Income tax for women is same as for men in India Until the financial year 2023-24 there are no specific income tax exemptions or lower taxes based on gender alone. Tax rates are determined based on income under two tax systems.

- What is Income Tax for Women?

- What are the Benefits of Income Tax For Women?

- What are the Advantages and Disadvantages of Income Tax For Women?

- What is Income Tax Slab for Women?

- What is Income Tax Slab for Female ay 2024-25?

- What is Tax Exemption for Women?

- What is the Tax Exemption Limit for Females in India?

- What is Taxable Income for Women?

- Income Tax for Female Employees in India Calculator?

- What is Income Tax Slab for Female above 60 Years?

- What are the Key Features Income Tax Slab for Female above 60 Years?

- Income Tax Slabs for Women Between 60-80 Years (FY 2024-25)?

- Income Tax Slab for Super Senior Citizens (Women Above 80 Years) (FY 2024-25)?

- What is Additional Surcharge for Women Under Old Regime and New Regime?

- Conclusion

- FAQ’s

- 1. What are the income tax slabs for women aged 60-80 years in FY 2024-25?

- 2. What are the income tax slabs for women super senior citizens above 80 years of age in FY 2024-25?

- 3. Is there any special deduction available for senior and very senior women under the old tax regime?

- 4. What is the exemption under section 87A for women in FY 2024-25?

- 5. What additional surcharges are applicable under the old and new tax regimes?

- 6. Can senior and extremely senior women choose between the old and new tax regimes?

- 7. Is there any difference in income tax slabs for men and women in India?

- 8. Are senior citizens required to pay advance tax?

- 9. What is the standard deduction available to salaried women under the old tax system?

- 10. What benefits will senior and very senior women get from the new tax system?

What is Income Tax for Women?

Income tax for women is the same as for men in India, with No gender-specific concessions or benefits. The tax structure depends on the level of income; one can choose between the old or new tax regime. In the old system, many types of deductions and exemptions are given under sections like 80C and 80D. However, in the new system, the tax rates are lower, but most of the deductions are not available despite previous provisions that offered separate tax slabs for women.

What are the Benefits of Income Tax For Women?

Although there are no income tax benefits specifically available for women in India they can avail various general provisions and deductions available to all taxpayers.

1. Standard Deduction Deduction of ₹50,000 for salaried women.

2. Section 80C Deduction Up to ₹1.5 lakh for investment (PPF, EPF, etc.)

3 Section 80D deduction Up to ₹25,000 for health insurance premiums (₹50,000 for senior citizens).

4. Section 80E Deduction on interest paid on education loan (No limit).

5. Home loan interest (Section 24B) Deduction of up to ₹2 lakh on home loan interest.

6. Tax exemption (Section 87A) Exemption up to ₹12,500 if income is less than ₹5 lakh.

7. House rent allowance (HRA) Deduction on HRA received as part of salary.

8. Additional home loan deduction (Section 80EEA) Up to ₹1.5 lakh for first-time home buyers under certain conditions.

What are the Advantages and Disadvantages of Income Tax For Women?

| Advantages | Disadvantages |

| Gender parity Equal tax slabs ensure gender neutrality in the tax system. | No gender-specific benefits Unlike before, this time there is no special tax concession or lower slab for women. |

| Access to Deductions Women can benefit from various tax deductions and exemptions (section 80C, 80D, etc.). | Complexity in filing Understanding and using the different deductions can be complicated and requires careful planning. |

| Financial planning Tax benefits encourage women to invest in savings vehicles, insurance and property. | Limitations of the new regime The new tax regime offers lower rates but limits deductions, which may be less beneficial for women with significant investments or loans. |

| Exemption for low income Women with income less than Rs 5 lakh can avail full tax exemption under Section 87A. | Higher tax rates for higher incomes High-earning women face the same high tax rates as men, and they don’t get any additional relief. |

| Support for education Tax deduction on interest on education loans helps women pursue higher education. |

What is Income Tax Slab for Women?

The income tax slabs for women in India are the same as for men and there are no gender specific exemptions. From the financial year 2023-24 women can choose from two tax regimes the old regime which allows various deductions and exemptions and the new regime, which offers lower tax rates without most deductions. Under both regimes tax rates are determined based on the level of income starting from 5% for income between Rs 2.5 lakh and Rs 5 lakh and going up to 30% for income above Rs 10 lakh in the old regime or Rs 15 lakh in the new regime. This uniform structure ensures that tax liabilities are based only on income, thereby promoting gender equality in the tax system.

