Kanpur is an important industrial city in Uttar Pradesh that not only holds historical significance but also stands as an urban center that requires proper urban governance including municipal services.

Apart from excise duty and other taxes, property tax is an essential component of Kanpur’s municipal management as it extends to infrastructure development, public utility, and controlling the city’s growth pattern.

In this blog post, you will discover every aspect of Kanpur property tax such as the importance of paying such taxes, how the payment is made and calculated, and also which department is in charge of these taxes.

- What is Kanpur Property Tax?

- What is the Importance of Property Tax in Kanpur?

- What is the Governing Authority for Property Tax in Kanpur?

- Which Types of Properties Liable for Taxation in Kanpur?

- What are the Benefits of Kanpur Property Tax?

- What is the Calculation of Kanpur Property Tax?

- How to Pay Kanpur Property Tax Payment?

- How to Find the Property Identification Number to Pay Kanpur Property Tax?

- What are the Required Documents for the Kanpur Property Tax Bill?

- How to Check Kanpur Property Tax Payment Status?

- How to Download the Kanpur Property Tax Payment Receipt?

- What is the Mutation Fee Charged by Kanpur Nagar Nigam?

- What are the Due Dates of Kanpur Property Tax?

- How to Pay Kanpur Property Tax Using NoBroker Pay?

- What is the Kanpur Property Tax Rebate 2024?

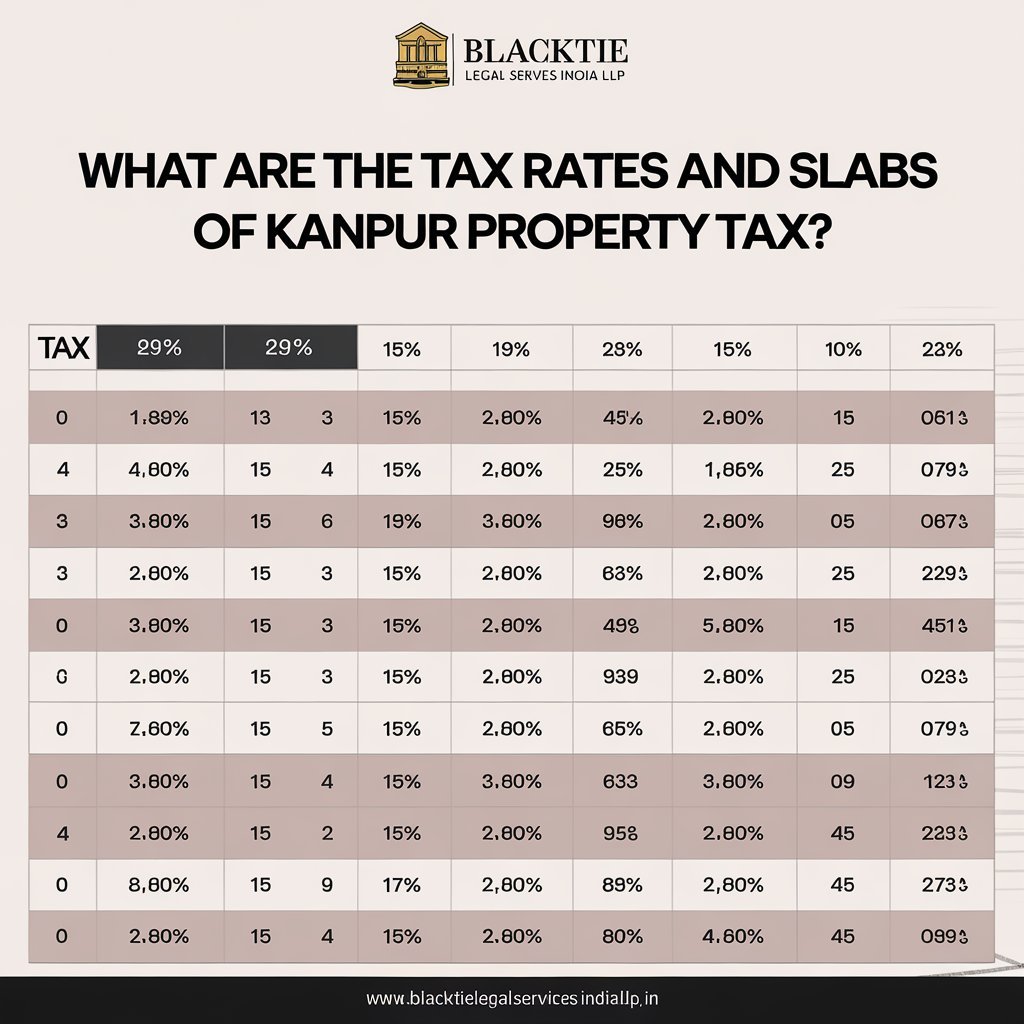

- What are the Tax Rates and Slabs of Kanpur Property Tax?

