Property tax is one of the major sources of revenue for most municipal bodies in our country India and Indore Municipal Corporation is no exception to this. Since Indore is one of the fastest growing cities in the country, the financial resources ...

The Superior Countervailing Duties in India (2024)

One of the critical issues of the open economy in the contemporary world is to provide a fair basis for the competitive interface of indigenous industries with foreign competitors. One of the ways to implement this route is through the application o ...

The Limited Nagar Nigam House Tax in India (2024)

In the year 2024, our country India has progressed very fast in terms of urbanization and this has transformed cities as well as towns. This is why with such urbanization, the function of municipal corporations or Nagar Nigams becomes even more impo ...

What is Agriculture Finance in India Taxation, Scope, and Cooperation in 2025

Agriculture finance in India is a vital part of the agriculture sector that provides farmers with the funds required for investing in all stuff like seeds fertilizers inputs and other inputs needed for crop production. It plays a role in enhancing t ...

What is Interest Subvention Scheme Meaning For MSME, RBI circular In 2024

Interest Subvention Scheme (ISS) is a good initiative by the government in India that is designed to provide financial help by subsidizing the interest on loans for various sectors or activities. The primary purpose of this is to reduce the cost of ...

What are SEBI AIF Regulations Guidelines, Categories, and Circulars in 2025?

SEBI (Securities and Exchange Board of India) Voluntary Investment Fund (AIF) Regulations, 2012 govern the registry, regulation and governance of voluntary investment funds in India. Here is a brief overview. The AIF Regulations provide for certain ...

The Ultimate Guide to How You Pay VVMC Property Tax In 2025

VVMC Property Tax refers to property tax levied by the Vasai-Virar Municipal Corporation VVMC. The VVMC is the governing body responsible for managing the Vasai-Virar Municipal Corporation in Maharashtra, India. Property tax is a type of tax that pr ...

The Exclusive Tax Structure of India (2024)

You must be well aware of the existing dual adopted tax structure of India, in which both direct and indirect taxes are used very well. In India, all the indirect taxes include excise duty, customs duty and goods and services tax (GST) and on the ot ...

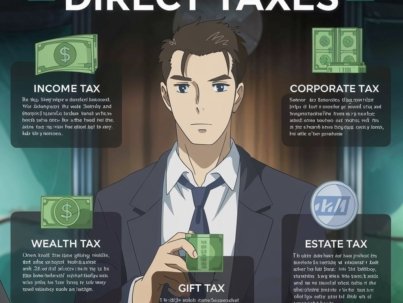

The Comprehensive Types of Direct Taxes in 2024

The Role of Taxation in India You all know very well that it is one of the most important sources supporting the financial system of the country, which fulfills the government expenditures for its functioning, development of public utilities and soc ...

The Revolutionary Wealth Taxes in India (2024)

The idea of wealth taxes, which the Indian government derives from the principle of equality, has been a topic of much discussion among policymakers and intellectuals across the world. In India, while considering the fiscal policies of the coun ...