What is Income Tax Slab for Female ay 2024-25?

The income tax slabs for women for the assessment year (AY) 2024-25 are as follows.

| Income Range | Old Tax Regime (with Deductions and Exemptions) | New Tax Regime (without Deductions and Exemptions) |

|---|---|---|

| Up to ₹2.5 lakh | Nil | Nil |

| ₹2.5 lakh to ₹5 lakh | 5% | 5% |

| ₹5 lakh to ₹10 lakh | 20% | 10% |

| Above ₹10 lakh | 30% | 15% (₹9 lakh to ₹12 lakh) |

| Above ₹15 lakh | – | 20% (₹12 lakh to ₹15 lakh) |

| Above ₹15 lakh | – | 30% |

What is Tax Exemption for Women?

These exemptions can reduce taxable income and the resulting tax liability to a great extent. Here are some of the significant discounts and cuts also Contact Our Expert Legal Adviser.

1. Standard deduction ₹50,000 deduction for salaried individuals including women.

2. Deduction under Section 80C Deduction up to Rs 1.5 lakh for investments in schemes like Public Provident Fund (PPF) Employees Provident Fund (EPF) National Savings Certificate (NSC) life insurance premium etc.

3. Deduction under Section 80D Deduction up to ₹25,000 (₹50,000 for senior citizens) on health insurance premiums paid for self, spouse, children and parents.

4. House Rent Allowance (HRA) Exemption on HRA received as part of salary, subject to conditions relating to the rent paid.

5. Section 24(b) Home loan interest Deduction of up to ₹2 lakh on interest paid on home loan for self-occupied house.

6. Section 80E Deduction on interest paid on education loan, no upper limit.

7. Tax exemption under Section 87A If the total income is less than Rs 5 lakh women are eligible for an exemption of up to Rs 12,500 reducing their tax liability to zero.

8. Section 80EEA Additional deduction of up to Rs 1.5 lakh on interest paid on home loan under certain conditions for first time home buyers.

What is the Tax Exemption Limit for Females in India?

The tax exemption limit for women is the same as that for men. There is no separate exemption limit depending on gender.

Old tax regime (with deductions and exemptions): Up to ₹2.5 lakh: No tax (exemption for all taxpayers including women).

The new tax regime (without deductions and exemptions) Up to ₹3 lakh: No tax (except for all taxpayers, including women).

What is Taxable Income for Women?

Taxable income for women in India is that part of their total income that remains after applying for eligible deductions and exemptions under the Income Tax Act.

1. Calculate Gross Income

Include all sources of income salaries rental income business or professional income capital gains and income from other sources like interest dividends etc.

2. Apply Deductions

Deduct eligible deductions under various sections like

Section 80C Deduction up to ₹1.5 lakh for investments in PPF EPF life insurance premium etc.

Section 80D Health insurance premium up to ₹25,000 or ₹50,000 for senior citizens.

Section 24(B) Home loan interest up to Rs 2 lakh for self-occupied property.

Section 80E Interest on Education Loan.

3. Subtract Exemptions

Some allowances are exempt from tax, such as

House Rent Allowance (HRA) Exemption is based on rent paid and is subject to specific conditions.

Standard deduction of Rs 50,000 for salaried individuals.

Section 87A exemption If total income is less than ₹5 lakh exemption of up to ₹12,500 can be claimed effectively reducing the tax liability to zero.

4. Determine Taxable Income.

The amount left after applying all deductions and exemptions is the taxable income.

This taxable income is then subject to the income tax slab applicable under the chosen tax regime (old or new).

