Table of Contents

Toggle🧭Introduction

Corporate Social Responsibility (CSR) has become an integral part of how businesses function in India. With the world moving towards sustainable and ethical growth, companies are no longer measured by profits alone but also by their social impact. As we step into 2025, the CSR Amendments 2025 – New Rules & Applicability bring crucial updates that Indian corporates must not ignore. These changes aim to align CSR practices with national priorities and global development goals like ESG and SDGs.

📌What is CSR? A Quick Recap for 2025

CSR refers to a company’s responsibility towards society, where a portion of its profits must be spent on approved activities like education, health, environment, and rural development. Under Section 135 of the Companies Act, 2013, certain companies are legally required to carry out CSR initiatives.

The new CSR Amendments 2025 continue this mandate but introduce refined definitions, clearer responsibilities, and updated compliance norms.

🔍Why CSR Amendments 2025 Are Crucial for Indian Companies

The CSR Amendments 2025 – New Rules & Applicability are designed to:

Ensure transparency in fund allocation and usage

Align CSR projects with national goals (Digital India, Green Energy, etc.)

Encourage strategic, long-term social impact over one-time donations

Streamline reporting and accountability for board members

These amendments directly impact company strategy, compliance teams, and CSR partners.

📰Latest CSR Amendments 2025 – At a Glance

Here are some of the headline changes:

Revised CSR threshold limits

Clarification on unspent CSR funds

New permissible CSR activities

Enhanced CSR-2 reporting structure

Inclusion of startups and SMEs under revised provisions (in specific cases)

📊Top 5 Key Changes in CSR Amendments Rules in 2025

-

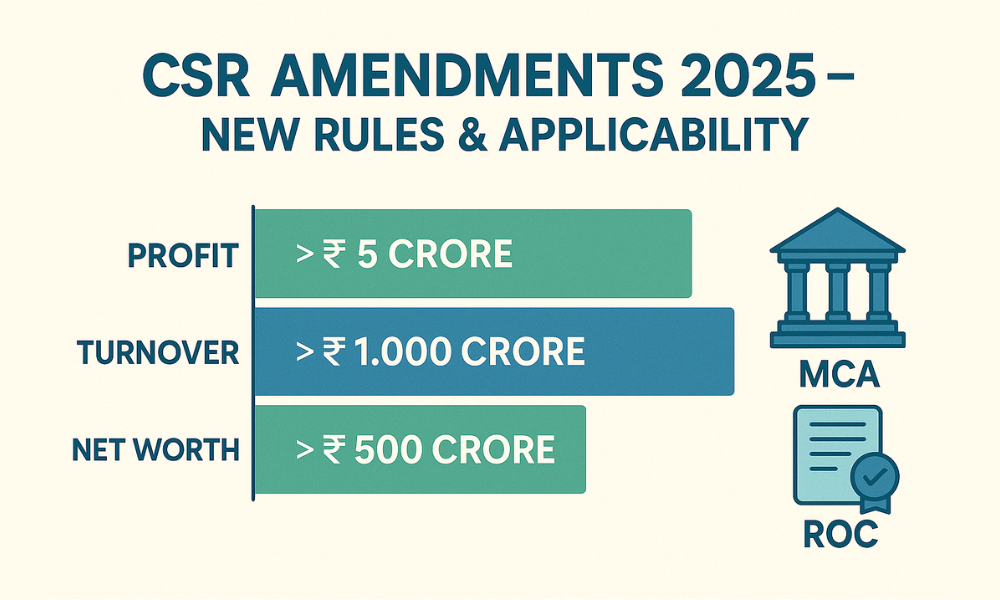

CSR Spending Threshold Updated – Companies now fall under CSR if they have:

-

Net worth of ₹500 crore or more, or

-

Turnover of ₹1000 crore or more, or

-

Net profit of ₹5 crore or more (no change here)

-

-

Mandatory Utilisation Timeline – All CSR funds must be allocated and utilized within 3 financial years.

