A sole proprietorship is one of the easiest forms of business that is quite common among small businesses and even freelancers. Although this method is useful because it offers a full range of control and is easy to organize, it also has quite a few drawbacks.

We will discuss the top 20 disadvantages of sole proprietorship in this blog post so that you can fully understand the risks you face before choosing a business structure.

- What is the Sole Proprietorship?

- What are the Top 10 Disadvantages of Sole Proprietorship?

- Unlimited Personal Liability

- Limited Access to Funding

- No Business Continuity

- Difficulty in Transferring Ownership

- Higher Tax Burden

- No Legal Separation Between Business and Personal Assets

- Limited Business Credibility

- Challenges in Hiring and Retaining Employees

- Over-reliance on the Owner

- Difficulty Scaling Operations

- What are the Characteristics of Sole Proprietorship?

- Which Factor is a Disadvantage of a Sole Proprietorship?

- In Conclusion

- FAQs

What is the Sole Proprietorship?

Sole Proprietorship Business is a basic and unincorporated type of business entity formed by an individual. This is the simplest and most prevalent type of business where the owner makes all the decisions for the business organization himself.

Here the limited liability structure does not separate the business and the owner, so the owner is fully liable for the debts, liabilities, and all other obligations put forward by the business.

For example, although the sole proprietor enjoys ease of operation and the freedom to decide when to start and end business activities, he is not protected from legal responsibility and lacks capital for business expansion.

If you want to know more about the Sole Proprietorship then you can click on the below video

What are the Top 10 Disadvantages of Sole Proprietorship?

Here are the top 10 disadvantages of a sole proprietorship:

- Unlimited Personal Liability

- Limited Access to Funding

- No Business Continuity

- Difficulty in Transferring Ownership

- Higher Tax Burden

- No Legal Separation Between Business and Personal Assets

- Limited Business Credibility

- Challenges in Hiring and Retaining Employees

- Over-reliance on the Owner

- Difficulty Scaling Operations

Unlimited Personal Liability

In sole proprietorships, there is no structure separation between the owner and the business where the owner will bear full responsibility for all business liabilities. If the situation in the industry gets worse means the company cannot pay the amount owed to the creditors, then the creditors can attach, and seize the owner’s personal property like a house or savings.

This means the owner’s financial well-being is up for grabs, and this leaves this model as one of the model’s major weaknesses.

Impact:

- High personal financial risk, especially if the business accrues large debts.

- Personal assets are vulnerable in the event of a lawsuit or business failure.

Unlimited Personal Liability is the 1st disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

Limited Access to Funding

Small-scale traders face a major problem when it comes to capital as they cannot issue shares or look for investors. Banks and other financial institutions around the world are always reluctant to lend money to a sole trader business. This restricts the potential growth of the industry by the owner and may result in the need to issue own funds or incur high-interest charges, which is not good to handle.

Impact:

- Business expansion is limited by the owner’s personal financial capacity.

- High dependence on personal funds, leading to potential financial strain.

Limited Access to Funding is the 2nd disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

No Business Continuity

For example, in the type of organization called a sole trader, the business is tied to the life and health of the owner. In most BCs, when the owner dies or becomes incapacitated, the business is reserved because there is no legal mechanism to maintain the existence of the enterprise.

Such discontinuity prevents the business from being transferred to the next generation without any legal complications affecting employees, customers, and creditors.

Impact:

- Sudden end of business operations in the event of the owner’s death or disability.

- No succession plan, creating uncertainty for employees and stakeholders.

No Business Continuity is the 3rd disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

Difficulty in Transferring Ownership

The main reason why selling or transferring ownership of a sole trader business is complicated is that the business is the owner and vice versa. Unlike a corporation, where ownership is represented by shares that can be sold, there is no clear way to assign ownership in a sole proprietorship.

Impact:

- Complicated and less attractive exit strategy for the owner.

- Hard to find buyers willing to take over a business closely tied to the original owner.

Difficulty in Transferring Ownership is the 4th disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

Higher Tax Burden

Self-employment taxes include Social Security Part A and Medicare taxes, where the owner pays both the employer and employee portion. To account for this, tax responsibility may be higher than in the case of corporate structures where taxes are shared between the firms and their employees.

Impact:

- Higher overall tax liability due to self-employment taxes.

- Fewer tax advantages and deductions compared to corporate structures.

