The objective behind the introduction of the Goods and Services Tax (GST) in India is to create a unified tax system, in which several central and state taxes will be integrated.

One of its many advantages is that it has completely eliminated the cascading effect of tax, reducing the need to pay taxes multiple times. It has also reduced the complexity involved in paying and calculating taxes.

GST encourages the formalization of business enterprises and increases transparency, thereby reducing tax evasion. For the government, this means improved revenue collection.

In this blog post, we are providing you with a detailed guide about the top 15 advantages and disadvantages of GST, which you will not find anywhere else yet, but you will not get to read this blog post completely. So let’s start now.

What are the Top 15 Advantages and Disadvantages of GST?

Here is the list of the top 15 advantages and disadvantages of GST:

Here is a table of advantages and disadvantages of GST based on the points you provided:

| Advantages of GST | Disadvantages of GST |

|---|---|

| Efficiency in logistics | Increased operational costs |

| No more cascading tax | Higher tax burden for SMEs |

| Minimized compliances | Compliance burden |

| Higher business threshold | Inconsistent tax rates |

| Minimizes tax evasion | Complicated tax system |

| Special treatment for e-commerce operators | Increased software expenses |

| Easy online procedures | Strict GST regime |

| Boosting of revenue | High tax liability |

| Ease of business operation | Loss in the real estate sector |

| Make in India | Difficult migration to online filing system |

| One tax system | Dual control between Centre and States |

| Regulation of unorganized sector | Income Tax credit mismatch |

| Common national market | Multiple cess rates |

| Increases consumption | Penalties and fines |

| Input tax credit | No GST charged on petroleum products |

| Mitigation of cascading effect | Tax cascading still present in certain cases |

| Higher registration threshold | Increased costs for some businesses |

| Better logistics | Loss in certain sectors like real estate |

| Increased transparency | Increased operational cost |

| Uniform tax system | High burden on compliance for small businesses |

| Convenience for small businesses | Complexity in filing returns online |

| Lesser compliances | Complicated dual control |

| Online simpler procedure | Income tax credit mismatches |

| Reduction in tax evasion | Penalties and fines are high |

| Simplified online process | |

| Simplified tax structure | |

| Unorganized sector regulated | |

| Boost to e-commerce | |

| Corruption-free tax administration | |

| Increased market competitiveness |

What are The Advantages of GST?

We have given complete detailed information about the Advantages of GST, you can understand it below:

- Efficiency in logistics: GST eliminates multiple state taxes, improving supply chain efficiency by reducing delays at checkpoints and boosting overall logistics operations.

- No more cascading tax: GST removes the tax-on-tax effect, allowing businesses to claim input tax credits and reducing the overall tax burden on goods and services.

- Minimized compliances: The unified tax system simplifies compliance by replacing multiple indirect taxes with a single tax regime, making it easier for businesses to follow.

- Higher business threshold: Under GST, businesses with a turnover below a specific threshold are exempt from tax, enabling small enterprises to grow without immediate tax burdens.

- Minimizes tax evasion: The transparent and digitized structure of GST reduces opportunities for tax evasion by improving monitoring and ensuring proper tax collection.

- Special treatment for e-commerce operators: GST provides a clear and structured framework for e-commerce businesses, simplifying tax collection at source and ensuring uniformity in tax practices.

- Higher tax burden: Some businesses, especially SMEs, may experience a higher tax burden due to the increase in compliance costs and additional record-keeping requirements.

- Composition scheme for small businesses: Small businesses can opt for the composition scheme under GST, which allows them to pay taxes at a lower rate and reduces the burden of filing regular returns.

- Easy online procedures: GST offers a fully online filing and compliance system, simplifying registration, return filing, and tax payments for businesses.

- Boosting of revenue: GST increases government revenue by broadening the tax base, ensuring that more businesses contribute to the economy’s tax pool.

- Compliance burden: Despite its simplification, GST still requires businesses to meet regular filing deadlines and maintain detailed records, which can be a burden for smaller businesses.

- Ease of business operation: The standardized tax system simplifies business operations across states, allowing for smooth inter-state trade and removing inconsistencies in tax policies.

- Make in India: GST supports the ‘Make in India’ initiative by reducing the cost of production through input tax credits and making Indian products more competitive globally.

- One tax system: GST consolidates multiple indirect taxes into a single tax system, reducing confusion and making tax compliance more straightforward.

- Regulation of unorganized sector: GST brings the unorganized sector into the tax net, promoting transparency and ensuring compliance across all business sectors.

- After GST: Post-GST implementation, businesses experience a more structured and simplified tax environment, facilitating growth and reducing compliance costs.

