Presumptive Taxation in India is a simplification project under the Income Tax Act designed to reduce the filing burden on small businesses and professionals. Instead of maintaining elaborate books of account, under this project taxpayers can declare their income at a fixed percentage of their total receipts or turnover. It aims to promote simplicity in filing filings for individuals with limited income, small income and professionals.

- What is Presumptive Tax Meaning?

- What are the Benefits of Presumptive Taxation?

- Presumptive Taxation Example?

- What is the Presumptive Taxation Scheme?

- Presumptive Taxation For Professionals?

- What is the Presumptive Taxation Income Tax Act?

- Presumptive Taxation 44AD?

- Presumptive Taxation 44ADA?

- Presumptive Taxation 44AE?

- What is the Due Date of Presumptive Taxation?

- What is the Presumptive Taxation Limit for ay 2024-25?

- Presumptive Tax Calculator India?

- What are the Presumptive Tax Rates?

- Who is Eligible for Presumptive Taxation?

- Conclusion

- FAQs

- 1. What is Presumptive Taxation?

- 2. What is the income percentage under Section 44AD?

- 3. What is the income percentage under Section 44ADA?

- 4. Do I need to maintain books of accounts under the Presumptive Taxation Scheme?

- 5. What is the due date for filing tax returns under the Presumptive Taxation Scheme?

- 6. What happens if I opt out of the Presumptive Taxation Scheme after choosing it?

- 7. Are deductions allowed under the Presumptive Taxation Scheme?

- 8. What is the turnover limit for presumptive taxation under Section 44AD?

- 9. What are the benefits of opting for Presumptive Taxation?

- 10. Is Presumptive Taxation mandatory for eligible taxpayers?

What is Presumptive Tax Meaning?

Presumptive Tax Meaning is a simplified method of calculating income tax, whereby income is estimated or estimated based on a certain percentage of turnover or receipts. Its main objective is simplifying tax treatment, especially for small businesses, professionals and taxpayers.

What are the Benefits of Presumptive Taxation?

1. Development of a simplified taxation system

- Taxpayers are not required to maintain detailed books of accounts.

- Income is calculated based on a non-negotiable percentage of gross receipts or turnover, which makes accounting income easier.

2. Reduction in compliance burden

- If a taxpayer opts for presumptive taxation, there is no need for detailed audit or record keeping.

- This reduces the cost and effort involved in the administration of tax compliance.

3. No audit requirement: Professions and professionals opting for presumptive taxation are exempted from the requirement of tax audit under sections 44AD and 44ADA, provided their total income does not exceed the abovementioned limits.

4. Lower Administrative Costs: Since no calculator exists, taxpayers save time and money on bookkeeping, account processing and tax consultation services.

5. Predictability in Tax Liability: With a fixed percentage of income declared under the project, taxpayers can easily predict their tax liability, leading to better financial planning.

6. Promotes digital transactions: Under Section 44AD, employees earning income through banking channels (digital transactions) can declare lower income (6% instead of 8% of turnover). This encourages digital transactions and increases seamlessness.

7. No need to track expenses: Taxpayers are not bothered to document personal business expenses or justify them as business expenses since they are considered a certain income level regardless of the actual costs.

8. Beneficial for small businesses and professionals: This benefits small businesses, freelancers, and professionals with a modest turnover compared to the typical form, as it simplifies tax processes for them.

Presumptive Taxation Example?

1. Example under Section 44AD (for small businesses):

Priya is a freelance architect with an annual gross income of ₹40 lakh. She has opted for the presumptive taxation scheme under section 44ADA.

- Declared income: She must declare 50% of her gross receipts as income.

Calculation:

- 50% of ₹40 lakhs = ₹20 lakhs.

- Taxable income: ₹20 lakhs is considered her taxable income.

- No detailed record-keeping: Priya doesn’t need to maintain detailed books or get her accounts audited.

2. Example under Section 44ADA (for professionals):

Priya is a freelance architect with an annual gross income of ₹40 lakh. She has opted for the presumptive taxation scheme under section 44ADA.

- Declared income: She must declare 50% of her gross receipts as income.