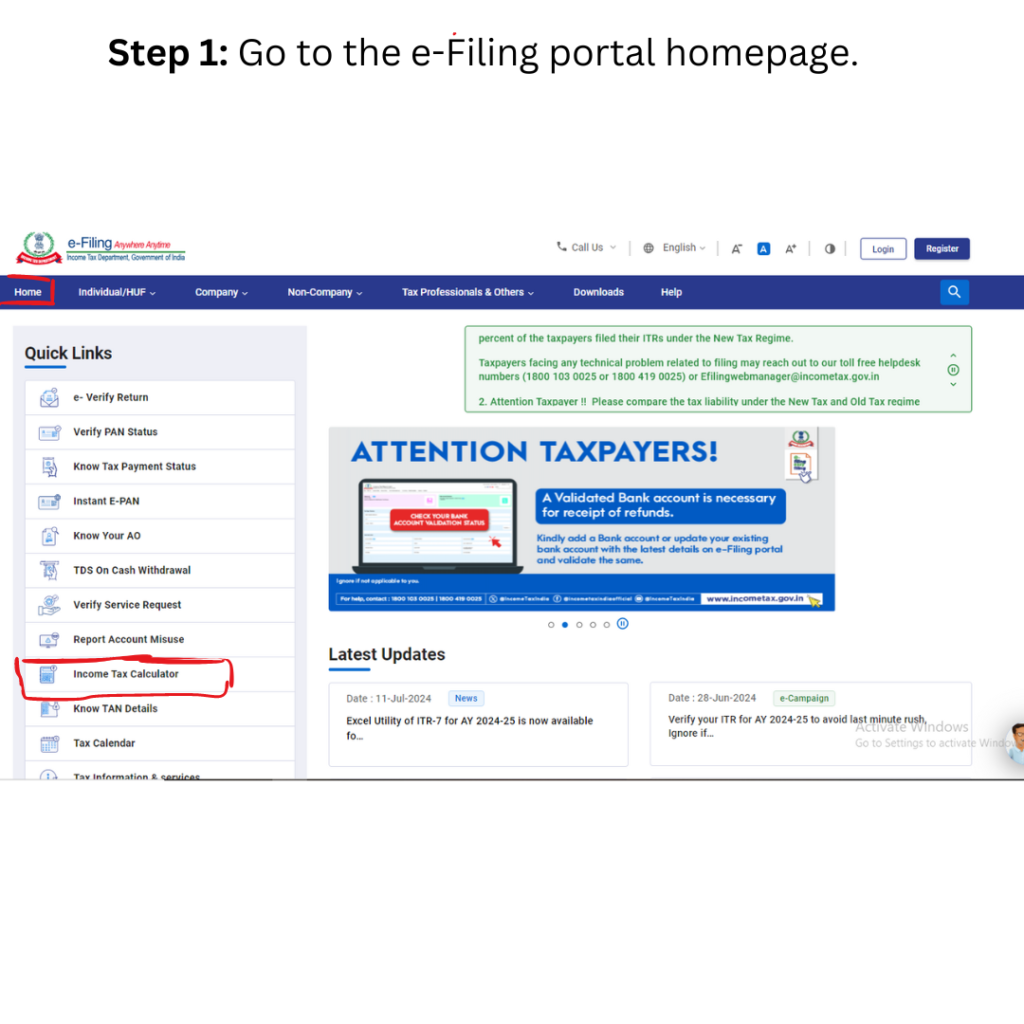

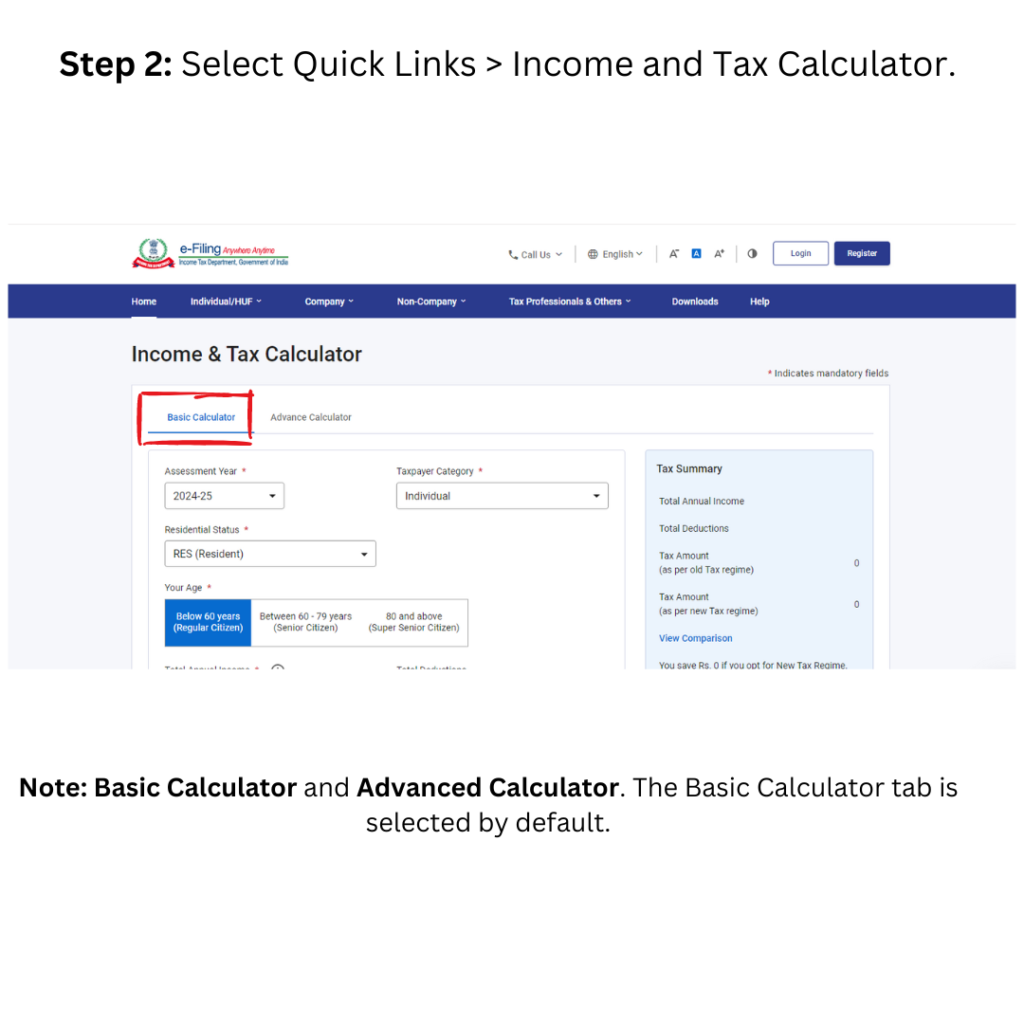

Income Tax for Female Employees in India Calculator?

You can use the following steps to calculate income tax for women employees in India. Here is a simple method to manually calculate income tax under both the old and new tax regimes for the financial year 2023-24 (assessment year 2024-25)

Step-by-Step Income Tax Calculation

Step 1: Determine Gross Income

Salary Income Includes basic salary, allowances, bonus etc.

Other income Includes income from rent, interest, dividends etc.

Step 2: Deductions (Old Tax Regime)

Section 80C For investments up to ₹1.5 lakh (PPF, EPF, life insurance, etc.).

Section 80D Up to ₹25,000 (₹50,000 for senior citizens) towards health insurance premiums.

Section 24(B) Up to ₹2 lakh for home loan interest (self-occupied property).

Standard deduction of Rs 50,000 for salaried employees.

Step 3: Calculate Taxable Income

Old system Subtract deductions from gross income.

New arrangement : No deductions, so taxable income will be equal to gross income.

Step 4: Apply Tax Rates

| Income Tax Slabs | Old Tax Regime | New Tax Regime |

|---|---|---|

| Up to ₹2.5 lakh | 0% | 0% |

| ₹2.5 lakh to ₹5 lakh | 5% | 5% |

| ₹5 lakh to ₹10 lakh | 20% | 10% |

| ₹10 lakh to ₹15 lakh | 30% | 15% |

| Above ₹15 lakh | 30% | 20% |

Step 5: Add Surcharge and Cess

Surcharge Applicable if income is more than Rs 50 lakh (10%, 15%, 25% or 37% depending on income level).

Health and Education Cess 4% of income tax.

Step 6: Calculate the Final Tax Payable

Old Regime Tax on income after applying for deductions and exemptions.

New system Tax on gross income without deductions.