- Common national market: GST establishes a single national market by removing tax barriers between states, enhancing the flow of goods and services across India.

- Increased costs: While GST simplifies the tax system, it may lead to increased operational costs for businesses in terms of software, compliance, and employee training.

- Increases consumption: The removal of cascading taxes under GST lowers the final price of goods and services, boosting consumer demand and overall consumption.

- Input tax: Businesses can claim input tax credits on goods and services used in production, reducing the overall tax liability and enhancing profitability.

- Mitigation of cascading effect: GST mitigates the cascading effect of taxes, allowing businesses to claim credits for taxes paid on inputs and reducing the overall cost of production.

- Higher registration threshold: GST offers a higher registration threshold, exempting small businesses from tax and allowing them to focus on growth without worrying about immediate compliance.

- Better logistics: GST removes state-level barriers, improving the efficiency of logistics by reducing transit times and ensuring a smoother flow of goods across the country.

- Increased transparency: GST’s digital framework enhances transparency by making it easier to track transactions, preventing tax evasion, and ensuring proper tax collection.

- A uniform tax system: GST introduces a uniform tax system across the country, eliminating regional tax discrepancies and providing a level playing field for businesses.

- Convenience for small businesses: GST’s simplified tax filing procedures and composition scheme make compliance easier for small businesses, reducing their tax burden.

- Lesser compliances: By integrating multiple taxes into a single system, GST reduces the number of returns and filings required by businesses, making compliance less time-consuming.

- Online simpler procedure under GST: The fully digitized GST system allows for seamless online registration, tax filing, and refunds, simplifying compliance and reducing paperwork.

- Reduction in tax evasion: The structured GST system, with digitized records and reporting, reduces the chances of tax evasion and ensures better tax compliance.

- Simplified online process: GST offers a streamlined online process for filing returns, claiming refunds, and paying taxes, reducing the overall complexity for taxpayers.

- Simplified tax structure: GST replaces multiple indirect taxes with a single tax system, simplifying the tax structure and making it easier for businesses to comply.

- Unorganized sector regulated under GST: GST brings the unorganized sector under its tax ambit, promoting transparency and accountability across all business sectors.

- Boost to e-commerce: GST provides a clear tax structure for e-commerce businesses, enabling easier compliance and tax collection, thereby boosting the growth of the sector.

- Corruption-free tax administration: GST’s digitized and transparent system reduces the scope for corruption by minimizing human intervention and ensuring accurate tax collection.

- Defined treatment for e-commerce operators: GST offers specific guidelines for e-commerce operators, simplifying tax collection and compliance for businesses in this sector.

- Increased market competitiveness: GST reduces production costs by eliminating tax cascading, making Indian goods more competitive in both domestic and global markets.

- Increased operational cost: While GST simplifies tax compliance, businesses may face higher operational costs due to the need for new software, training, and record-keeping.

- Increasingly efficient logistics: GST streamlines logistics operations by removing state checkpoints, reducing transit times, and lowering overall transportation costs.

So far we have learned about all the advantages of GST from the advantages and disadvantages of GST above and now below we will talk about the advantages of GST.

If You Want to Know Also About New GST Set Off Rules than Click Here

What are The Disadvantages of GST?

We have given complete detailed information about the Disadvantages of GST, you can understand it below:

- Tax cascading: Despite efforts to eliminate it, tax cascading can still occur in specific cases, leading to higher costs for businesses and consumers.

- Increased costs: The implementation of GST has led to increased costs for businesses, especially in terms of compliance, software, and employee training.

- Tax evasion: Although GST aims to reduce tax evasion, loopholes and inefficiencies in enforcement still allow some businesses to evade taxes.

- Better logistics: While GST improves logistics for many, small businesses might struggle with the increased compliance and operational requirements associated with efficient logistics.

- Higher threshold limit: The higher threshold for GST registration can create inequality, as smaller businesses are exempt, while medium-sized enterprises face heavier tax burdens.

- Inconsistent tax rates: GST has multiple tax slabs, leading to confusion and inconsistency in the tax rates applied to different goods and services.

- Advantages of GST: While GST offers many benefits, the disadvantages in terms of increased compliance and operational costs often outweigh the advantages for smaller businesses.

- Composition scheme: The composition scheme is designed to help small businesses, but it comes with limitations like restricted input tax credit and limited turnover benefits.

- Higher tax burden of SMEs: Small and medium enterprises (SMEs) often face a higher tax burden under GST due to the increased cost of compliance and tax payments.

- One tax system: Although the idea of one tax system sounds ideal, the complexity of GST rules, multiple rates, and compliance requirements often complicate this simplicity.

