For Applying 12A & 80G Registration Click Here…

Introduction & Basics

The 80G registration process is an essential step for NGOs, trusts, and charitable institutions in India that want to offer tax benefits to their donors. Under Section 80G of the Income Tax Act, donors can claim tax deductions on the amount they contribute, which makes fundraising easier and more trustworthy. For any NGO planning long-term growth, government recognition through the 80G registration process adds credibility, transparency, and legal backing. Understanding how this process works helps organisations prepare better and avoid unnecessary delays.

What is 80G Registration and Why It Matters for NGOs?

80G registration is an official approval given by the Income Tax Department that allows NGOs to provide tax deduction benefits to their donors. When an NGO completes the 80G registration process, it becomes eligible to issue 80G receipts, which donors can use to reduce their taxable income.

This matters greatly for NGOs because tax benefits motivate more people and companies to donate confidently. It builds trust in the organisation, increases financial support, and boosts overall social impact. For NGOs that depend on public funding, completing the 80G registration process is not just helpful—it is almost essential to grow and sustain operations.

Who is Eligible for the 80G Registration Process?

Not every organisation automatically qualifies for the 80G registration process. The Income Tax Department approves only those NGOs that follow proper legal and operational guidelines. To be eligible, an organisation must be registered as a charitable trust, society, or Section 8 company. It should operate strictly for charitable purposes such as education, healthcare, welfare, environment, or poverty relief.

Additionally, the NGO must maintain transparent accounts, should not distribute profits to members, and must not use funds for religious or commercial activities. Another key requirement is that the organisation should already have a valid 12A registration, which verifies it as a genuine charitable entity. If these conditions are satisfied, the NGO can successfully apply for and complete the 80G registration process.

Documents, Eligibility & Rules

Understanding the paperwork, eligibility criteria, and latest rules is important for any NGO planning to complete the 80G registration process smoothly. If the organisation prepares the required documents properly and follows the updated guidelines, the chances of approval increase significantly. Below are the essential documents, eligibility points, and new updates for 2025 that NGOs must know.

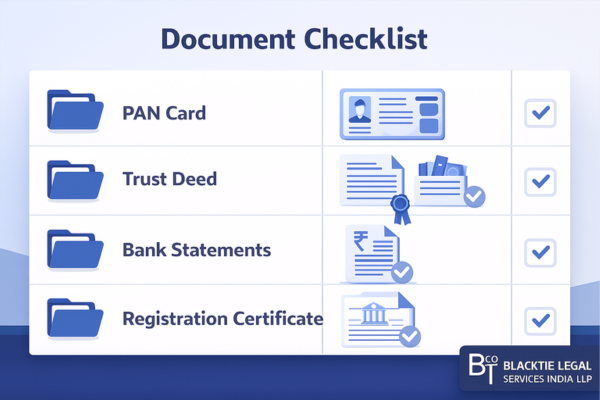

Documents Required for the 80G Registration Process

To successfully complete the 80G registration process, NGOs must upload specific documents on the Income Tax portal. These documents help the department verify the authenticity and operations of the organisation. Here are the key documents required:

- Registration Certificate of the NGO (Trust Deed, Society Registration, or Section 8 License)

- PAN Card of the NGO

- 12A Registration Certificate

- Address Proof of the registered office

- Founding documents such as Trust Deed or Memorandum of Association (MOA) & Articles of Association (AOA)

- Details of the trustees, directors, or office bearers

- Financial statements for the last three years (Balance Sheet, Income & Expenditure Statement, Receipts & Payments)

- Bank statements of the NGO

- Activity Report describing the charitable work done

- Donation receipts and donor details, if available

- Board Resolution approving the 80G registration process

Having all these documents prepared in advance helps NGOs avoid delays and ensures a smooth registration experience.

Eligibility Criteria for Successful 80G Registration

Not all NGOs automatically qualify for the 80G registration process. The Income Tax Department evaluates whether the organisation genuinely works for charitable purposes. Below are the main eligibility criteria:

- The NGO must operate solely for charitable purposes like education, health, poverty relief, social welfare, or environmental protection.

- The organisation must be properly registered as a Trust, Society, or Section 8 Company.

- Profits or income must not be distributed among members or trustees.

- The NGO should maintain proper books of accounts and follow transparent financial practices.

- Activities should not benefit any specific religious community or caste.

- The organisation must have an active and valid 12A registration.

- The NGO must ensure donations are used strictly for charitable activities and not for personal benefits.

If an NGO meets these eligibility conditions, the 80G registration process becomes much easier and more likely to be approved.

Latest Rules & Conditions for 80G Registration (Updated 2025)

In 2025, the Income Tax Department updated certain rules to make the 80G registration process more transparent and standardised. NGOs applying this year must follow these conditions:

- Mandatory Online Filing: All applications must be submitted online through the Income Tax Portal using Form 10A or 10AB.

