PLCs offer certain advantages that facilitate the company’s growth and enhance its reputation. Firstly, issuing shares to the public helps the business raise capital for further investment in growth and development.

In addition, the enterprise benefits from a higher credit rating and reputation due to the transparency and scrutiny that regulatory bodies exercise over the company’s operations.

In this blog post, we tell you all about the top 22 advantages of public limited company which are going to be discussed in great detail for every individual dealing with a public limited company.

- What is the Public Limited Company?

- What are the Top 22 Advantages of Public Limited Company?

- Raise Capital

- Share Transferability

- Transparency

- Legal Entity

- Limited Liability

- Better Financial Opportunities

- Expansion Opportunities

- Additional Fundraising Possibilities

- Brand Recognition and Reputation

- More Regulation

- Spreading Risk

- Enhanced Credibility

- Vulnerable to Takeovers

- Prestige

- Shareholder Liquidity

- Stocks Listed on the Stock Exchange

- High Initial Financial Commitment

- Support from Shareholders

- Exit Strategy

- Less Risk Involved

- Tax Breaks

- Raise Capital Through Public Buyers

- What are the 5 Disadvantages of a Public Company?

- What are the Advantages of Ltd over PLC?

- What are the Features of Public Limited Company?

- In Conclusion

- FAQs

What is the Public Limited Company?

A public limited company is a type of corporate business that is allowed to issue its shares to the public and is listed on a recognized stock exchange.

The main feature of a public limited company is that the shareholders’ liability is limited to the amount they have invested in the shares. There must be a minimum share capital, and their financial affairs are more transparent due to greater regulatory oversight than private companies.

PLCs can typically raise large amounts of capital by selling shares to the public, so they are suitable for larger businesses looking to expand.

If you want to see about what is the public limited company? then just click the below video

What are the Top 22 Advantages of Public Limited Company?

We have written all the names of the top 22 public limited companies in a very concise manner in front of you all, just below which we have given essential information about it:

- Raise Capital

- Share Transferability

- Transparency

- Legal Entity

- Limited Liability

- Better Financial Opportunities

- Expansion Opportunities

- Additional Fundraising Possibilities

- Brand Recognition and Reputation

- More Regulation

- Spreading Risk

- Enhanced Credibility

- Vulnerable to Takeovers

- Prestige

- Shareholder Liquidity

- Stocks Listed on the Stock Exchange

- High Initial Financial Commitment

- Support from shareholders

- Exit strategy

- Less risk involved

- Tax breaks

- Raise capital through public buyers

Raise Capital

The biggest advantage of a public limited company is that it can raise sufficient capital. This can be done by offering shares to the public through the stock exchange, thereby providing adequate funds for business expansion, acquisitions, or other projects. Such capital inflow is significant for companies that have ambitions of operating on a wider scale.

Raise Capital is the 1st advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Share Transferability

In a public limited company, shares are freely transferable. This allows the shareholder to easily buy and sell shares on the stock exchange, thereby ensuring liquidity for the shareholder. It is easy to attract investors to the company, as they can leave the company whenever they need their investment.

Share Transferability is the 2nd advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Transparency

Public limited companies are also expected to maintain reporting standards at a high level. Their financial and operational information must be clear due to the submission of annual statements, financial reports, and statutory reports on meeting regulatory standards. When the company maintains transparency, it naturally builds investor confidence regarding its credibility in the market.

Transparency is the 3rd advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Legal Entity

A public limited company is separate from its owners and shareholders as a separate legal entity. This implies that the company can own property, enter into contracts, sue, or be sued independently of the shareholders. Therefore, there is a legal separation between the assets that the shareholder may own outside the business entity and the liabilities created in the firm.

Legal Entity is the 4th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Limited Liability

Shareholders in a public limited company have limited liability. That is to say, their financial liability is limited only to the amount they have actually invested in the company. In the event of a company’s default or bankruptcy, its debts are not payable out of the shareholders’ pockets individually for an additional amount, but only to the extent of their shareholding.

