The History of GST is considered one of the most significant milestones in global taxation reform. Introduced to replace a range of indirect taxes in India, GST serves as a pivotal tool in making the economy more effective, transparent, and efficient by harmonizing indirect taxes.

But how did this revolutionary tax system evolve? Who were the key figures behind its development? The History of GST in India reflects decades of debate and planning, culminating in a modern system that has reshaped the nation’s tax landscape.

Its implementation not only marks a crucial chapter in the History of GST but also stands as a testament to its global influence, inspiring countries worldwide to adopt similar frameworks.

In this blog post, let us take you through the chronological history of GST from its inception to its implementation in India on July 1 2017.

In the meantime, the major developments in GST, its predecessors, challenges, and how it has impacted and improved the Indian economy are briefly discussed. Let us read more about GST, which has written a new chapter in Indian fiscal policy.

- What is the Goods and Services Tax (GST)?

- What is the Origin of GST?

- Why Did Countries Adopt GST?

- What is the Vision of GST in India?

- Who Introduced GST in India?

- What is the History of GST Bill and GST Act In India?

- What is the Timeline and Evolution of GST in India?

- What are the Key Features of the GST Regime?

- What is the GST Council?

- Which Type of Decisions Taken By the GST Council?

- Which Types of Taxes are Levied in India Before the Introduction of GST?

- What is the Tax Structure of India Before GST?

- What is the Tax Structure of India after the Implementation of GST?

- What are the Benefits of GST Implementation?

- What are the Key Reforms and Updates Post-Implementation?

- What is the Goods and Services Tax Network (GSTN)?

- How is GST Calculated?

- How Does India’s GST Fare?

- In Conclusion

- FAQs

What is the Goods and Services Tax (GST)?

As it happens, GST is a holistic, stage-wise, consumption-based tax that is levied at each stage of the supply chain of goods and services. VAT, excise duty, service tax and other similar taxes of the system of indirect taxation were replaced by it.

While implementing combined taxes in the form of GST, its main objective as a reform is to eliminate tax on tax in an efficient manner, where consumers will be taxed independently on the final price of goods through levying tax at the final point of consumption.

What is the Origin of GST?

GST originally evolved from a tax structure that began in the mid-20th century. The concept originated in France in 1954, which became the first nation to establish a unique, detailed VAT structure that morphed into GST.

Over the next few years, many countries have adopted GST, such as Canada, Australia, UAE-Singapore and New Zealand, where the systems have been adapted to suit the countries’ systems.

Why Did Countries Adopt GST?

There are several reasons why countries adopt GST, which we have mentioned below:

- To create a unified tax system.

- To eliminate double taxation.

- To simplify compliance and administration.

By the early 2000s, GST had been adopted by over 140 countries, showcasing its effectiveness in boosting tax revenues and simplifying tax regimes.

What is the Vision of GST in India?

In India, official state-level serious deliberations on the History of GST began in the year 2000, when the Vajpayee government set up a task force headed by West Bengal Finance Minister Dr. Asim Dasgupta to prepare a blueprint for the Goods and Services Tax.

However, the History of GST shows that it was not easy to implement from the day it was introduced. There was an issue of disparity between the policies of the Centre and the State in terms of the distribution of revenue, taxes, and administrative authority in the country.

The History of GST highlights the numerous challenges faced during its evolution, particularly in aligning the interests of both levels of government. Despite these hurdles, the History of GST reflects a determined effort to reform India’s tax system and create a unified tax structure that benefits the economy as a whole.

Who Introduced GST in India?

The journey of GST in India began in 2000 when the then-Atal Bihari Vajpayee-led NDA government formed a committee to formulate the modalities of GST.

Though the concept of the GST bill was introduced during the UPA government, it was passed only in 2011.

However, the NDA government led by Prime Minister Narendra Modi completed the process of bringing back the scheme and successfully launched it in 2017.

Key Contributors:

- Vajpayee Government (2000): Formation of the GST Task Force.

- UPA Government (2004–2014): Drafting and introduction of the GST Bill.

- NDA Government (2014–2017): Passage of the GST Bill and implementation.

What is the History of GST Bill and GST Act In India?

The GST Bill’s passage was a historic achievement. Below is a brief overview of its legislative journey:

- 2000: Vajpayee-led government formed a GST task force.

- 2006: Former Finance Minister P. Chidambaram announced the implementation of GST before FY 2010.

- 2011: The current UPA government brought the 115th Constitutional Amendment Bill for the purpose of GST.

- 2014: The NDA government again introduced the GST Bill in Parliament for its passage.

- 2016: It is in force from July 1, 2017, and later, GST was given constitutional status through the 101st Constitutional Amendment Act.