- 80G Validity Period: Initially, 80G approval is granted for 5 years, after which NGOs must apply for renewal.

- Annual Reporting: NGOs must file Statement of Donation (Form 10BD) every year and provide donors with Donation Certificates (Form 10BE).

- Strict Verification: Authorities may conduct background checks or request extra documents to verify activities.

- Transparent Financial Records: NGOs must maintain clean accounts and avoid any misreporting or unaccounted donations.

- No Commercial or Religious Activity: Any involvement in business activities or religious promotion can lead to rejection.

- Timely Renewal: NGOs must renew 80G registration before its expiry to avoid cancellation.

These updated rules help ensure that only genuine and transparent charitable organisations receive the benefit of 80G status.

Step-by-Step Guide

The 80G registration process may seem complicated at first, but it becomes simple once you understand each step clearly. This guide will help NGOs, trusts, and Section 8 companies follow the correct process, avoid mistakes, and complete the registration smoothly. Whether you apply online or offline, the process follows a structured set of actions that ensure transparency and verification by the Income Tax Department.

Step-by-Step 80G Registration Process (Online & Offline)

✅ Online 80G Registration Process

The government now encourages online applications to make the process faster and more transparent. Here are the key steps:

- Visit the Income Tax e-Filing Portal

NGOs must log in using their organisation’s PAN and password. - Navigate to ‘e-File → Income Tax Forms → File Income Tax Forms’

This is where all statutory registration forms are available. - Select Form 10A or 10AB

- Form 10A → For fresh 80G registration

- Form 10AB → For renewal or revalidation

- Form 10A → For fresh 80G registration

- Fill in the Basic Details

Enter the organisation’s legal name, address, trustee details, nature of activities, etc. - Upload All Required Documents

This includes trust deed, financial statements, registration certificate, 12A proof, and activity reports. - Submit Form with Digital Signature (DSC) or EVC

Verification is compulsory for completing the 80G registration process. - Track Application Status

The application can be monitored under the “Pending for Action” section.

✅ Offline 80G Registration Process (Traditional Method)

Although most registrations now happen online, some NGOs still follow the offline process. Here are the basic steps:

- Prepare the required documents in physical format.

- Fill out Form 10A manually.

- Attach notarized copies of all supporting documents.

- Submit the application to the Commissioner of Income Tax (Exemptions).

- Wait for verification and potential inspection by authorities.

- Receive approval or request for additional information.

Offline processing is slower and less preferred, but still allowed in some cases.

How to Apply Online for 80G Registration on the Income Tax Portal

Applying online is the quickest and most reliable method in the 80G registration process. Follow this simple step-by-step guide:

- Login to the Income Tax Portal using the NGO’s PAN-based user ID.

- Go to ‘e-File’ → ‘Income Tax Forms’ → ‘File Income Tax Forms’.

- In the search bar, type “10A” or “10AB” depending on your requirement.

- Select the Assessment Year and click Continue.

- The form will open with multiple tabs:

- Basic Details

- Additional Information

- Religious Activity Details

- Verification

- Basic Details

- Fill each section correctly, ensuring all legal details match your registration documents.

- Upload the required documents in PDF format (maximum size as per portal guidelines).

- Proceed to verification using DSC, EVC, or Aadhaar OTP (for authorized person).

- Submit the form.

- Download and save the Acknowledgement Receipt for future tracking.

Once submitted, the Income Tax Department begins the scrutiny of your 80G registration process.

Timeline & Approval Stages in the 80G Registration Process

The approval timeline for the 80G registration process depends on the accuracy of documents and the response time of the NGO. Here’s a simple breakdown:

1. Acknowledgement Receipt (Day 1)

You instantly receive an online acknowledgement after submitting Form 10A/10AB.

2. Document Verification (10–20 Days)

The Income Tax Department examines your documents, financial records, and activities.

3. Additional Queries or Clarifications (If Required)

If something is unclear, the department may issue a notice seeking more documents.

4. Physical/Online Inspection (Optional)

In some cases, authorities may verify your NGO’s activities.

5. Final Approval (30–45 Days)

If everything is correct, you will receive the 80G Registration Certificate, valid for 5 years.

6. Renewal After 5 Years

NGOs must reapply using Form 10AB before expiry to keep the benefits active.

Overall, the typical 80G registration process takes 30 to 60 days, depending on compliance and documentation.

Benefits & Importance

Completing the 80G registration process is one of the most valuable steps an NGO can take to build trust, increase donations, and establish long-term credibility. This registration not only offers tax benefits to donors but also enhances the NGO’s reputation in the eyes of government authorities, corporates, and the general public. With 80G approval, organisations gain better fundraising opportunities, improved transparency, and stronger legal standing.