-

CSR Surplus Reinvestment – Any income earned from CSR activities must be plowed back into CSR and not added to business profit.

-

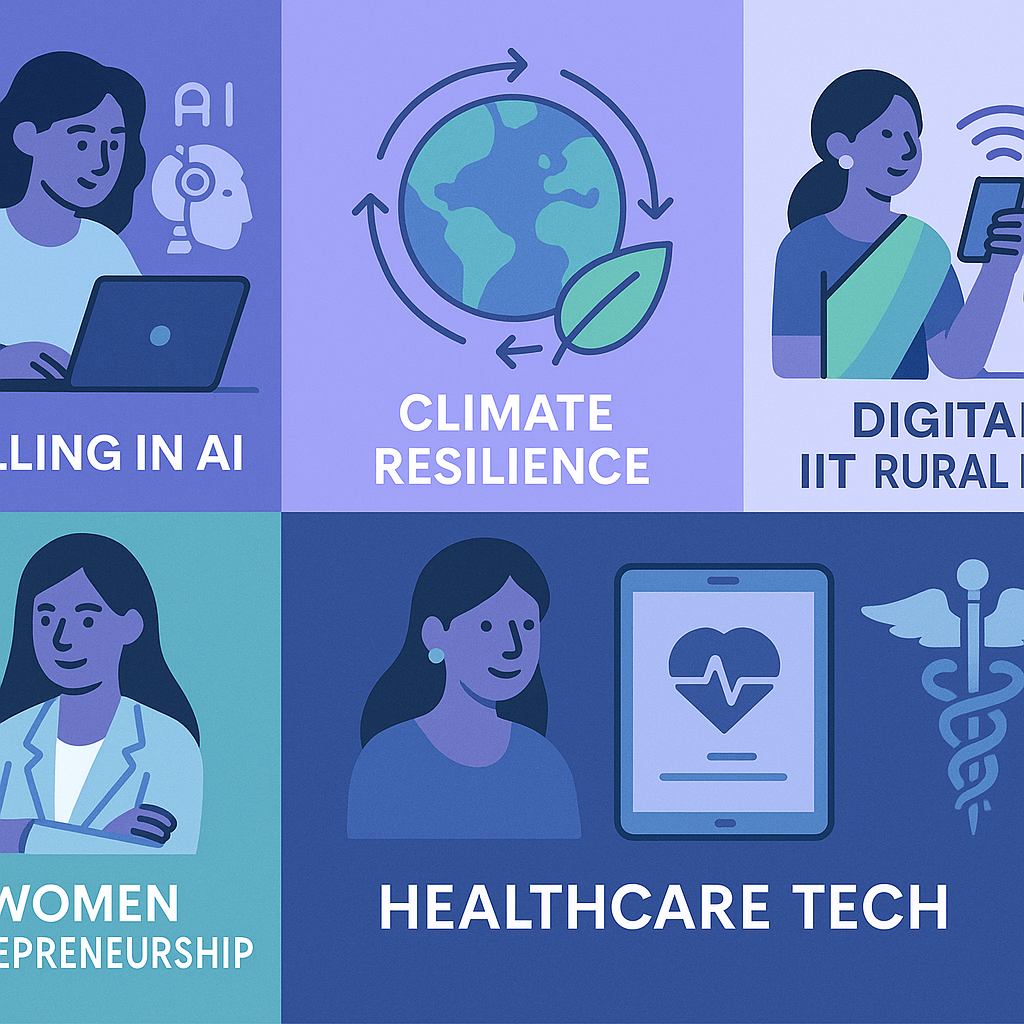

Focus Areas Added – New government priorities like climate resilience, digital inclusion, and skilling for future jobs are added under Schedule VII.

-

Mandatory Impact Assessment – For projects above ₹1 crore, companies must submit third-party impact reports.

⚖️CSR Amendments Applicability Rules in 2025

➤ Which Companies Must Comply with CSR in 2025?