Limited Liability is the 5th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Better Financial Opportunities

Public limited companies have a variety of financial opportunities, such as issuing bonds, debentures, or taking loans at low interest rates. The credibility and size of the business often enable it to negotiate better financial terms from lenders and investors.

Better Financial Opportunities is the 6th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Expansion Opportunities

Public limited companies are well positioned for a rigorous expansion strategy through what is available in the form of adequate capital and resources. This can be realized in the form of financial strength to pursue long-term growth plans, both in acquisitions and entering new markets or investing in innovative projects.

Expansion Opportunities is the 7th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Additional Fundraising Possibilities

Public limited companies can raise more money even after the corporation’s IPO. They can issue more shares, bonds, or debentures when needed, giving them more flexibility to respond to financial needs as the business grows.

Additional Fundraising Possibilities are the 8th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Brand Recognition and Reputation

Being a public company provides status and branding prestige. Being listed on a stock exchange raises the company’s profile and makes it more recognizable to customers, investors, and partners. Strong reputations often bode well for even more business opportunities for growth and partnerships.

Brand Recognition and Reputation is the 9th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

More Regulation

While regulations include greater transparency and protection for investors, they come with certain disadvantages. Public limited companies are generally more vulnerable to regulations, such as those set by governing bodies such as the Securities and Exchange Board. The former ensures that the company operates within the legal framework but tends to be more taxing in terms of compliance.

More Regulation is the 10th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Spreading Risk

Issuing shares to the public allows the company to share financial risk among a larger group of shareholders. The financial disadvantages will be less pronounced among any one shareholder, and therefore, the company will be able to serve a more diverse investor base.

Spreading Risk is the 11th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Enhanced Credibility

Public limited companies are taken very seriously in many quarters because they follow the rules of finance, are transparent, and have adequate capital. Investors and banks will be more willing to put their trust in a public limited company, which offers better business opportunities for them.

Enhanced Credibility is the 12th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Vulnerable to Takeovers

The disadvantage of a public limited company may be that it is susceptible to takeovers. If the majority of the company’s shares are bought by a single investor or group of investors, it may result in the control of the company passing into someone else’s hands. Hostile takeovers can also disrupt the strategic plans of the business.

Vulnerable to Takeovers is the 13th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Prestige

The prestige of public limited companies is always higher than that of private companies. Being listed on the stock exchange sends the message that the company has grown and is successful, which can then attract better talent, investors, and partners and make its position in the industry even more dominant.

Prestige is the 14th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Shareholder Liquidity

Shareholders of a public limited company enjoy liquidity as shares can be easily bought and sold on the stock exchange; hence, liquidity makes it easier to attract investors. Also, liquidity provides shareholders with flexibility in managing their investments.

Shareholder Liquidity is the 15th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Stocks Listed on the Stock Exchange

Stock exchange platforms list the shares of public limited companies. This makes them accessible to a large number of investing publics across the world. Apart from providing capital, listing improves their public profile and market value.

Stocks Listed on the Stock Exchange is the 16th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

High Initial Financial Commitment

A PLC has access to vast sources of capital, but formation and regulation with listing requirements are very costly and require a very large initial financial commitment for small companies.

High Initial Financial Commitment is the 17th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Support from Shareholders

Being one of the major types of listed companies, public limited companies usually have a very wide and dispersed shareholder base. Such support to the company brings not only capital but also credibility, as shareholders are usually interested in the good performance of a company, thereby contributing to stability and support when it expands or needs funding.

Support from Shareholders is the 18th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Exit Strategy

This is really attractive to business owners and early investors because the public limited company, due to the clear exit route it offers, is very attractive. By listing part or all of the interest on the stock exchange, they can liquidate. This flexible route is effective in delivering a return on their investment while allowing the company to grow.

Exit Strategy is the 19th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Less Risk Involved

Since a public limited company has many shareholders, the financial risk is diversified and distributed among them. The larger the base, the lesser the loss on the part of each investor or owner. This model of shared risk makes the business more stable during crises in its system.