Higher Tax Burden is the 5th disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

No Legal Separation Between Business and Personal Assets

Unlike properly formed business entities, there is no separation between the business entity and the owner, and, therefore, all assets are considered personal and business assets.

This not only puts the owner’s personal assets at risk of being seized in case of business debts but also complicates the process of accounting and completely eliminates any aspect of tax concern; the owner has to account for every expense incurred.

Impact:

- Personal assets are exposed to business-related risks.

- Complex financial management and potential for tax issues.

No Legal Separation Between Business and Personal Assets is the 6th disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

Limited Business Credibility

Sole trader businesses are generally perceived as small and uninspiring, and this can frustrate or arouse suspicion from larger, potential customers, distributors, or financial backers.

Most employers prefer to incorporate more structured legal entities such as corporations or limited liability partnerships for their operations because it gives them that spice of professionalism. This would leave the sole proprietor in a position to bid for larger contracts or obtain good supplier credit terms.

Impact:

- Harder to build trust with clients, suppliers, or partners.

- Perceived as less stable and professional compared to corporations.

Limited Business Credibility is the 7th disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

Challenges in Hiring and Retaining Employees

This is easier said than done for sole proprietors, as they lack the resources to offer the compensation packages of a larger organization, or the higher topos, promotions, and additional bonuses that employees often expect after joining a larger business entity.

If employees have no ladder to climb or do not receive good compensation, they may move to another company where their job is secure, resulting in a high turnover rate. This instability can further impede the potential growth of the business.

Impact:

- Difficulty in retaining skilled employees, leading to operational inefficiencies.

- High employee turnover due to limited compensation and benefits.

Challenges in Hiring and Retaining Employees are the 8th disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

Over-reliance on the Owner

Sole trader businesses rely heavily on the owner’s abilities, time, and health as there is no infrastructure to support the business. This is particularly so because the owner is usually involved in every decision, and illness, personal problems, or even ‘burn-out’ can harm the venture.

This makes it difficult to generate any more business as there is an excessive reliance on one person to carry the company forward if someone else fails to do so.

Impact:

- Business performance suffers if the owner is unable to manage the workload.

- Risk of burnout from excessive responsibilities and stress.

Over-reliance on the Owner is the 9th disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

Difficulty Scaling Operations

Lack of capital and human resources is a restrictive factor in sole trader growth, and the owner usually cannot delegate responsibilities. When the business grows, it becomes difficult for the owner to increase production or venture into other areas to meet growing needs.

Lack of capital and infrastructure to support expansion traps many sole trader businesses in their small and locally based operations making them most vulnerable to a lack of a sustainable future.

Impact:

- Business growth is restricted by the owner’s personal capacity and resources.

- Limited ability to enter new markets or scale up operations.

Difficulty Scaling Operations is the 10th disadvantage among the Top 10 Disadvantages of Sole Proprietorship and also a very important one.

If you want to also know about the Registration of Sole Proprietorship you can get a complete guide of this just by clicking here.

If you want to know more about the Disadvantages of Sole Proprietorship then you can click on the below video