- What is the Kanpur Property Tax Transfer Online 2024?

- What are the Kanpur Property Tax Transfer Charges 2024?

- How to Use the Kanpur Property Tax App in 2024?

- What are the Exemptions and Concessions on Kanpur Property Tax?

- What are the Consequences of Non-Payment or Late Payment?

- What are the Steps for Property Tax Assessment in Kanpur?

- What is the Property Tax Grievances and Redressal Mechanism?

- What are the Reforms and Future of Property Tax in Kanpur?

- What is the Contact Information of Kanpur Nagar Nigam?

- In Conclusion

- FAQs

- 1. Is property tax applicable to leased properties in Kanpur?

- 2. How is the annual rental value determined for property tax purposes in Kanpur?

- 3. Can NRIs (Non-Resident Indians) own property in Kanpur and are they required to pay property tax?

- 4. Are agricultural lands subject to property tax in Kanpur?

- 5. Is there a specific time of year when property tax rates are revised in Kanpur?

- 6. What happens if I sell my property mid-year? Who is responsible for paying the tax?

- 7. Can joint property owners share the property tax burden in Kanpur?

- 8. Are there any incentives for early tax payments for businesses in Kanpur?

- 9. Can I transfer my property tax account if I relocate within Kanpur?

- 10. What are the steps to dispute a tax assessment for new construction in Kanpur?

What is Kanpur Property Tax?

Kanpur Property Tax is revenue collected by the Kanpur Municipal Corporation (KNN), the municipal body responsible for managing the city’s affairs, based on the market value of the immovable property, which can be a house, building, factory, or any land that cannot be transferred.

This tax is one of the most important revenue sources for the municipal corporation, which in turn uses the money to set up and maintain various civic amenities such as roads and drains, water supply and lighting, and waste control mechanisms.

Talking Kanpur property tax is an important tax that is levied on both private and commercial establishments. It is a tax that is paid by every property owner on an annual basis and if a property owner fails to pay then there is some penalty and interest on the amount.

What is the Importance of Property Tax in Kanpur?

Kanpur Property taxes are an important source of revenue for the development and maintenance of infrastructure in Kanpur.

Also, since Kanpur is a developing city, with growing business and residential areas, it costs a lot of money to maintain public amenities. Property taxes help in the following:

- Maintaining roads, bridges, and flyovers.

- Providing and upgrading the water supply and sewage systems.

- Ensuring the proper disposal and management of waste.

- Maintaining public parks and recreational spaces.

- Funding public services such as firefighting and public safety.

- Upgrading the city’s sanitation and health systems.

Without such a fixed income source, the development of the city and the quality of public amenities will be adversely affected.

What is the Governing Authority for Property Tax in Kanpur?

The municipal body in Kanpur is called Kanpur Municipal Corporation (KNN) and is also involved in the collection of Kanpur property taxes.

KNN, also known as Kanpur Nagar Nigam, bears the responsibility of proper management of the city and providing timely public amenities to the people as well as traders. KNN has set tax rates, payment deadlines, concessions, and penalties associated with Kanpur property tax and adjusts them from time to time.

Apart from Kanpur property tax, KNN is also responsible for other types of taxes such as water tax, sewage tax, and advertisement tax. Payment of these taxes is mandatory and therefore crucial for the success of the concerned civic body.

Which Types of Properties Liable for Taxation in Kanpur?

Kanpur property tax applies to various types of properties, including:

- Residential Properties: Houses, apartments, and flats used for residential purposes.

- Commercial Properties: Offices, retail stores, shopping complexes, and hotels.

- Industrial Properties: Factories, warehouses, and manufacturing units.

- Vacant Lands: Undeveloped or unused land within the city limits.

