In this blog, we will explore India’s top 10 income tax books, each offering comprehensive coverage, expert analysis and real-world applications to help you understand the nuances of taxation in India. When understanding and dealing with the complexities of income tax laws in India, having the right resources is necessary.

Income tax books provide in-depth knowledge, practical insights and up-to-date information on the constantly evolving tax landscape. Whether you are a student preparing for the exam, a tax professional or a business owner looking to comply, these books serve as invaluable guides.

- What is the Tax Book?

- What are the Top 10 Income Tax Books in India?

- 1. Comprehensive Coverage Of Income Tax Laws

- 2. Income Tax Law And Practice Textbooks

- 3. Best Practices For Learning Income Tax

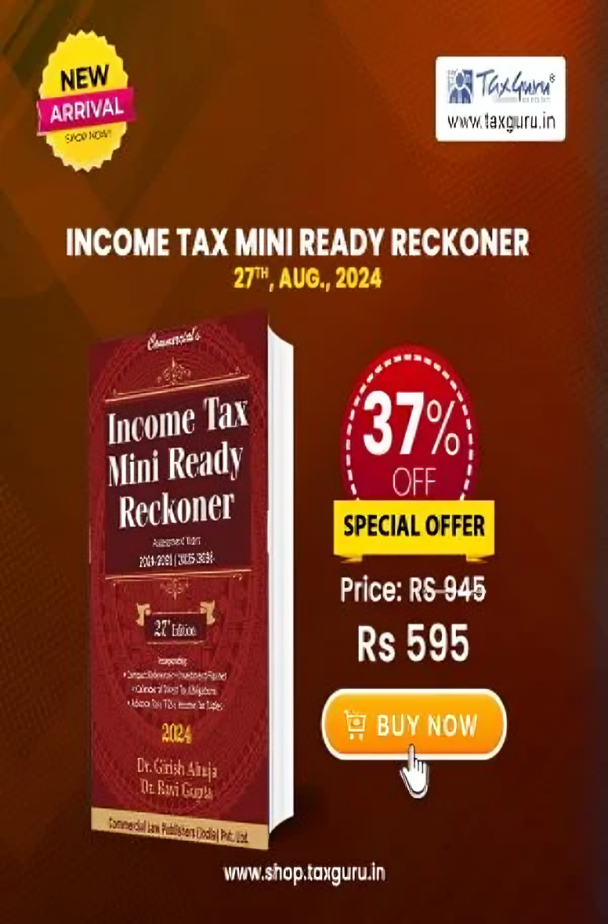

- 4. Girish Ahuja

- 5. Books on Indian Taxation

- 6. Chaturvedi And Pithisaria’s Taxation Law Volumes

- 7. Dr. H.C. Mehrotra, Dr. S.P. Goyal

- 8. Personal Investment And Tax Planning Yearbook

- 9. Specialized Tax Manuals

- 10. GST Ready Reckoner

- Conclusion

- FAQs

What is the Tax Book?

A tax book is a comprehensive document or ledger used to maintain detailed records of tax-related information for individuals, businesses, or governments. It is an organized repository for tracking taxable income, deductions, credits, liabilities, and payments. Tax books are essential for ensuring compliance with tax laws, preparing accurate tax returns, and maintaining transparency during audits.

1. Income records: Documentation of all sources of income, such as salary, business profits, dividends or rental income.

2. Expense Tracking: Record deductible expenses, including business expenses, charitable donations, and other allowable deductions.

3. Taxable assets and liabilities: Details of property, investments or other assets subject to taxation.

4. Tax rates and calculations: Historical and applicable tax rates, as well as calculation of tax payable.

5. Payment History: Documentation of Advance Tax payments, Self-Assessment Tax payments and refunds.

6. Compliance Records: Documentation of documents filed with tax authorities, notices received and proposals.

What are the Top 10 Income Tax Books in India?