Top Benefits of Completing the 80G Registration Process

Completing the 80G registration process offers multiple advantages that directly support the NGO’s growth and sustainability. Here are the top benefits:

✅ 1. Attracts More Donations

Donors prefer contributing to NGOs that offer tax benefits. With 80G approval, contributions become more attractive, leading to increased financial support.

✅ 2. Provides Tax Deduction to Donors

Donors can claim a significant portion of their donations as tax deductions under Section 80G. This benefit encourages individuals and corporates to donate more frequently.

✅ 3. Builds Credibility and Trust

The 80G certificate acts as government-backed proof that the NGO is genuine and follows transparent charitable practices. This increases public confidence.

✅ 4. Boosts Corporate Funding & CSR Opportunities

Companies often prefer donating to 80G-approved NGOs because their contributions qualify for tax savings and compliance benefits.

✅ 5. Enhances NGO’s Reputation

With 80G recognition, the NGO appears more professional, trustworthy, and accountable, which helps in expanding partnerships and collaborations.

✅ 6. Better Fund Management and Transparency

The registration requires the NGO to maintain proper accounts and activity reports, leading to structured and responsible handling of funds.

✅ 7. Long-Term Benefits With 5-Year Validity

Once approved, the 80G certificate remains valid for five years, providing stability and continuous access to donor funding.

Why NGOs Must Apply for 80G: Tax Advantage Explained

The biggest reason NGOs should complete the 80G registration process is the powerful tax advantage it gives to their donors. When donors know they can reduce their taxable income by contributing to a certified NGO, they are more motivated to support charitable causes.

👉 Tax Advantage for Donors:

Under Section 80G, donors can claim a deduction of 50% or 100% of their donated amount, depending on the NGO and type of contribution. This directly lowers their income tax liability.

👉 Better Fundraising Opportunities:

People and companies often choose NGOs that provide 80G receipts, making it easier to raise funds consistently.

👉 Encourages Corporate Support:

Corporate donors, especially those involved in CSR, prefer NGOs with 80G status because it helps them manage tax burden and comply with statutory requirements.

👉 Increases Regular Donors:

Once donors enjoy the tax benefits, they often become repeat contributors, strengthening long-term financial stability for the NGO.

Fees, Validity & Renewal

Understanding the cost, validity, and renewal requirements is an important part of the 80G registration process. While the government does not charge heavy fees, NGOs must follow specific guidelines to maintain their approval. Knowing these details helps organisations plan their finances better and avoid unnecessary delays in the future.

80G Registration Fees, Validity Period & Renewal Process

✅ 80G Registration Fees

One of the biggest advantages of the 80G registration process is that the government does not charge any official fee for filing Form 10A or 10AB.

However, NGOs may incur basic costs such as:

- Professional fees (for CA, CS, or consultant assistance)

- Document preparation costs

- Digital Signature (DSC) charges if needed

These are not mandatory government charges but may be required for smooth and error-free applications.

⭐ Validity Period of 80G Registration

As per the updated rules, the 80G certificate is issued with:

- 5-year validity period for newly registered NGOs

- After 5 years, renewal is mandatory

- Provisional 80G registration may be granted for new NGOs for 3 years

This validity ensures that only active and compliant organisations continue to enjoy tax exemption benefits for donors.

⭐ Renewal Process for 80G Registration

Renewal is a crucial part of the 80G registration process. NGOs must apply for renewal before the expiry of their current certificate to maintain uninterrupted benefits. The steps include:

- Login to the Income Tax Portal

- Go to e-File → Income Tax Forms → File Income Tax Forms

- Select Form 10AB for renewal

- Fill the details and update any changes made during the last 5 years

- Upload updated financial statements, activity reports, and documents

- Verify and submit using DSC/EVC

- Track application status online

Once approved, the renewed 80G certificate is again valid for 5 years.

How Long Does the 80G Registration Approval Take?

The approval time for the 80G registration process depends on document accuracy and the verification needed by authorities. Here’s the typical timeline:

⏳ 1. Submission Acknowledgement – Same Day

Once the form is submitted online, an instant acknowledgement is generated.

⏳ 2. Preliminary Scrutiny – 10 to 15 Days

The department checks basic details, documents, financial records, and trust deed information.

⏳ 3. Additional Queries (If Required)

If the department needs clarification, the NGO receives an online notice.

Responding quickly helps avoid delays.

⏳ 4. Final Review and Approval – 30 to 45 Days

Most NGOs receive approval and their 80G certificate within this period.

Total Expected Duration: 30 to 60 Days

If all documents are correct, the process is completed faster.