Each type of property is taxed differently, with the rates depending on the property’s use, location, and size. Owners of such properties are required to register with the municipal corporation and pay Kanpur property tax annually.

What are the Benefits of Kanpur Property Tax?

Kanpur property tax offers several benefits for property owners and the city itself:

- Infrastructure Development: All the money collected from property tax is used to develop and maintain Kanpur’s roads, parks, street lights, and other important infrastructure.

- Improved Civic Amenities: All the money raised is used to upgrade Kanpur’s waste disposal, sewerage, and entire water supply systems, improving the quality of life for everyone.

- Lawful Property Ownership: Paying property tax on a regular basis makes it much easier to ensure that your entire property is considered legal by all municipal authorities, minimizing the chances of any legal challenges or penalties.

- Access to Municipal Services: Paying property tax makes it easier to access various municipal services such as emergency services, sanitation, and waste collection.

- Contribution to City’s Growth: By paying property tax, you help your city’s economy to thrive and grow, thereby improving the overall quality of life there in a significant way.

- Discounts and Rebates: Many cities offer rebates for paying property taxes early or before the due date, making it much easier for all fiscally responsible taxpayers to get financial relief.

What is the Calculation of Kanpur Property Tax?

The determination of Kanpur property tax is affected by various aspects: location of the property, type of property, use of the property, and age of the property.

The formula for calculating Kanpur property tax can be stated as follows:

Property Tax = Annual Value of Property × House of Tax

- Annual value of Property: The annual value is determined based on its rental value or based on its market value if there is insufficient information.

- Tax Rate: The tax rate is determined for different buildings (property types) by the Kanpur Municipal Corporation.

Aspects Affecting the Calculation of Tax:

- Location: Properties located on major commercial streets or upscale neighborhoods will be taxed more than those in suburban or undeveloped areas.

- Built-Up Area: The amount that will be taxed is directly related to the size of the building or parcel.

- Type of Use: A property with commercial use will be taxed differently than a residential type of property.

- Age of the Building: The property may get allowances for depreciated value depending on its age.

Example Calculation of Kanpur Property Tax

Suppose you have a residential property with an ARV of ₹1,00,000 and the tax rate is 15%. The Kanpur property tax calculation would be:

Property Tax = ₹1,00,000 × 0.15 = ₹15,000

This ₹15,000 is the property tax payable for the year.

How to Pay Kanpur Property Tax Payment?

With time, Kanpur has seen a lot of development in all types of cities, in view of which the government there has introduced the online method along with the offline method for paying Kanpur property tax, which indicates that digitalization is also being promoted a lot there:

Kanpur Property Tax Pay Online:

- Visit the official website: First of all, you have to go directly to the official website of Kanpur Municipal Corporation (KMC).

- Select the property tax option: After which you have to choose the property tax area, which is often marked by the website as “Property Tax” or “Pay Property Tax”.

- Provide property details: In the next step, you have to provide all kinds of information about your entire property, such as area, assessment number, or property ID. All these facts can be in the records of the municipal corporation or previous tax receipts.

- View Tax Payable: Right after you register, the website will show you how much property tax is due on your official land, which you have to pay.

- Transmit Money: Choose between using a credit card, debit card, net banking, or UPI as your payment option. Complete the payment by entering the required data.

- Create Receipt: You can download or print a receipt for your records as soon as the money is received.

Kanpur Property Tax Pay Offline:

- Visit the KMC Office: First, visit your nearest authorized property tax collection facility or Kanpur Municipal Corporation (KMC) office.

- Provide Property Details: In the next step, provide the municipal officer with details of your property, such as your area, assessment number, or ID. These details will help them search for your tax documents.

- Generate Tax Bill: Your Kanpur property tax bill, including the outstanding amount, will be presented to you by the officer.

- Make Payment: Cash, cheque or demand draft can be used to pay Kanpur property tax at the counter.

- Get a Receipt: As a confirmation of payment, get a receipt as proof immediately after the payment is made.

Advantages of Paying Online of Kanpur Property tax Payment:

- Convenient: You can pay from anywhere without visiting the municipal office.

- Fast and Secure: The payment process is quick and offers multiple secure payment options.

- E-receipt: Instant generation of a digital receipt for record-keeping.

In contrast, the offline method may take more time but is helpful for those who prefer in-person transactions or have difficulty with online systems.