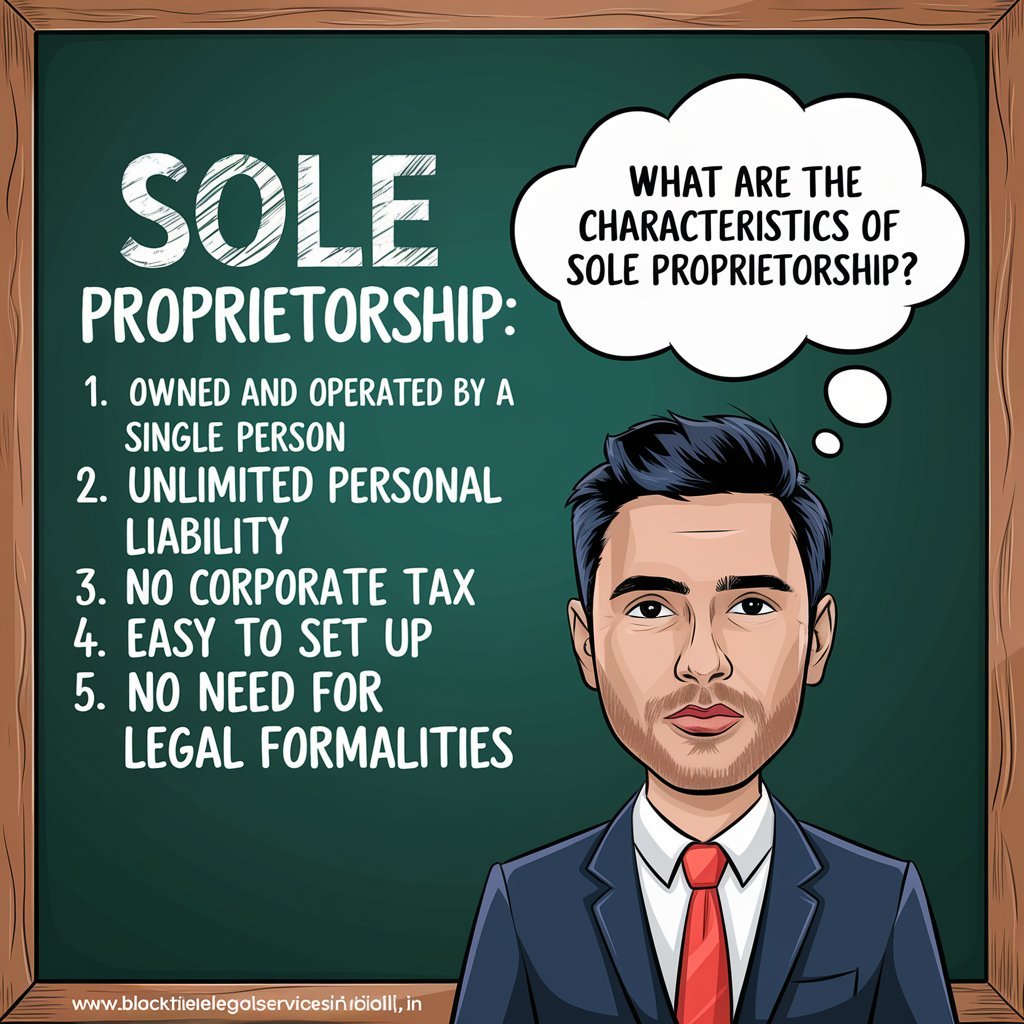

What are the Characteristics of Sole Proprietorship?

Here are the all Characteristics of a Sole Proprietorship:

- Single Ownership: Run by one person to another; without a partner.

- Unlimited Liability: The owner has full legal liability for all business liabilities.

- No Legal Separation: The business and the owner here are not different in the legal sense of the two words acting as two different entities.

- Direct Control: The owner makes all the decisions for the company because he has full authority over everything.

- Profit Retention: The owner keeps all profits.

- Limited Lifespan: The business ceases when the owner dies or decides to shut it.

Which Factor is a Disadvantage of a Sole Proprietorship?

One major demerit attached to sole trader business is that the trader is exposed to unlimited business liability. This means that the owner is directly liable for all the commitments of the business organization.

If the business experiences some market downturns or faces some legal issues, the owner’s personal money, and property among other assets can be used in clearing the debts thus at some point the owner’s money is at risk.

In Conclusion

As is evident, there are many disadvantages of Sole Proprietorship associated with the sole trader, as it is a form of business organization designed to make specific deals and manage the risks involved in business and personal finances.

Since it provides ease and complete authority to the owner, the disadvantages of sole proprietorship are that this form of business presentation can be problematic for both the business and the owner.

These include unlimited legal responsibility, limited access to capital and credit, problems of scale, and brand development, which are major challenges that a sole proprietor cannot avoid if he is to ensure the sustainable existence of the business.

FAQs

Q1. What is the biggest disadvantage of a sole proprietorship quizlet?

The biggest disadvantage is unlimited liability, where the owner is personally responsible for all business debts, risking personal assets.

Q2. What is the disadvantage of a corporation?

A major disadvantage of a corporation is double taxation, where profits are taxed at both the corporate and shareholder levels.

Q3. What is the major disadvantage of partnerships and proprietorships?

Both structures face unlimited liability, meaning owners are personally liable for business debts, risking their personal assets.

Q4. What is one advantage of a sole proprietorship?

Sole proprietorships offer full control to the owner, allowing for quick decision-making and flexibility in business operations.

Q5. What are the disadvantages of working in a corporation?

Disadvantages include limited individual decision-making power, bureaucracy, and potential lack of personal connection to company goals.

Add a Comment