Example Calculation

| Calculation | Old Tax Regime | New Tax Regime |

|---|---|---|

| Gross Income | ₹10,00,000 | ₹10,00,000 |

| Deductions | ₹1,50,000 (Section 80C) + ₹50,000 (Standard Deduction) | None |

| Taxable Income | ₹10,00,000 – ₹2,00,000 = ₹8,00,000 | ₹10,00,000 |

| Tax Calculation | ||

| 5% on ₹2,50,000 | ₹12,500 | ₹15,000 |

| 20% on ₹3,00,000 | ₹60,000 | ₹30,000 |

| 15% on ₹1,00,000 | – | ₹15,000 |

| Total Tax | ₹72,500 | ₹60,000 |

| 4% Health & Education Cess | ₹2,900 | ₹2,400 |

| Total Tax Payable | ₹75,400 | ₹62,400 |

Visit the official website for Income Tax Calculator for full guide.

What is Income Tax Slab for Female above 60 Years?

The income tax slabs for the financial year 2023-24 assessment year 2024-25 for women taxpayers senior citizens above 60 years of age in India are as follows.

| Income Range | Old Tax Regime (with Deductions and Exemptions) | New Tax Regime (without Deductions and Exemptions) |

|---|---|---|

| Up to ₹3 lakh | Nil (No tax) | Nil (No tax) |

| ₹3 lakh to ₹5 lakh | 5% | 5% |

| ₹5 lakh to ₹10 lakh | 20% | 10% |

| More than ₹10 lakh | 30% | 15% (₹9-12 lakh) / 20% (₹12-15 lakh) / 30% (Above ₹15 lakh) |

Additional marks for senior citizens (above 60 years)

Section 80D: Higher deduction limit for health insurance premium (up to Rs. 50,000).

No advance tax requirement: Senior citizens without business income need not pay advance tax.

What are the Key Features Income Tax Slab for Female above 60 Years?

Key highlights of Income Tax slabs for women above 60 years of age senior citizens in India for Financial Year 2023-24 Assessment Year 2024-25.

1. Higher Basic Exemption Limit.

Old and new regime: The basic exemption limit is ₹3 lakh.

2. Progressive Tax Rates

Old regime: 5% on Rs 3-5 lakh, 20% on Rs 5-10 lakh, 30% above Rs 10 lakh.

The new regime is 5% on Rs 3-6 lakh, 10% on Rs 6-9 lakh, and up to 30% above Rs 15 lakh.

3. Deductions and Exemptions

Old system ₹1.5 lakh is included under section 80C and ₹50,000 is included under section 80D.

New arrangement No deduction other than ₹50,000 standard deduction.

4. Section 87A Rebate No tax if income is less than ₹5 lakh exempt up to ₹12,500.

5. No Advance Tax Senior citizens who do not have business income are not required to pay advance tax.

6. Regime Choice Option to choose between old and new tax regimes every year.

Income Tax Slabs for Women Between 60-80 Years (FY 2024-25)?

The income tax slabs for the financial year 2023-24 (assessment year 2024-25) for women (senior citizens) aged 60 to 80 years in India are as follows.

1. Old tax regime with deductions and exemptions.

| Income Range | Tax Rate |

|---|---|

| Up to ₹3 Lakh | Nil |

| ₹3 Lakh to ₹5 Lakh | 5% |

| ₹5 Lakh to ₹10 Lakh | 20% |

| Above ₹10 Lakh | 30% |

2. New Tax Regime without deductions and exemptions.

| Income Range | Tax Rate |

|---|---|

| Up to ₹3 lakh | Nil (No tax) |

| ₹3 lakh to ₹6 lakh | 5% |

| ₹6 lakh to ₹9 lakh | 10% |

| ₹9 lakh to ₹12 lakh | 15% |

| ₹12 lakh to ₹15 lakh | 20% |

| Above ₹15 lakh | 30% |

Income Tax Slab for Super Senior Citizens (Women Above 80 Years) (FY 2024-25)?

The income tax slabs for very senior citizens women above 80 years of age in India for the financial year 2023-24 assessment year 2024-25 are as follows.

| Income Range | Old Tax Regime (with deductions and exemptions) | New Tax Regime (without deductions and exemptions) |

|---|---|---|

| Up to ₹3 lakh | Nil (No tax) | Nil (No tax) |

| ₹3 lakh to ₹5 lakh | Nil (No tax) | 5% |

| ₹5 lakh to ₹10 lakh | 20% | 10% |

| ₹10 lakh to ₹15 lakh | 30% | 15% |

| Above ₹15 lakh | 30% | 20% (₹12 lakh to ₹15 lakh) / 30% (Above ₹15 lakh) |

What is Additional Surcharge for Women Under Old Regime and New Regime?