How to Find the Property Identification Number to Pay Kanpur Property Tax?

To pay Kanpur property tax, you require the Property Identification Number also referred to as the Property ID which is an identification number the KMC assigns to the property in question.

Here’s the Key Steps to Know your property Identification Number

Check Previous Property Tax Receipts

The simplest way of identifying your PIN is by checking past Kanpur property tax receipts or bills that you may have at hand. The Property ID is normally printed on these papers.

Visit the Kanpur Municipal Corporation Website

- Type ‘’Kanpur Municipal Corporation’’ in the search engine, and access the official KMC website.

- Scroll to find the “Property Tax” section Now, to search for your specific property, there is often an option to have your Property ID retrieved provided you enter your property location, owner, and or address details.

Contact KMC Office

Some of the registration documents or the sale deeds contain the Property Identification Numbers, particularly in case the properties are registered with the municipal authorities.

Look in the Property Registration Documents

View property registration documents: Some registration documents or sale deeds contain property identification numbers, especially when properties are registered with municipal authorities.

Ask the Tax Inspector or Agent

The local tax inspector or any other local agent familiar with the area will help you a lot in finding your property ID in municipal records.

The property identification number is therefore very important, especially when paying property tax through the internet or physically, as it is a unique number allotted to your property in municipal government records.

What are the Required Documents for the Kanpur Property Tax Bill?

When you pay your Kanpur property tax, it’s important to have certain documents ready. Here’s what you’ll need:

- Property Identification Number: The unique number that will be issued for your property on which you will make the payment.

- Property Address: All details related to the address of the property you have chosen to sell.

- Previous Tax Receipts: Whenever possible, they should submit copies of previous property tax receipts that will indicate the payment record.

- Owner Identification: Photo ID proof may include an Aadhaar card, PAN card, voter card, or any other government-issued photo identity card; this may be required for identification purposes.

- Proof of Ownership: Original copies of documents such as sale deeds or registration papers may be required at the time of the first payment of tax or when there is a mistake in the records.

How to Check Kanpur Property Tax Payment Status?

Knowing Kanpur Property Tax Payment Status has become very easy. Follow these steps:

- Visit the KMC Website: First of all go to www.kmckanpur.com to visit the Kanpur Municipal Corporation homepage.

- Go to the Property Tax section: Find the “Property Tax” or “Check Payment Status” link on the homepage.

- Enter the Property ID: You will need to enter some basic information about the property such as the Property Identification Number (PID) or any other information about the property including the name and address of the property owner.

- View Payment Status: Once a user enters the correct details, he or she will be able to view the current tax payment rating of his or her property, the amount still due, and the latest payment status.

How to Download the Kanpur Property Tax Payment Receipt?

Once you complete your property tax payment, you can also get the payment receipt. Here’s how:

- Log in to the KMC Portal: Open the official website of Kanpur Municipal Corporation (KMC) and navigate to Property Tax.

- Access payment record: In the property tax section, you will need to find the option called “Payment Receipt” or “Download Receipt”.

- Enter all the Property Details: Type in your property ID or any other details related to the property such as the owner’s identity or property address.

- Download the Receipt: Depending on the type of payment you offer, your payment details will be displayed and there will be a button you can click to download the receipt. You can also save or print the receipt by clicking on the copy icon for your reference.

What is the Mutation Fee Charged by Kanpur Nagar Nigam?

Here is a table summarizing the mutation fee charged by Kanpur Nagar Nigam based on different property types and sizes:

| Property Type | Mutation Fee (₹) |

|---|---|

| Residential (up to 50 sq. meters) | ₹100 |

| Residential (50-100 sq. meters) | ₹200 |

| Residential (above 100 sq. meters) | ₹300 |

| Commercial (up to 50 sq. meters) | ₹500 |

| Commercial (50-100 sq. meters) | ₹1,000 |

| Commercial (above 100 sq. meters) | ₹2,000 |

| Industrial Property | ₹5,000 |

What are the Due Dates of Kanpur Property Tax?

The due dates for Kanpur property tax typically follow an annual or biannual schedule. Here’s a general outline:

Annual Payment:

- Due Date: 31st March (for the full financial year).

Biannual Payments (if allowed):

- First Half Payment:

- Due Date: 30th September (for the April to September period).