- 2017: The Red Flags Bill was passed in Lok Sabha and Rajya Sabha, and its implementation started on September 8, 2015.

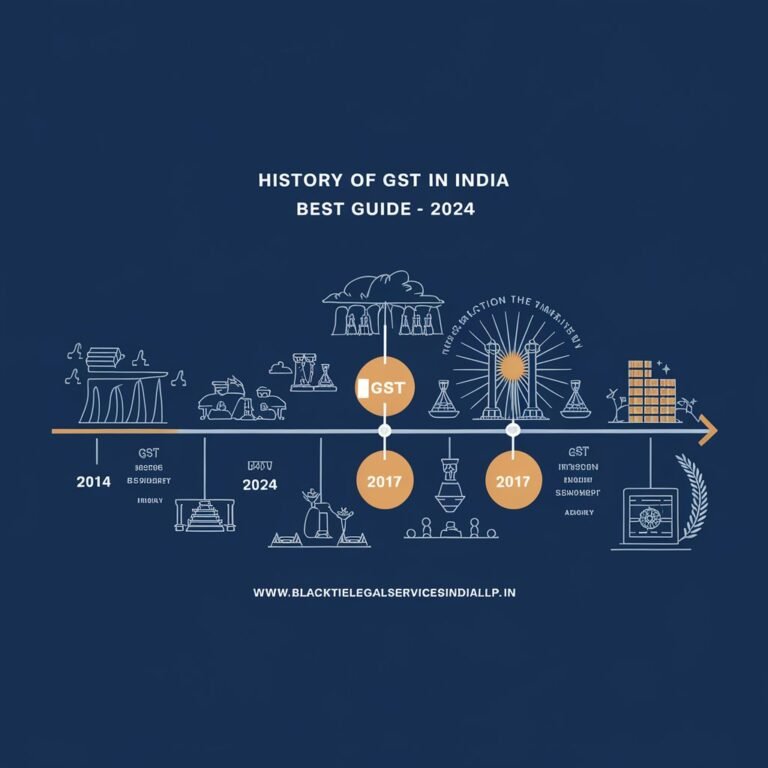

What is the Timeline and Evolution of GST in India?

The complete timelines and evolution of GST are mentioned below in a very concise manner:

- 2000: GST committee formed.

- 2004: Kelkar task force supports the single model of GST.

- 2014: GST bill format restated by the current Modi government.

- 2016: 101st Constitutional Amendment passed by Parliament to clarify constitutional provisions for the Act.

- 2019: Introduction of e-invoicing and further simplification of compliance processes.

What are the Key Features of the GST Regime?

GST in India has several defining features that make it unique and impactful:

- Dual Structure: The general sales tax can be divided as Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST) and Integrated Goods and Services Tax (IGST).

- Destination-Based Tax: Obviously, tax is paid at the demand level, not at the supply level.

- Input Tax Credit (ITC): Enables firms to take credit for taxes levied on inputs.

- E-Way Bill System: Coordinates the movement of goods from one state to another in a very efficient manner.

- Digital Compliance: Return filing, e-invoices, and web-based filing of taxes.

What is the GST Council?

The GST Council, integral to the history of GST, is the apex decision-making body overseeing its implementation in India. It comprises the Union Finance Minister, Minister of State for Finance, and State Finance Ministers.

The Council plays a vital role in the history of GST by promoting cooperative federalism, ensuring consensus on tax rates, exemptions, and procedures.

As part of the history of GST, the Council’s decisions have shaped the framework, making it a cornerstone of India’s taxation reform. Understanding the Council’s role is essential to grasp the broader history of GST in the country.

Which Type of Decisions Taken By the GST Council?

The GST Council plays a crucial role in shaping the GST regime. It has members from the central and state governments and takes key decisions related to rates, exemptions, compliance, procedures, etc.

Significant Decisions by the GST Council:

- Implementation of different tax rates (0%, 5%, 12%, 18% and 28%).

- Compensation cess for states so that they do not fail to meet their current and contingency revenue requirements.

- Reduction in GST return filing forms.

- A composition scheme has recently been introduced to help small units.

Which Types of Taxes are Levied in India Before the Introduction of GST?

Before GST, India’s tax system was fragmented, with multiple indirect taxes levied by both the Centre and States. These taxes often led to cascading effects, where tax was imposed on already taxed goods or services.

Key Indirect Taxes Before GST:

- Central Taxes: Excise Duty, Service Tax, Central Sales Tax, Custom Duties.

- State Taxes: VAT, State Sales Tax, Octroi, Entertainment Tax, Luxury Tax.

What is the Tax Structure of India Before GST?