The threshold remains similar to previous years, but calculation of net profit is now based on average profits from the last 3 financial years, not just the immediate one.

➤ CSR Applicability for Startups and SMEs in 2025

While small companies are still mostly exempt, startups receiving government grants or involved in public service delivery may be directed to adopt CSR under certain schemes.

📋Changes in CSR Amendments Activities & Schedule VII

✅ Updated List of Permissible CSR Activities (2025)

Skilling in AI, Robotics, and Climate Tech

Rural healthcare digitization

Disaster management and climate adaptation

Women entrepreneurship and STEM education

Digital literacy in Tier 2 & 3 cities

❌ What Is Not Allowed Under CSR in 2025?

Direct or indirect political contributions

Employee welfare programs (beyond CSR projects)

Donations to for-profit institutions

💸 CSR Spending Norms & Fund Utilisation

➤ Is CSR Still 2% of Net Profit?

Yes, the 2% rule continues, based on average net profit of the past 3 years. However, companies are encouraged to exceed this, especially if unspent from previous years.

➤ What Happens to Unspent CSR Amount?

For ongoing projects: Transfer to a special “Unspent CSR Account” within 30 days

If not used: Must be transferred to a government-specified CSR fund (like PM CARES) within 6 months

🧾CSR Compliance, Reporting & Audit

CSR committee details

Detailed fund allocation

Impact metrics

Project-wise disclosures

⚠️ Penalties for Non-Compliance

Failure to spend or misreport CSR activities may attract penalties:

Fine up to ₹1 crore for the company

Fine up to ₹2 lakh for directors or officers involved

Role of the CSR Committee

The CSR Committee must:

Ensure alignment with Schedule VII

Approve CSR projects and budgets

Oversee impact reports and disclosures

Include at least one independent director

📊Sectoral Impact of CSR Rule Amendments

Impact on NGOs, Trusts & Section 8 Companies

Must be registered on the MCA CSR portal with valid Form CSR-1

Must show measurable impact

Annual fund utilization report now mandatory

CSR Impact on Pharma, IT, Manufacturing & Startups

Pharma: Can contribute to healthcare tech and mobile clinics

IT firms: Encouraged to drive digital education & cybersecurity awareness

Startups: Can co-execute projects as implementing partners if registered

🧠 Expert Insight & Legal Analysis

CSR Amendments Align with ESG and SDGs

The 2025 rules are deeply aligned with:

Environmental, Social, and Governance (ESG) benchmarks

UN Sustainable Development Goals (SDGs) – including quality education, clean water, and climate action

Corporate Compliance Tips:

Set up a dedicated CSR dashboard

Hire CSR professionals or NGOs with audit experience

Don’t treat CSR as charity—make it strategic

📝Case Study: How a Company Restructured CSR in 2025

A leading Indian IT company shifted from one-time donations to a 3-year rural skilling program. It not only ensured CSR compliance but also improved the company’s ESG score, attracting new global investors.

✅Conclusion

The CSR Amendments 2025 – New Rules & Applicability reflect India’s push towards strategic, transparent, and impactful corporate responsibility. With clearer rules, new focus areas, and stricter compliance, companies must treat CSR not as a mandate but as a long-term investment in national progress.

Discover detailed guides, comparisons, and expert insights on business law and company registration in India. Learn about LLP vs Pvt Ltd, compliance rules, tax benefits, and how to choose the right structure for your startup or enterprise in 2025 and beyond.

📌 FAQs (SEO Boosters)

Q1: What is the new CSR threshold in 2025?

No major change—net worth ₹500 crore+, turnover ₹1000 crore+, or net profit ₹5 crore+.

Q2: Can administrative overhead exceed 5% in 2025?

No, admin expenses from CSR funds must not exceed 5% of total CSR expenditure.

Q3: Is CSR mandatory for loss-making companies in 2025?

Only if they qualify based on average profit in the past three years.

Q4: Can surplus from CSR activities be reinvested in 2025?

Yes, but it must be used only for further CSR, not business expansion.