Calculation:

- 50% of ₹40 lakhs = ₹20 lakhs.

- Taxable income: ₹20 lakhs is considered her taxable income.

- No detailed record-keeping: Priya doesn’t need to maintain detailed books or get her accounts audited.

What is the Presumptive Taxation Scheme?

The presumptive taxation scheme makes tax filing more accessible for minor concerns and professionals. Taxpayers declare income as a certain percentage of turnover or receipts.

8% for businesses (Section 44AD).

50% for professionals (Section 44ADA).

There is no need for detailed accounts or audits. It is for businesses with a turnover of up to Rs 2 crore and professionals with receipts up to Rs 50 lakh.

Presumptive Taxation For Professionals?

The presumptive taxation structure for professionals under section 44ADA makes tax filing simpler for certain professionals such as doctors, lawyers, architects and freelancers.

1. Eligible Professionals: The scheme applies to individuals, Hindu Undivided Families (HUFs) and partnerships engaged in specified professions (e.g., legal, medical, architectural, engineering).

2. Income Declaration: Businessmen can declare up to 50% of their gross receipts as income.

3. Eligibility Criteria: Total receipts should not exceed ₹50 lakh in a financial year.

4. No need for detailed accounts: Professionals opting for this project do not need to maintain detailed books of accounts or undergo audits.

What is the Presumptive Taxation Income Tax Act?

Presumptive Taxation Income Tax Act refers to the rule under the Income Tax Act, 1961 that allows small taxpayers to calculate their taxable revenue on a presumptive basis, without maintaining extensive accounting books. It makes it easier for businessmen, professionals and transporters to file taxes by estimating their income as a certain percentage of turnover or gross receipts.

1. Section 44AD: Small businesses with turnover up to Rs 2 crore. They can declare 8% of their turnover (or 6% for digital transactions) as income.

2. Section 44ADA: Professionals like doctors, lawyers, etc. whose gross receipts are up to Rs 50 lakh. They can declare 50% of their receipts as income.

3. Section 44AE: For transporters owning up to 10 goods vehicles, income is presumed based on the number of cars owned.

Presumptive Taxation 44AD?

Section 44AD of the Income Tax Act makes tax filing more accessible for small businesses with a turnover of up to Rs 2 crore.

- Income Declaration: 8% of turnover (6% for digital payments) is taxable.

- Eligibility: Individuals, HUFs and partnership firms (except LLPs).

- No Auditing Required: There is no need for detailed accounting or auditing.

- Restrictions: If expelled, re-entry will not be permitted for 5 years.

Presumptive Taxation 44ADA?

Section 44ADA makes tax filing easier for professionals such as doctors, lawyers and architects with gross receipts up to Rs 50 lakh.

- Income Declaration: 50% of gross receipts is considered taxable income.

- No accounting required: No need for detailed books or auditing.

- Eligibility: Applicable to certain specified professionals.

Presumptive Taxation 44AE?

Section 44AE simplifies taxation by allowing certain declaration of income for small transporters owning up to 10 goods vehicles.

- Eligibility: Transporters with up to 10 goods trains.

- Estimated income: ₹7,500 per month per vehicle, or ₹1,000 per tonne of vehicle weight for heavy vehicles.

- No bookkeeping required: No need to keep detailed accounts or audits.

- Deductions: No additional business expense deductions are allowed.

What is the Due Date of Presumptive Taxation?

The Last date for filing an Income Tax Return (ITR) under the presumptive taxation project is generally the 31st July of the tax assessment year to filing on time to avoide penalty contact our Expert Legal Adviser.

- For individuals and professions opting for section 44AD or 44ADA, the due date is 31st July of the year following the financial year.

- If the taxpayer’s total income exceeds the basic exemption limit and they do not file the return by the due date, late filing may attract fees and penalties.

This deadline may be extended by the Government, but 31 July is the standard cut-off date.

What is the Presumptive Taxation Limit for ay 2024-25?