- Compliance burden: Businesses, especially small ones, face a heavy compliance burden with frequent filing requirements, record maintenance, and updates under GST.

- Ease of business operation: While GST aims to simplify business operations, it often leads to higher operational costs and complexity for small businesses, reducing overall ease.

- Better compliances and tracking: Though GST enhances tracking, it also increases compliance requirements for businesses, creating additional administrative burdens.

- Simple access: Access to the GST system is not as simple as intended, especially for businesses in remote areas or those without adequate technology.

- GST composition scheme for small business: The composition scheme helps small businesses, but it restricts them from claiming input tax credits, limiting their growth potential.

- Increased product competitiveness: While GST increases product competitiveness by lowering costs, the complexity of compliance and higher operational costs reduce overall benefits for smaller companies.

- Increases consumption: Though GST aims to increase consumption, higher costs and complex compliance may discourage businesses from passing savings on to consumers.

- No GST charged on petroleum products: Key sectors like petroleum remain outside the GST framework, which creates tax gaps and affects the pricing of essential goods.

- Regulates unorganized sector under GST: The inclusion of the unorganized sector in the GST framework imposes compliance burdens on small players, which may hinder their growth.

- Transparency: While GST increases transparency, the complexity of the system leads to errors in filing, input tax credit mismatches, and increased scrutiny from tax authorities.

- Complicated tax system: Despite being promoted as a simplified system, GST remains complicated due to multiple tax slabs, complex rules, and frequent updates.

- Increased software expenses: Businesses need specialized software for GST compliance, increasing operational costs, especially for small businesses without technological expertise.

- Strict GST regime: The strict regime of GST requires timely compliance, and even small delays or errors can result in significant penalties and interest charges.

- High tax liability: GST often results in a higher tax liability for businesses due to the multi-tiered rate structure and the complexities of claiming input tax credits.

- Loss in the real estate sector: GST has negatively impacted the real estate sector, increasing construction costs and lowering demand for new properties.

- Difficult migration to online filing system: Many small businesses find it challenging to migrate to the fully online GST system, especially in areas with limited internet access or technological resources.

- Dual control: The dual control by both state and central governments leads to confusion, disputes, and increased compliance requirements for businesses.

- Income Tax credit mismatch: Mismatches between the data submitted by businesses and the tax authorities often lead to delays in claiming input tax credits, affecting cash flow.

- Multiple cess rates: GST includes various cess rates, which increase the complexity of tax calculations and compliance for businesses.

- Penalties and fines:The GST regime has stringent penalties and fines for non-compliance, creating a heavy burden for businesses that may struggle to meet all requirements on time.

What are the Disadvantages of Having a GST Number?

Here are the disadvantages of having a GST Number as well as the positive and negative effects of GST:

- Increased Compliance

Regular GST filings can be time-consuming and complex.

- Higher Operating Costs

Small businesses may need to hire professionals for managing GST, increasing costs.

- Technical Challenges

Requires digital expertise for online filings, tough for traditional businesses.

- Complex for Small Businesses

Managing GST across states can be difficult, especially for small traders.

- Input Tax Credit Delays

Refund delays can affect cash flow.

