The New Delhi Municipal Council (NDMC) is one of the major urban local bodies that helps in the functioning of New Delhi covering some of the major areas of the capital of India.

The NDMC is involved in providing several civic services and for this it undertakes several activities out of which tax is one of the essential sources of revenue and one of them is property tax.

This blog post attempts to explain everything about NDMC property tax including the reason for its calculation, how it is calculated, properties that enjoy special privileges and deductions, how to pay online, penalties, etc.

- What is the NDMC Property Tax?

- What is the Importance of Property Tax in New Delhi?

- Which Types of Properties are Taxed in New Delhi?

- What is the NDMC Property Tax Calculation?

- What are the Benefits of NDMC Property Tax?

- Which Regions are Covered by NDMC?

- What is the NDMC Property Tax Bill Payment 2024?

- How to Pay NDMC Property Tax Payment?

- How to Pay NDMC Property Tax Using NoBroker Pay?

- What are the Benefits of Online Payment of NDMC Property Tax?

- How to Download NDMC Property Tax Receipt in 2024?

- What is the NDMC Property Tax Rate 2024?

- What is the NDMC Property Tax Rebate 2024?

- How is NDMC Property Tax Transfer Online 2024?

- What are the NDMC Property Tax Transfer Charges 2024?

- How to Use the NDMC Property Tax App in 2024?

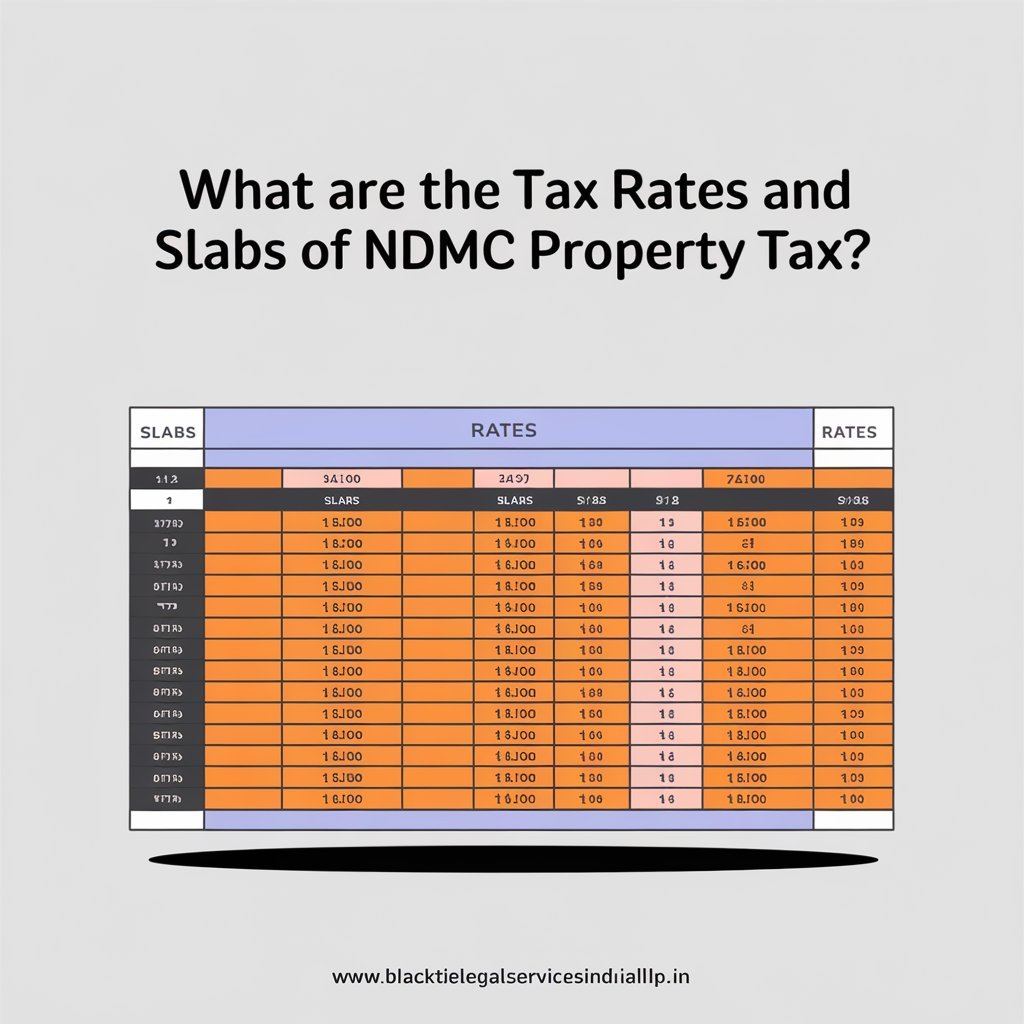

- What are the Tax Rates and Slabs of NDMC Property Tax?

- What are the Exemption and Concessions on HBMC Property Tax?

- What is the Role of GIS Mapping in NDMC Property Tax Collection?

- What is the Importance of Self-Assessment?

- What is the Dispute Resolution Mechanism?

- What is the Appeal Procedures and Legal Recourse?

- What are the Reforms and Initiatives of NDMC?

- How to Compare NDMC Property Tax with Other Municipalities?

- What is the NDMC Property Tax Registration?

- What is the NDMC Property Tax Last Due Date 2024?

- What is the NDMC Property Tax Helpline Number 2024?

- In Conclusion

- FAQs

- 1. How does NDMC notify property owners about their tax dues?