1. Comprehensive Coverage Of Income Tax Laws

2. Income Tax Law And Practice Textbooks

3. Best Practices For Learning Income Tax

4. Girish Ahuja

5. Books on Indian taxation

6. Chaturvedi And Pithisaria’s Taxation Law Volumes

7. Dr. H.C. Mehrotra, Dr. S.P. Goyal

8. Personal Investment And Tax Planning Yearbook

9. Specialized Tax Manuals

10. GST Ready Reckoner

To File Any Types Of Taxes Contact Our Expert Legal Adviser

1. Comprehensive Coverage Of Income Tax Laws

Comprehensive Coverage of Income Tax Laws is an income tax book designed to provide an in-depth understanding of the taxation framework in India. It is highly regarded among professionals, students and practitioners for its detailed analysis of the Indian Income Tax Act, rules and related provisions.

1. Charts & Summaries: Includes flowcharts, diagrams and summary tables for quick revision.

2. Case Studies and Illustrations: Real-world tax scenarios are analyzed for better understanding.

3. Landmark Judgments: Discussion of important judicial pronouncements and their relevance.

4. Amendment Highlights: Highlights the recent tax law changes per the latest Finance Act.

2. Income Tax Law And Practice Textbooks

The textbook titled “Income Tax Laws and Practice” is a widely recognized and widely used resource for understanding income tax laws in India. Written by renowned tax experts Dr. Vinod K. Singhania and Kapil Singhania, this book is trusted by students, tax practitioners and professionals alike for its clear explanation of complex tax provisions.

Provisions of the Income Tax Act, 1961, including tax computation, exemptions and deductions.

Practical examples and case law to simplify complex concepts.

Latest amendments and updates in tax laws.

It covers topics like residential status, source of income, tax planning and TDS.

3. Best Practices For Learning Income Tax

“Best Practices for Learning Income Tax” is a guide designed to help individuals, students and professionals effectively understand and master the subject of income tax. However, it is not a widely recognized book title like other books.

The concept of “best practices” in learning income tax can be gleaned from various comprehensive resources. However, I can outline the key principles typically emphasized in a book focusing on practical ways to master income tax knowledge.

4. Girish Ahuja

Girish Ahuja is a renowned author on Indian taxation, mainly because of his comprehensive and practical approach to income tax law. His books are widely used by professionals, students and tax practitioners to understand the nuances of income tax provisions in India. Below are the details of his most prominent books.

It incorporates the latest amendments to the Income Tax Laws.

Provides detailed case studies and illustrations for easy understanding.

It is structured in such a way that it is suitable for both students and professionals.

It covers income tax, tax deductions, exemptions, capital gains etc.

5. Books on Indian Taxation

Books on Indian taxation provide detailed information about the tax laws of India, such as income tax, corporate tax, and more. Here is a brief overview of the main features of popular income tax books.

1. Overview of Indian Tax System: Explains the Income Tax Act 1961 and types of taxes (direct and indirect).

2. Income Tax Provisions: Detailed analysis of significant sections like deductions, exemptions and tax slabs.

3. Types of Taxes: These include taxation on income, capital gains and corporate taxes.

4. Filing Tax Returns: Guidance on filing returns, filling ITR forms and common mistakes to avoid.

5. Tax Planning: This includes tax-saving tips and strategies for individuals and corporations.

6. Amendments & Updates: Incorporates the latest tax law and judicial decision changes.

6. Chaturvedi And Pithisaria’s Taxation Law Volumes

Chaturvedi & Pithisaria’s Taxation Laws Volumes is a comprehensive series on Indian Income Tax Law, written by Dr. H.C. Chaturvedi and Dr. S.P. Pithisaria. The series is known for its in-depth commentary on the Income Tax Act.

1. Detailed Analysis: It covers all aspects of Income Tax, such as sources of income, deductions, and assessment procedures.

2. Case law: Extensive use of judicial precedents and landmark decisions.

3. Practical Examples: Presents practical examples and solves problems to explain tax provisions.

4. Tax Planning: This includes strategies to minimize tax liabilities.

5. Regular Updates: Each edition is updated with amendments, changes in the Finance Act, and the latest case laws.

7. Dr. H.C. Mehrotra, Dr. S.P. Goyal

The book “Income Tax Law and Practice” by Dr. H.C. Mehrotra and Dr. S.P. Goyal is a comprehensive guide to Indian Income Tax Law, suitable for students, tax practitioners, and professionals. It covers.