- Second Half Payment:

- Due Date: 31st March (for the October to March period).

Late Payment Penalties:

Each state has set certain dates within which the property tax should be paid and if you do not pay it before the stipulated dates, a penalty or interest is levied on the amount.

Discounts for Early Payment:

- Some states may also offer some incentives such as lower property tax or even discounts to those who pay property tax before a certain deadline which in many cases is June 30.

It is better to visit the Kanpur Municipal Corporation (KMC) webpage or call them about the exact due dates as these dates may vary slightly according to the respective policy.

How to Pay Kanpur Property Tax Using NoBroker Pay?

NoBroker Pay is a platform that allows property owners to pay their property taxes online. Here’s how you can use it for Kanpur property tax payment:

- Download the NoBroker App: Download the NoBroker app on your Android phone using the Google Play Store or on your iPhone using the Apple App Store.

- Sign Up or Log In: If you don’t have an account, create a new account and log on if you have one.

- Navigate to Property Tax Payment: Select the ‘Pay Property Tax’ option from the home screen.

- Enter Property Details: Enter your PIN (Property Identification Number) and enter “Kanpur” for the city.

- Check Your Dues: The app will display the outstanding property tax amount.

- Make the Payment: Choose the payment option as per your preference from Credit Card/Debit Card/Net Banking/UPI and proceed with the payment.

- Download the Receipt: After the payment is completed, you will receive the receipt either as a download or through your email.

What is the Kanpur Property Tax Rebate 2024?

In the financial year 2024, Kanpur Municipal Corporation (KMC) may give some concessions for early or on-time payment of taxes, especially property tax. Common rebates include:

- 5% to 10% Discount: Availed for the payment of property taxes before a certain date normally before 30th June in this case.

- Senior Citizen or Disabled Discounts: At times it is possible to negotiate for a rebate if one is a senior citizen, a person with a disability, or a woman who owns a property.

The more accurate and up-to-date information about the rebates for 2024 would be to check the KMC website or the office.

What are the Tax Rates and Slabs of Kanpur Property Tax?

The tax rates and slabs for Kanpur property tax vary depending on the type of property (residential, commercial, industrial, etc.) and the zone in which the property is located. Below is a general representation of property tax rates and slabs for Kanpur Nagar Nigam.

Kanpur Property Tax Rates and Slabs

| Category | Property Type | Zone | Tax Rate (per sq. meter) |

|---|---|---|---|

| Residential | Self-Occupied | Prime Zone | ₹1.25 – ₹2.00 |

| Non-Prime Zone | ₹0.75 – ₹1.25 | ||

| Rented | Prime Zone | ₹2.50 – ₹3.00 | |

| Non-Prime Zone | ₹1.50 – ₹2.00 | ||

| Commercial | Shops/Offices | Prime Zone | ₹5.00 – ₹7.50 |

| Non-Prime Zone | ₹3.00 – ₹5.00 | ||

| Malls/Complexes | Prime Zone | ₹10.00 – ₹12.00 | |

| Non-Prime Zone | ₹7.00 – ₹9.00 | ||

| Industrial | Small Industries | Industrial Zone | ₹4.00 – ₹6.00 |

| Large Industries | Industrial Zone | ₹7.50 – ₹9.50 | |

| Vacant Land | Residential Use | All Zones | ₹0.50 – ₹1.00 |

| Commercial Use | All Zones | ₹1.50 – ₹2.50 |

What is the Kanpur Property Tax Transfer Online 2024?

They will also need to transfer property tax, for example, if a house is sold or transferred to another person due to inheritance. Below are the procedures to transfer property tax online in 2024:

- Visit KMC Website: Visit the official website of Kanpur Municipal Corporation (KMC).

- Log in or Create Account: Login with a registered account or register for a new account.

- Find the Property Transfer Option: Visit “Property Transfer” commonly known as “Mutation”.

- Submit Required Documents: Upload the required documents such as the sale deed, proof of ownership, no objection certificate (NOC) from the previous owner, and identity proof.

- Pay Transfer Fee: Decide the amount for the mutation fee also known as transfer fee.

- Submitting the Application: Once you have applied and the fee is processed, you are given an acknowledgment number to use at the time of tracking.

What are the Kanpur Property Tax Transfer Charges 2024?