Under both the old and new tax regimes in India an additional surcharge is applicable on income tax for both men and women based on their total income. The surcharge rates are the same for all taxpayers regardless of gender. Here are the details.

| Income Range | Surcharge under Old Tax Regime | Surcharge under New Tax Regime |

|---|---|---|

| Above ₹50 lakh to ₹1 crore | 10% of income tax | 10% of income tax |

| Above ₹1 crore to ₹2 crore | 15% of income tax | 15% of income tax |

| Above ₹2 crore to ₹5 crore | 25% of income tax | 25% of income tax |

| Above ₹5 crore | 37% of income tax | 37% of income tax |

Health and Education Cess.

An additional 4% Health and Education Cess is applicable on the total income tax including surcharge for both the old and new tax regimes.

Key Points

- This surcharge is applicable only if your total income exceeds Rs 50 lakh.

- The rates increase progressively as the income bracket increases.

- The surcharge is calculated on the amount of income tax and not on the entire income.

Conclusion

The income tax system in India provides different tax slabs and provisions for women, especially the senior and very senior citizen categories. Both the old and new tax regimes offer unique benefits allowing women to choose the most beneficial option based on their financial situation. The levy of additional surcharges on higher income groups ensures a progressive tax structure, while deductions and exemptions under the old regime provide opportunities to reduce taxable income. Like all taxpayers women too can plan their taxes strategically to maximize savings and meet their financial goals effectively.

FAQ’s

1. What are the income tax slabs for women aged 60-80 years in FY 2024-25?

Answer. For women aged 60–80 years, the old tax regime provides a basic exemption limit of ₹3 lacks, with tax rates of 5% for income between ₹3 lacks to ₹5 lacks, ₹5 lacks to ₹ The tax rates are 20% for ₹10 lacks and 30% for income above ₹10 lacks. The new tax regime offers a basic exemption limit of ₹3 lakh with progressive tax rates up to 30% for income above ₹15 lakh.

2. What are the income tax slabs for women super senior citizens above 80 years of age in FY 2024-25?

Answer. For very senior women above 80 years the old tax regime offers a higher basic exemption limit of ₹5 lakh. The tax rates are 20% for income between ₹5 lakh and ₹10 lakh and 30% for income above ₹10 lakh. The new tax regime follows the same structure for other senior citizens.

3. Is there any special deduction available for senior and very senior women under the old tax regime?

Answer. Yes, under the old tax regime senior and very senior women could avail deductions of up to ₹1.5 lakh under Section 80C ₹50,000 under Section 80D for health insurance premium and ₹2 lakh under Section 24b for home loan interest.

4. What is the exemption under section 87A for women in FY 2024-25?

Answer. If a woman total income is less than ₹5 lakh she is eligible to avail exemption under Section 87A which can reduce her tax liability to zero. The maximum amount of exemption is ₹12,500.

5. What additional surcharges are applicable under the old and new tax regimes?

Answer. Surcharge applies if total income exceeds Rs 50 lakh with rates starting at 10% and going up to 37% for income above Rs 5 crore. These surcharges are applicable equally under both the old and new tax regimes.

6. Can senior and extremely senior women choose between the old and new tax regimes?

Answer. Yes both senior and ultra-senior women can choose between the old and new tax regimes every year depending on which regime provides better tax benefits to them.

7. Is there any difference in income tax slabs for men and women in India?

Answer. No, the income tax slabs and rates are the same for both males and females. Although tax slabs vary depending on age, higher exemption limits are available for senior citizens 60-80 years and super senior citizens above 80 years.

8. Are senior citizens required to pay advance tax?

Answer. Senior citizens whose income is not from business or profession are exempted from paying advance tax. They can pay their entire tax liability through self-assessment tax.

9. What is the standard deduction available to salaried women under the old tax system?

Answer. Under the old tax regime salaried women could claim a standard deduction of Rs 50,000 from their income thereby reducing their taxable income.

10. What benefits will senior and very senior women get from the new tax system?

Answer. The new tax regime provides low tax rates without allowing most deductions or exemptions. This may be beneficial for those who do not have significant deductions to claim under the old system.

Add a Comment