In-depth coverage of the Income Tax Act 1961, including key provisions and updates.

Illustrations and solved examples for practical understanding.

Case law to highlight judicial interpretations.

Topics such as tax computation, deductions, corporate taxation and assessment process.

It is written in simple language, making it accessible to beginners and advanced learners.

8. Personal Investment And Tax Planning Yearbook

The Personal Investment and Tax Planning Yearbook is a comprehensive guide that combines investment strategies with tax planning advice. It provides information about various investment options (stocks, bonds, mutual funds, real estate) and how they affect taxes. Key features include.

1. Tax-saving strategies: Covers deductions under sections 80C, 80D, capital gains tax, etc.

2. Annual Update: It includes the latest tax laws and amendments.

3. Practical Examples and Case Studies: Provides real-life applications for tax planning.

4. Retirement Planning: Guidance on aligning investments with retirement goals.

5. For all levels: Suitable for beginners and advanced investors.

9. Specialized Tax Manuals

Special tax manuals are in-depth books focusing on specific areas of tax law, providing detailed analysis, updates, case studies, and practical guidance. They cater to specific topics such as income tax, GST, corporate tax, international tax, and transfer pricing.

1. Targeted Focus: Covers specific tax areas.

2. In-depth Analysis: Explains laws with examples and judicial decisions.

3. Illustrations and Case Studies: Practical applications of tax laws.

4. Tax Updates: Regularly updated with amendments.

5. Practical Guidance: Step-by-step instructions for tax filing and compliance.

10. GST Ready Reckoner

GST Ready Reckoner is a comprehensive guide that simplifies India’s Goods and Services Tax (GST) laws. It is a practical tool for understanding, calculating and complying with GST-related provisions. Although it is not primarily an income tax book, it is widely used by tax professionals, businesses, and accountants in India for GST-related tax matters.

1. Comprehensive Coverage: Covers GST Act, Rules, Notifications and Circulars.

2. Practical Examples: These include real-life examples, case studies, and solutions to common issues.

3. GST Filing Guide: Step-by-step instructions for registration, return filing and compliance.

4. Latest Updates: Regularly updated with amendments and notifications.

5. User-friendly: Simplifies complex GST concepts for businesses, tax professionals, and students.

Conclusion

Income Tax books are indispensable tools for understanding and dealing with the complexities of India’s tax system. Whether you are a student, a tax professional, or a business owner, these books provide detailed explanations of tax laws, practical examples, and the latest amendments crucial for accurate tax filing and compliance.

By regularly referring to these books, individuals and businesses can ensure timely compliance, minimize tax liabilities, and avoid legal issues. For tax professionals, these books are helpful for day-to-day practice and keeping up with the latest changes in tax laws.

FAQs

Q1. What is the best book to learn about taxes?

The best book to learn about taxes in India is “Income Tax Law and Practice” by Vinod K. Singhania and Kapil Singhania. It presents clear explanations and practical examples and covers essential tax provisions.

Q2. Is 7 lakh income tax-free?

No, income of ₹7 lakh is not tax-free. However, it can be reduced to a lower taxable amount through deductions under sections such as 80C or 80D, thereby potentially reducing or eliminating tax liability. The basic exemption limit for individuals below 60 is ₹2.5 lakh.

Q3. How can I learn income tax quickly?

To learn Income Tax quickly, start with the basics like taxable income, deductions, and tax slabs. Use simple resources like online tutorials, books and sample problems. Stay updated about tax laws and consider online courses for a deeper understanding. Practicing consistently will help you understand the concepts effectively.

Q4. What is the complete IRS form?

The complete IRS form is from the Income Tax Department. It refers to the government agency responsible for enforcing tax laws, collecting taxes, and overseeing tax compliance.

Q5. What is the book-tax difference?

Book tax difference is between the income tax expense reported in the financial statements and the actual tax payable. It is caused by differences in accounting rules and tax laws, such as depreciation or revenue recognition, resulting in deferred tax assets or liabilities.

Add a Comment