Less Risk Involved is the 20th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

Tax Breaks

Other jurisdictions may offer tax incentives or exemptions specifically to public limited companies. Governments promote public offerings as a way to encourage investment and other economic activity; within such policies, there may be tax incentives. This can increase profitability and improve cash flow for PLCs.

Tax Breaks Involved is the 21th advantage among Top 22 Advantages of Public Limited Company and also a very important one.

If you want to do the public limited company registration then just click here to get the proper guidance

Raise Capital Through Public Buyers

For example, the stock exchange provides public limited companies with an opportunity to raise very large amounts of capital through the issuance of shares to public buyers. As a result, it provides the company with a larger group of potential investors and is useful in raising funds for growth and expansion or other strategic initiatives without reliance on more traditional funding sources such as banks or private investors.

Raise Capital Through Public Buyers are the 22nd advantage among Top 22 Advantages of Public Limited Company and also a very important one.

If you want to see about the advantages of public limited company then just click the below video

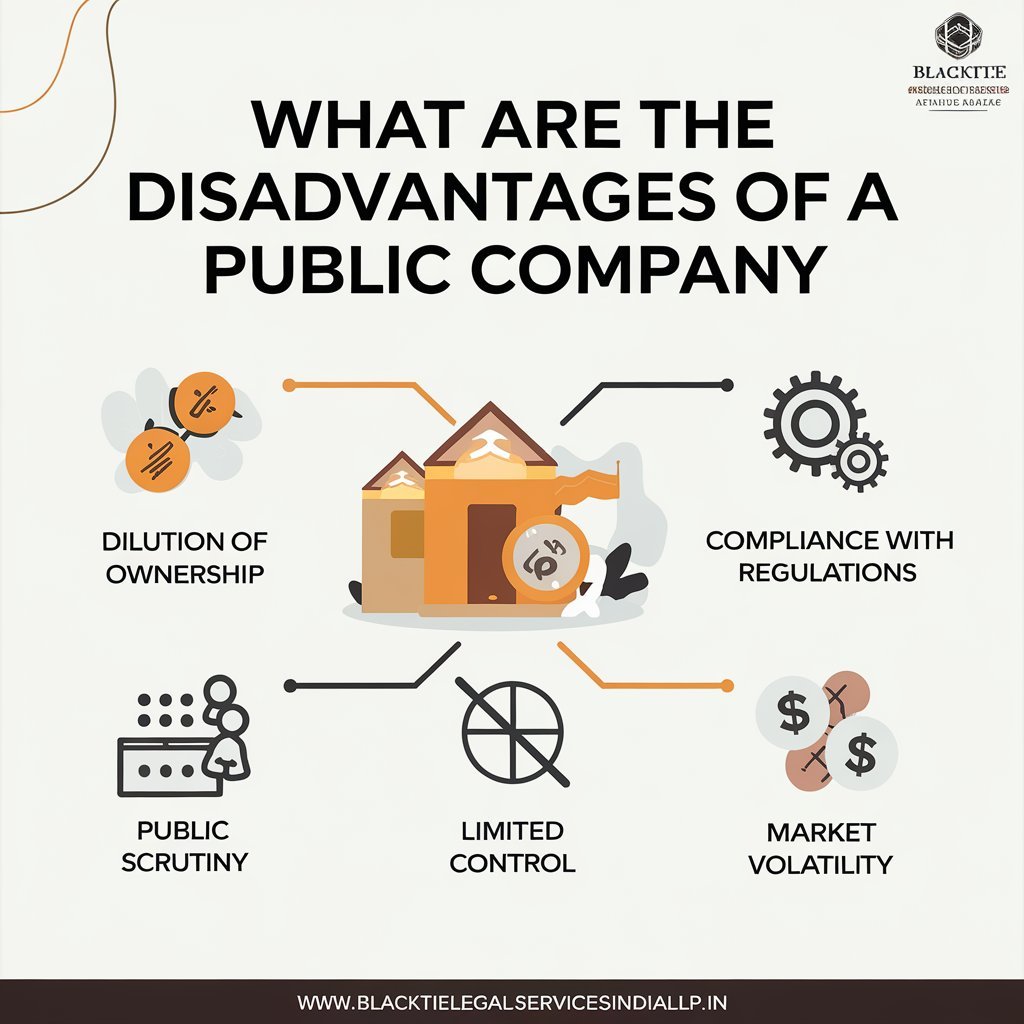

What are the 5 Disadvantages of a Public Company?