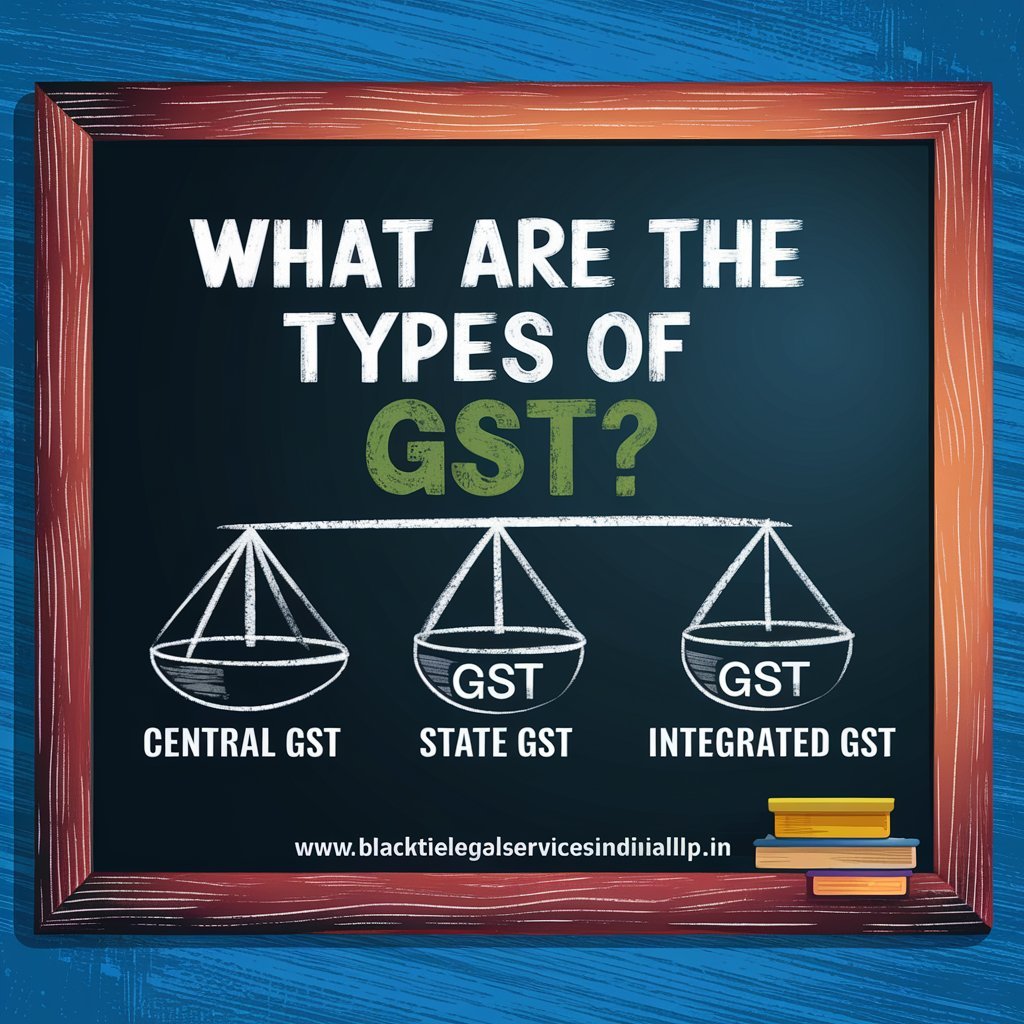

What are the Types of GST?

Here’s a table outlining the different types of GST in India:

| Type of GST | Full Form | Applicable On | Collected By |

|---|---|---|---|

| CGST | Central Goods and Services Tax | Intra-state supply of goods or services | Central Government |

| SGST | State Goods and Services Tax | Intra-state supply of goods or services | State Government |

| IGST | Integrated Goods and Services Tax | Inter-state supply of goods or services | Central Government |

| UTGST | Union Territory Goods and Services Tax | Supply of goods or services within Union Territories | Union Territory Government |

What are the Positive and Negative Effects of GST?

Here’s the list of positive and negative effects of GST:

| Positive Effects | Negative Effects |

|---|---|

| Simplified tax structure | Complex compliance for small businesses |

| Eliminated multiple indirect taxes | Higher operational costs |

| Input tax credit reduces the cascading effect of taxes | Delays in input tax credit refunds affect cash flow |

| Encourages transparency and accountability | Technology challenges for traditional businesses |

| Boosts inter-state trade by unifying the tax system | Some goods/services attract higher tax rates under GST |

If you want to know more about the advantages and disadvantages of GST than just click below:

Which country has no GST?

There are only 3 countries in the world where GST has not been implemented yet, whose names we have mentioned below:

- Malaysia

- United States

- Puerto Rico

In Conclusion

While GST has been very beneficial for India, it has also posed several challenges as it has steadily increased compliance costs, as well as created technical and operational problems for many businesses. When both businesses and the government understand the process, the benefits will outweigh the disadvantages. However, the GST system will continue to improve through constant innovations and clarifications to make it more smooth in the long run.

FAQs

Q1. What is the Advantage of GST Number?

Small businesses with an annual turn-over less than the prescribed threshold limit (now ₹20 lakh for most states) would have the right to choose exemption from GST registration and compliance.

Q2. Who can avoid GST?

Having a GST number will allow businesses to collect input tax credits on purchases; flatten the complicated tax structure of many indirect taxes; and make compliance easier and tax liabilities trackable.

Q3. What is negative GST?

Negative GST is a scenario where the output tax liability is less than the available input tax credits and thus that amount is in excess or a claim for refund with an adjustment due to excess input credits.

Q4. Who Introduced GST in India?

GST was implemented in India by the Goods and Services Tax Council on 1 July 2017 consisting of the Union Finance Minister and the Finance Ministers of the States.

Q5. Is GST good or bad for people?

GST is both bad and good; it simplifies the tax structure by promoting transparency, yet often with compliance burdens, particularly on small businesses, and so varies for everyone in some way.

Add a Comment