Before the introduction of GST, the Indian government had a complex structure of taxes that included central and state taxes. This increased compliance costs, increased tax evasion and led to an inefficient tax system.

Key Issues with the Pre-GST Tax Structure:

- Cascading tax effect: Tax is levied on values that have already been taxed.

- Complex compliance: Multiple tax returns and officials in a centralised department.

- Uneven taxation: Variation in rates across states developed inefficiency issues.

What is the Tax Structure of India after the Implementation of GST?

In the case of India, GST is implemented in two tiers, namely Central GST (CGST) and State GST (SGST). In the case of inter-state transactions, Integrated Goods and Services Tax, or IGST, is levied.

Components of GST

- CGST: Collected by the Central Government on intra-state sales.

- SGST: Collected by the State Government on intra-state sales.

- IGST: Collected by the Central Government on inter-state sales.

Types of GST Slabs in India

- 0% – Essential goods like food grains.

- 5% – Items of mass consumption.

- 12% and 18% – Standard rates for most goods and services.

- 28% – Luxury goods and sin items like tobacco and luxury cars.

What are the Benefits of GST Implementation?

We have mentioned all the benefits of GST Implementation:

- Elimination of Cascading Taxes: GST integrates several other indirect taxes and, thus, reduces the incidence of tax on tax.

- Simplified Tax Structure: The single tax substructure gets rid of multiple taxes levied on factors of production.

- Boost to Make in India: For Indian products and materials, tax rates have been standardized, which will improve their competitiveness in the global market.

- Increased Compliance: Most supply chain members have purchased and adopted e-invoicing technology for enhanced automation and real-time compliance.

- Enhanced Revenue: Expansion of the tax base, as well as reduction in evasion levels, leads to increased government revenue.

What are the Key Reforms and Updates Post-Implementation?

Since its rollout, GST has undergone several changes to address concerns from various stakeholders.

- E-invoicing: Introduced to enhance transparency and curb tax evasion.

- Simplified Return Filing: The GST return filing process has been streamlined over time.

- Composition Scheme: Aimed at small businesses to reduce compliance burden.

What is the Goods and Services Tax Network (GSTN)?

GSTN is the interaction technology backbone that supports the Indian GST system and plays a crucial role in the history of GST. It facilitates the filing of returns, paying taxes, and compliance checks, making the process seamless.

As part of the history of GST, GSTN ensures smooth integration of data in a convenient manner for both taxpayers and tax officials.

The history of GST highlights the importance of GSTN in transforming India’s tax structure. With its robust framework, GSTN has become a pivotal tool in the history of GST implementation.

How is GST Calculated?

GST is calculated based on the applicable tax rate for goods or services. The formula is:

GST Amount = (Original Cost × GST Rate) / 100

For example, if a product costs ₹1,000 and the GST rate is 18%, the GST amount would be:

(1000 × 18) / 100 = ₹180

The final price of the product would be ₹1,180.

How Does India’s GST Fare?

However, the History of GST in India is relatively more complex than that of countries like Canada or Australia, as it follows a dual structure with multiple tax rates.

Given the size and diversity of the Indian economy, the adoption of this model reflects the evolution seen in the History of GST, balancing both national and state interests.

The History of GST highlights how India crafted a unique approach to address its diverse needs, making it a significant milestone in its economic reforms. Understanding the History of GST helps to appreciate the intricate framework that ensures both central and state participation.

In Conclusion

The history of GST in India gives a good lesson about India’s profession and its impetus for economic transformation and growth. Although it also faced some problems, GST has become the basis of India’s tax structure, which is effective in reducing complexities and encouraging growth, structure and transparency. This is why it will continue to further improve the efficiency of taxation and India’s competitiveness in the global environment.

For any member of society including students, achievers, policy enthusiasts or business people, the history of GST in India is informative about fiscal transformation.

FAQs

Q1. Who is called the father of GST?

Although the technicalities of GST in India were discussed as early as the 2000s, the first chief architect of GST was Asim Dasgupta, former finance minister of West Bengal, who headed the committee that designed the structure for GST.

Q2. Who launched GST first?

France was the first country to implement GST in 1954, setting a precedent that many countries are following today.

Q3. Which country has no GST?

The US currently does not use a central GST or VAT but instead applies state sales taxes.

Q4. Which country is 100% tax-free?

Most states in the Middle East are tax-exempt, especially those such as Saudi Arabia, Qatar, and the UAE.

Q5. Who pays GST?

Consumers pay GST on every product or service they purchase, while the responsibility of passing it on to the government lies with the business side.

Q6. Who controls GST?

In India, GST is implemented under the governance of the GST Council, an organization composed of both the central and state governments, which makes most of the decisions.

Add a Comment