The presumptive taxation limits for various sections under the Income Tax Act are as follows:

1. Section 44AD (for small businesses): Turnover limit: Up to ₹2 crore in a financial year.

2. Section 44ADA (for professionals): Gross receipts limit: Up to ₹50 lakh in a financial year.

3. Section 44AE (for transporters): Number of vehicles: Applicable if owning up to 10 goods vehicles.

These limits determine eligibility for a projected taxation scheme, which streamlines revenue accounting and reduces permitting requirements.

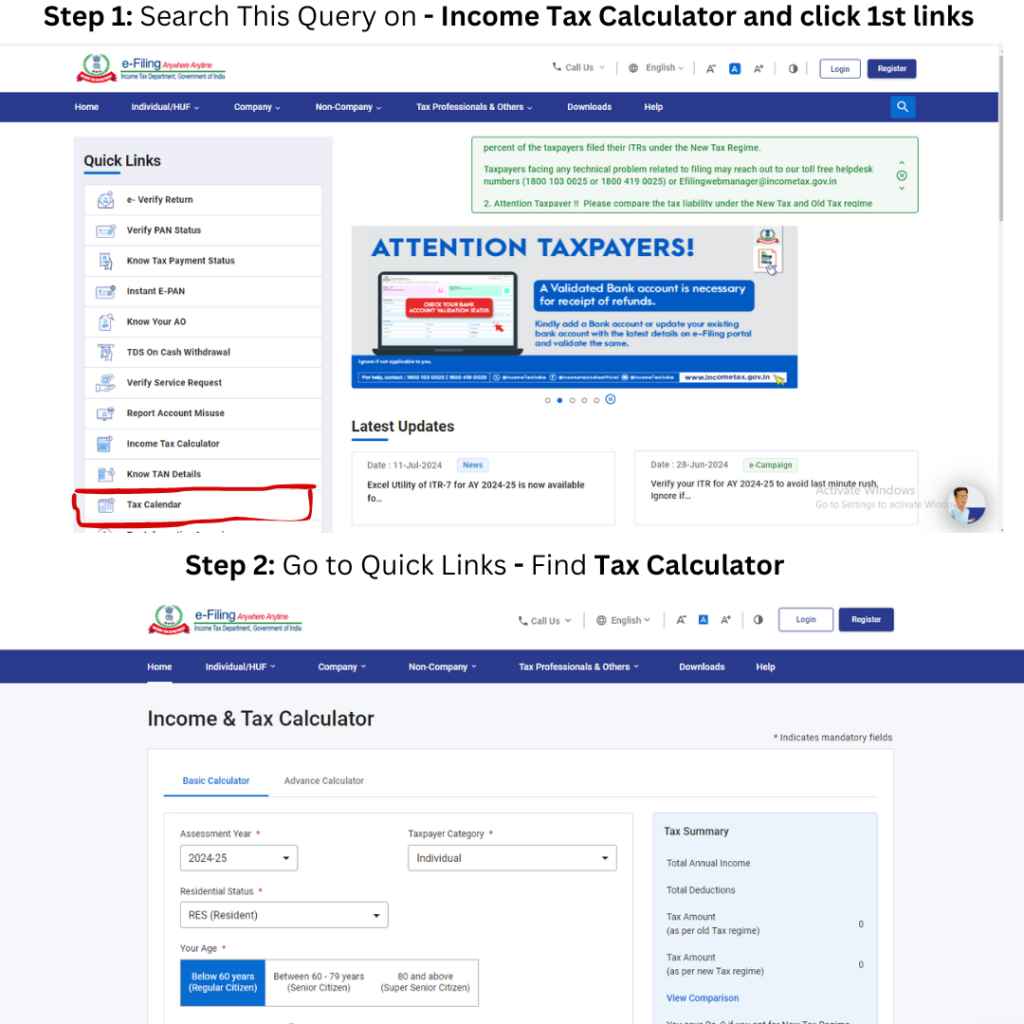

Presumptive Tax Calculator India?