Common Issues & Solutions

Many NGOs face delays or rejections during the 80G registration process due to small errors or incomplete documents. Understanding these issues in advance can save time and ensure smooth approval. Below are the most common challenges and practical solutions that NGOs can follow to avoid unnecessary complications.

Common Mistakes to Avoid in the 80G Registration Process

Even well-established NGOs sometimes make mistakes that slow down the 80G registration process. Here are the common ones:

❌ 1. Submitting Incomplete or Incorrect Documents

If documents like trust deeds, financial statements, or identity proofs are missing or incorrect, the application gets delayed.

✔ Solution:

Prepare and verify all documents beforehand. Ensure they match legal records.

❌ 2. Not Having a Valid 12A Registration

Many NGOs apply for 80G without first getting 12A registration, which is mandatory.

✔ Solution:

Always complete the 12A registration before starting the 80G registration process.

❌ 3. Discrepancies in Financial Records

Mismatch in income, expenses, or bank statements creates doubt about the NGO’s transparency.

✔ Solution:

Maintain clean, audited financial statements for at least three years.

❌ 4. Incorrect Information in Form 10A/10AB

Errors in names, dates, or registration numbers can lead to rejection.

✔ Solution:

Double-check every detail before submitting the form.

❌ 5. Engaging in Religious or Commercial Activities

If an NGO’s activities appear to benefit a specific community or generate profit, approval may be denied.

✔ Solution:

Ensure activities promote general charitable purposes and avoid any profit-sharing.

❌ 6. Delay in Responding to Notices

If the Income Tax Department asks for clarification and the NGO delays response, the application may be rejected.

✔ Solution:

Monitor the portal regularly and reply to notices promptly.

Reasons Why 80G Applications Get Rejected & How to Fix Them

Understanding the reasons behind rejection helps NGOs avoid repeating the same mistakes. Below are the most frequent causes and their solutions.

❌ 1. Lack of Clarity in Charitable Activities

If the NGO does not clearly show its charitable work, authorities cannot verify its purpose.

✔ How to Fix:

Submit detailed activity reports, photographs, and beneficiary records.

❌ 2. Improper Accounting System

Poor documentation or financial mismanagement creates doubts about fund usage.

✔ How to Fix:

Maintain proper books of accounts, audit reports, and transparent transaction records.

❌ 3. No Proof of Public Welfare Work

Some NGOs fail to provide evidence of real on-ground activities.

✔ How to Fix:

Present annual reports, project summaries, donation utilisation records, and receipts.

❌ 4. Violation of Charitable Guidelines

Activities favouring a specific caste, religion, or business purpose are not allowed.

✔ How to Fix:

Ensure all activities support public welfare and align with Income Tax Act guidelines.

❌ 5. Mismatch in Details Between Documents

If information in financial statements, trust deeds, or PAN details does not match, authorities reject the application.

✔ How to Fix:

Review and update all documents before starting the 80G registration process.

❌ 6. Incomplete Renewal Application

Some NGOs forget to upload updated documents when applying for renewal.

✔ How to Fix:

Attach the latest financial data, reports, and changes made during the validity period.

❌ 7. Late Filing or Expired Registration

Applying after the expiry date reduces approval chances.

✔ How to Fix:

Track validity dates and apply for renewal at least 6 months before expiry.

Additional Information

Understanding the difference between 80G and 12A is extremely important for NGOs because both registrations work together to offer tax benefits and compliance advantages. Also, many NGOs have common questions about the 80G registration process, so the FAQ section below will help clear all doubts.

Difference Between 80G and 12A Registration

Both 80G and 12A are essential registrations for NGOs, but they serve different purposes. Many organisations get confused between the two, so here’s a clear and simple explanation:

✅ Purpose

- 12A Registration:

It exempts the NGO’s own income from tax.

Meaning, the NGO does not have to pay tax on donations or grants it receives. - 80G Registration:

It provides tax benefits to donors who contribute to the NGO.

✅ Who Benefits?

- 12A:

The NGO itself benefits by getting tax exemption. - 80G:

Donors benefit as they get tax deductions under Section 80G.

✅ Requirement Order

- An NGO must first obtain 12A registration.

- Only then can it apply for the 80G registration process.

✅ Validity

- Both 12A and 80G now come with 5-year validity and require renewal.

✅ Mandatory for Funding

- Without 12A: NGOs cannot claim tax exemption on their income.

- Without 80G: NGOs may face difficulty in attracting donors because donations won’t provide tax benefits.

⭐ Simple Explanation:

12A = Tax exemption for NGO

80G = Tax exemption for donors

Both are essential for long-term fundraising and compliance.

FAQs on the 80G Registration Process

Below are the most commonly asked questions related to the 80G registration process, explained in a simple and clear manner.