A6. There are some cities that offer tax incentives in the form of rebates to companies investing in green or environmentally sustainable structures. You should consult Surat Municipal Corporation to know if they offer any kind of concessions for energy or eco-friendly construction.

7. Can I transfer property tax to a new owner if I sell my property?

A7. One important information about the property that is usually passed on to the new owner is the property tax. It is advisable that both the parties make the necessary changes in the property records at Surat Municipal Corporation so that confusion does not arise between each of them.

8. Is there a difference in tax rates between self-occupied and rented properties?

A8. Yes, this is true to some extent as the property tax rates may vary if the property is self-occupied or rented out. This is because they have different charges on such periods and you should contact the SMC for them.

9. What should I do if I believe my property tax is too high?

A9. If you feel that you have been treated unfairly in terms of property tax, you should appeal by contacting the Surat Municipal Corporation. You may need to submit documents and make a claim for a second review.

10. Can property tax be paid in installments?

A10. Sometimes the Surat Municipal Corporation may also allow payment of taxes in installments. Consult the SMC to find out their policies on payment in installments which the company needs to follow.

Add a Comment