The property tax transfer charges (mutation fees) in 2024 will depend on the type and size of the property:

| Property Type | Transfer Charges (₹) |

|---|---|

| Residential (up to 50 sq. meters) | ₹100 – ₹200 |

| Residential (above 50 sq. meters) | ₹300 – ₹500 |

| Commercial Property | ₹1,000 – ₹2,000 |

| Industrial Property | ₹5,000 and above |

These charges can vary, so it’s recommended to confirm with the KMC for the exact rates for 2024.

How to Use the Kanpur Property Tax App in 2024?

Kanpur Municipal Corporation may have a dedicated property tax app for easy tax payments and other services. Here’s how to use it:

- Download the App: There is the Kanpur property tax app which you need to download from Google Play Store or App Store respectively.

- Register or Log In: Choose the registration method using your phone number or e-mail or visit the site with the help of existing credentials.

- Enter Property Details: Enter your 11-digit property identification number (PIN) to get information about property taxes.

- Check Dues and Make Payments: View your outstanding property tax and pay on this portal via credit card or internet banking/UPI.

- Download Receipts: After the payment, you can get the receipt instantly on your mobile device if it is done in this application.

- Track Status: Through the app, you can check your payment status or apply for services like property tax transfer or mutation among other services.

This app helps in the easy payment of property taxes in 2024 and organizing property-related records.

What are the Exemptions and Concessions on Kanpur Property Tax?

Now the Kanpur Municipal Corporation provides some exemptions and concessions for some specific categories of property owners. Some of the common exemptions include:

- Senior Citizens: There may be tax exemptions for the elderly; for example property tax.

- Female Owners: Tax exemptions may be given for female property owners, under which a woman may be allowed to pay less tax on her property.

- Disabled Persons: Properties owned by disabled persons may be given tax exemptions.

- Educational Institutions: Education is one of the areas where schools and other similar institutions enjoy certain tax privileges or exemptions.

- Charitable Institutions: There may be certain parts of the property that are owned by charitable institutions and will be given tax exemptions.

These exemptions and concessions are conditional and depend on certain requirements that have to be met, and some application has to be made by the property owners for this.

What are the Consequences of Non-Payment or Late Payment?

Missing the property tax deadline in Kanpur if not paid on time can turn out to be a nightmare for many property owners. The penalties include:

- Late Payment Penalty: This means that if you pay your taxes within a certain time period, a certain percentage of the total amount is added as a penalty.

- Interest Charges: They also attract interest charges that compound the amount of money for the delayed period.

- Legal Action: If all methods fail or become ineffective, Kanpur may decide to take legal action against the defaulter and in the process, the property may be seized.

Timely Payment of Property tax helps the property owner avoid incidences of additional charges from municipal authorities.

What are the Steps for Property Tax Assessment in Kanpur?

Kanpur Nagar Nigam reassesses properties at regular intervals to ensure correct tax assessment. Such assessments may be mandatory for property owners or their representatives or may require submission of required documents. It involves the following steps:

- Self-Assessment: Property owners can estimate the annual value and applicable tariff rates using a do-it-yourself tool.

- Survey: Based on the NGLS search, KNN may engage in a field survey to confirm property details, particularly the size, use, and where the property is located.

- Tax Notice: Finally, KNN writes a tax notice to the property owner informing him of the amount of tax due.

- Payment: When the notice is issued the property owner is required to pay the tax within the specified time.

What is the Property Tax Grievances and Redressal Mechanism?

Kanpur Municipal Corporation has a proper complaint registration system to deal with grievances arising out of the assessment and collection of property tax. Property owners can approach the Municipal Corporation officials if:

- The amount of tax charged by it has been wrong.

- No deduction has been made.

- We have a database of such properties that are inconsistent in some way.

The redressal process basically involves writing an application to the concerned department, then the matter is considered and settled.

What are the Reforms and Future of Property Tax in Kanpur?

One of the key areas that the Kanpur Municipal Corporation has focused its attention on is property tax reforms. These include:

- Digitization: The online payment method has been improved to increase the level of transparency as well as remove complexities.

- GIS Mapping: A new technology of Geographic Information System (GIS) mapping is also being introduced to prepare a database of properties across Kanpur.

- Revised Taxation Rates: While determining property tax, KNN periodically updates its rates on properties based on the current trends in the market and also reflects the current inflation rates.