An estimated tax calculator for India helps you calculate the taxable income under the presumptive taxation schemes provided by the Income Tax statute. These calculators use fixed percentages to make calculations easier. Here is an essential guide on how to use it for different sections.

| Section | Criteria | Presumptive Income | Example Calculation |

|---|---|---|---|

| 44AD (Small Businesses) | Turnover/Receipts: Up to ₹2 crore | 8% of turnover (6% if payments are digital) | Turnover of ₹50 lakh = 8% of ₹50 lakh = ₹4 lakh |

| 44ADA (Professionals) | Gross Receipts: Up to ₹50 lakh | 50% of gross receipts | Gross receipts of ₹40 lakh = 50% of ₹40 lakh = ₹20 lakh |

| 44AE (Transporters) | Number of Vehicles: Up to 10 | Fixed income per vehicle per month based on tonnage or flat amount | Income calculated per vehicle per month |

What are the Presumptive Tax Rates?

Here are the estimated tax rates for various sections under the Income Tax Act.

| Section | Criteria | Turnover/Gross Receipts Limit | Presumptive Income/Tax Rate |

|---|---|---|---|

| Section 44AD | Small Businesses | Up to ₹2 crore | – 8% of turnover (if receipts are not through digital modes) – 6% of turnover (if receipts are digital) |

| Section 44ADA | Professionals (Doctors, Lawyers, etc.) | Up to ₹50 lakhs | 50% of gross receipts |

| Section 44AE | Transporters (Goods Carriages up to 10) | Up to 10 goods carriages | – ₹1,000 per ton of gross vehicle weight per month – Or ₹7,500 per vehicle per month (if weight not applicable) |

Who is Eligible for Presumptive Taxation?

The eligibility for presumptive taxation under the Income Tax Act is as follows:

1. Section 44AD (Small Businesses):

- Individuals, Hindu Undivided Families (HUFs), and Partnership Firms (excluding LLPs).

- Turnover up to ₹2 crore.

2. Section 44ADA (Professionals):

- Professionals like doctors, lawyers, architects, engineers, etc.

- Gross receipts up to ₹50 lakhs.

3. Section 44AE (Transporters):

- Owners of up to 10 goods carriages.

Conclusion

The presumptive taxation scheme under the Income Tax Act offers a simplified tax-filing process for small businesses, professionals and transporters. With a certain percentage or amount of income to declare, it significantly reduces the filing burden by eliminating the need for elaborate calculations, audits and complex record-keeping. Sections 44AD, 44ADA and 44AE cater to every unusual community, prescribing soft turnover or receipt limits to determine eligibility. This system benefits taxpayers with modest incomes, encouraging simpler tax compliance while promoting transparency.

FAQs

1. What is Presumptive Taxation?

Presumptive taxation is a simplified tax accounting system in which income is presumed to be a certain percentage of turnover or receipts, aimed at reducing the tax burden for small businesses and professionals.

2. What is the income percentage under Section 44AD?

Under Section 44AD, 8% of the total turnover is taxable income. If the payment is received digitally, the rate reduces to 6%.

3. What is the income percentage under Section 44ADA?

Under Section 44ADA, 50% of gross receipts are considered taxable income.

4. Do I need to maintain books of accounts under the Presumptive Taxation Scheme?

No, taxpayers opting for a presumptive taxation scheme are not required to maintain detailed accounts or get audited.

5. What is the due date for filing tax returns under the Presumptive Taxation Scheme?

The last date for filing tax returns is generally 31st July of the assessment year.

6. What happens if I opt out of the Presumptive Taxation Scheme after choosing it?

If you opt for a presumptive taxation scheme (especially under Section 44AD) and exit it, you cannot re-enter it for the next 5 years.

7. Are deductions allowed under the Presumptive Taxation Scheme?

Once you declare income under the presumptive scheme, no upfront professional value deduction is allowed. However, you can still claim deductions under Section VI-A, such as Section 80C.

8. What is the turnover limit for presumptive taxation under Section 44AD?

The turnover limit for presumptive taxation under Section 44AD is ₹2 crore.

9. What are the benefits of opting for Presumptive Taxation?

Unique advantages include simplified tax filing, no need for extensive record keeping or auditing, predictable tax liability and low administrative costs.

10. Is Presumptive Taxation mandatory for eligible taxpayers?

No, it is not compulsory. Eligible taxpayers can opt for ordinary taxation if they want to maintain detailed accounts and request actual costs.

Add a Comment