Here are all the 5 Disadvantages of a Public Company:

- Loss of Control: Share ownership in a public firm is dispersed among various shareholders, which weakens the control of key decisions on new ventures by the original owners, and thus, results in conflicts.

- High Regulatory Compliance: Public firms have to comply with heavy standards of regulatory requirements for disclosure in financial statements, auditing, and reporting, resulting in increased compliance costs.

- Expensive Process: The process of going public is expensive, involving underwriting fees, legal costs, and continued administrative costs to maintain the status quo as a public firm.

- Market Pressure: Public companies are vulnerable to the pressure of short-term financial goals, which can sometimes deviate them from their long-term goals and innovation.

- Risk of Hostile Takeover: A public company is at risk of a hostile takeover; if another firm or investor acquires a large share of it, they may acquire it.

If you want to see about the disadvantages of public limited company then just click the below video

What are the Advantages of Ltd over PLC?

Here are all the Advantages of Ltd over PLC:

- More Control: In a private limited company, ownership generally rests with a small number of shareholders, giving the founders better control over the direction of the company.

- Less Regulatory Burden: Private limited companies have fewer legal and regulatory requirements than PLCs. This makes compliance easier and less costly.

- Confidentiality of Financial Statements: In the case of a limited company, the process is relatively private compared to a PLC as the company’s financial statements are not required to be presented to the public. Under a PLC, the company has to give a fair account of its detailed financial statements.

- Less Hostile Takeover: Due to the fact that the shares of a limited company cannot be publicly traded, the risk of a hostile takeover is reduced, thus providing more stability for the original owners.

- Less Market Pressure: A limited company does not have to face market fluctuations or the pressure of achieving quarterly financial results; thus, there is more room for long-term objectives.

What are the Features of Public Limited Company?

Here are all the Features of Public Limited Company:

- Limited Liability: Shareholders of a PLC have limited liability; their personal assets are protected, and they can only be held responsible for the company’s debts to the extent of the capital committed.

- Publicly Traded Shares: Shares of a PLC are traded on a stock exchange. Such a company can offer its free float to the public, so that its shares can be freely bought and sold by the public, thereby providing access to a vast pool of capital.

- Strict Regulations: PLCs have to adhere to strict rules and regulations, often involving financial reporting, audits, and transparency, to protect shareholders and the public.

- Minimum Share Capital: PLCs must have a certain amount of share capital before they become registered. Its basic purpose is to ensure the financial soundness of the company.

- Board of Directors: PLCs are guided by a board of directors elected by the shareholders, which oversees the company in the best interest of the company’s shareholders.

If you want to see about the features of public limited company then just click the below video

In Conclusion

The advantages of public limited company has the convenience of issuing capital, getting better credibility, and increasing growth prospects. However, it also has disadvantages such as greater regulatory compliance and the possibility of takeover.

For business organizations aiming for growth and expansion, the public limited company form allows them to take advantage of the capital markets, reputation, and distribution of risk while remaining transparent and increasing confidence in their shareholders.

FAQs

1. What are the advantages of a limited company going public?

It enables the company to raise large amounts of capital, increase its visibility, and credibility and provide liquidity for shareholders.

2. Who runs a public limited company?

A public limited company is guided by a board of directors who control its operations and are accountable to shareholders.

3. What is the importance of a PLC?

This is very important as it can raise a lot of money, maintain transparency, ensure investments, and expand the business across the country or even abroad.

4. What are the important points of a PLC?

The corporate system allows raising capital through public shares, has limited liability for shareholders, regulated transparency, and must be listed on a stock exchange.

5. What are some of the advantages of becoming a PLC?

Additional benefits include better access to capital, enhanced brand recognition, improved shareholder liquidity, and increased credibility. The potential for business expansion is also a benefit.

Add a Comment