- Property Tax Amnesty Schemes: At one point or another, KNN comes up with ‘amnesties’, where defaulters are given a chance to pay their taxes without penalty and/or interest. Such schemes are generally adopted to increase compliance with tax laws and increase the corporation’s revenue.

- Public Awareness Programmes: It is also worth noting that KNN has been promoting civic taxes to property owners to make them aware of their liabilities. These initiatives are aimed at curbing tax evasion and increasing the timely payment of fees.

What is the Contact Information of Kanpur Nagar Nigam?

Here is the contact information for Kanpur Nagar Nigam:

- Address: Kanpur Municipal Corporation, Nagar Nigam Bhavan, Moti Jheel, Kanpur, Uttar Pradesh, India.

- Phone Number: +91-512-2295656 / +91-512-2295640

- Email: kanpur.nagarnigam@gmail.com

- Official Website: kanpurnagarnigam. in

For any property tax-related queries or other municipal services, you can visit their office or contact them via phone or email.

In Conclusion

Kanpur property tax plays a vital role in the proper administration of the city and its development work. It helps in financing the works necessary for the people such as the repair of roads, collection and disposal of garbage, water supply, etc. All property owners including residential, commercial, and industrial property owners have to pay their tax dues on an annual basis.

Kanpur Municipal Corporation has adopted a policy of adopting measures to facilitate the payment system, which is both an online and offline payment system. Also, there is a provision under which senior citizens, women property owners, and charitable institutions get concessions which makes it a balanced system.

Now for the last time, we hope that you will not face any kind of complexity in reading, doing, and understanding this blog post on Kanpur Property Tax and you will also get a lot of knowledge about the information given about it, which will definitely be useful for you sometime in your future.

FAQs

1. Is property tax applicable to leased properties in Kanpur?

Yes, property tax is paid on any property irrespective of being possessed or leased out. The owner and the lessee both have to determine under which scenario is the tax being paid according to the lease agreement.

2. How is the annual rental value determined for property tax purposes in Kanpur?

This value is normally assessed by the respective municipal authorities based on the geographical location, applicable standard market rates including the potential rental value of the property. Which is not in fact the real rent, but rather an appraisal of the same.

3. Can NRIs (Non-Resident Indians) own property in Kanpur and are they required to pay property tax?

Yes, NRIs have the right to own a property in Kanpur and like every other property owner, they pay property tax to the government. That is, the process is also similar to the one description of residents: The process for them is the same as for residents above.

4. Are agricultural lands subject to property tax in Kanpur?

No, agricultural lands are exempted from the municipal property tax. However, the moment the land is used for non-agricultural uses for instance for developing houses or businesses, it attracts tax levying.

5. Is there a specific time of year when property tax rates are revised in Kanpur?

The property tax rates may be adjusted every year, mostly at the start of the financial year, which is April But this is according to the policies put in place by the municipal corporation. Rates are revised from time to time which are declared by Kanpur Nagar Nigam in the public.

6. What happens if I sell my property mid-year? Who is responsible for paying the tax?

In other cases, it has been established that property tax is the responsibility of either the buyer or the seller depending on the agreement made while selling the house. Normally, the seller is supposed to pay all the dues to the day of the sale while the buyer incurs the cost of taxes after the sale.

7. Can joint property owners share the property tax burden in Kanpur?

Yes , property tax payment can be split among joint owners, however the municipality specifies the contact name whenever one is preparing the tax statement. As far as splitting the tax is concerned, it is usually as per internal agreement.

8. Are there any incentives for early tax payments for businesses in Kanpur?

Although specific incentives for business are rare, residential owners may be given discounts for prompt payment. Still, the municipal corporation may come up with special schemes from time to time.

9. Can I transfer my property tax account if I relocate within Kanpur?

No, property tax has nothing to do with the property owner but with the property concerned. For example in Kanpur if you have shifted to another house, you have to pay tax on the previous house and pay tax again from zero on your new residence.

10. What are the steps to dispute a tax assessment for new construction in Kanpur?

Property tax in case of new construction, if one has any doubts about the first assessment, he can apply for reassessment in Kanpur Municipal Corporation. You have to submit the building plans that are relevant, the valuation of the building, and any other document that is considered relevant in the process.

Add a Comment