- 2. Can a tenant be held responsible for paying property tax in NDMC areas?

- 3. Is there a property tax refund process in case of overpayment?

- 4. Does NDMC offer installment options for property tax payment?

- 5. How can I update my property details if they change during the year?

- 6. Are there any tax rebates for eco-friendly or Green buildings in NDMC areas?

- 7. How long does it take for NDMC to process property tax payments?

- 8. What should I do if I misplace my property tax payment receipt?

- 9. Can I appeal the tax rate applied to my property if I believe it’s too high?

- 10. How does NDMC handle property tax for jointly-owned properties?

What is the NDMC Property Tax?

NDMC Property tax is a fee levied on real estate by a municipal corporation or local governing body. In 2004, New Delhi imposed a property tax on areas within the NDMC, where the value of property is assessed annually.

The NDMC levy is in the form of property tax for both homes and commercial buildings, while the money is used for the provision of civic amenities such as water, sewerage, roads, and public lighting.

Also, the NDMC area is different from other parts of the city of Delhi as the primary facilities of the government and diplomatic institutions are located here.

Although NDMC is relatively small in size compared to other municipal corporations, properties located here are generally more valuable, so NDMC property tax is huge as a source of revenue.

What is the Importance of Property Tax in New Delhi?

NDMC Property tax can also be described as one of the city’s most important sources of revenue. The finances of any civic body are a prerequisite for the maintenance of civic amenities, especially in a densely populated capital city like Delhi, where property tax forms a major part of it. This revenue is important for:

- Infrastructure Development: Road maintenance, maintenance of recreational areas like parks, and maintenance of drainage systems.

- Cleanliness and Waste Management: Maintaining cleanliness through proper disposal of waste by regularly putting the garbage in the dustbin.

- Public Services: Services like street lighting, water supply, and ensuring lawns and other such places are also included in civic amenities.

This is because if NDMC did not receive a proper amount of revenue from its NDMC property taxes it would not be able to offer these basic services.

Which Types of Properties are Taxed in New Delhi?

NDMC levies taxes on various kinds of properties that exist in the NDMC area. These include:

- Residential Properties: Houses, apartments, bungalows, and any other type of living homes.

- Commercial Properties: Agent houses, office complexes, shops, malls, and business centers.

- Industrial Properties: Industries including factories, warehouses, manufacturing units, etc.

- Institutional Properties: Social setting includes schools, hospitals, and all other institutions present in the society.

Residential houses are taxed based on their use, location, and size while commercial properties are also taxed based on their use and size but all are taxed differently depending on the area.

What is the NDMC Property Tax Calculation?

NDMC Property Tax Calculation is done using the Capital Value System (CVS). The ultimate advantage of CVS is that it assesses tax based on the market value of the property, while in Unit Area System (UAS), it assesses tax based on the size of the property.

Capital Value System (CVS)

Under the CVS, NDMC property tax is determined based on the capital value of the property, which is calculated using the following formula:

Capital Value=Built-up Area×Base Rate per sq. meter×Age Factor×Use Factor×Structure Factor

Each of these components is discussed below:

Built-up area: All built-up spaces, walls, balconies, and roof of the property.

- Base rate per square meter: There are several standard rates that apply at different rates depending on the nature and location of the property falling under the jurisdiction of the NDMC.

- Age factor: Since depreciation is generally associated with older buildings, the tax rates on these properties are lower.

- Usage factor: In most cases, commercial and industrial properties are taxed more than residential properties.

- Structure factor: Buildings that are newer or have more amenities installed may attract higher taxes.

Important Factors Affecting Tax Calculation

- Location: Increased base rates are often prescribed for properties located in prestigious areas such as Connaught Place, and not for areas that are not well developed.

- Type of property use: Commercial premises, especially retail businesses, are taxed more than the residential portion.

- Age of the property: Common area maintenance is another hit to income due to tax, but this applies only to older properties, where there is some tax relief due to depreciation.

What are the Benefits of NDMC Property Tax?

New Delhi Municipal Council (NDMC) property tax has several benefits for property owners living in the NDMC area. Here are some of the key benefits:

Civic Amenities Maintenance: NDMC uses the collected property tax to develop and maintain properties owned by it for civic amenities in the city such as roads, street lights, parks, drainage systems, and sanitation services. This helps ensure that the environment where residents live is well maintained.

Online Payment Convenience: For instance, property owners under NDMC can easily pay property tax online and this will save time. An obvious benefit is the possibility to make online payments, view tax bills, and view transaction history.

Rebates and Discounts: Some of the discounts offered by NDMC are different discounts and concessions for property tax. For instance:

- Early payment discount: The government offers a discount of 15% on NDMC property tax to individuals who pay taxes before a specified date.

- Senior Citizen and Women Discounts: People in this group are usually provided with additional discounts, which reduce their taxes, for example, female property owners and senior citizens.

Transparency and Accountability: Another benefit evident from the case of NDMC is that the online portal through which NDMC property tax is handled is accountable and traceable. Information such as tax assessment, dues, and receipts of a particular property is always with the owner, reducing the chances of disputes.

Support for Public Services: This tax is used to secure essential public utilities including healthcare, education, and even garbage collection. This helps the society and thus the quality of life will increase due to improved income levels among the people.

Facilitates Urban Development: Property tax is one of the main sources of NDMC’s own revenue, as well as it contributes to urban development works such as improving infrastructure, development of public utilities, security features, and other such developments, which make the lives of residents better.

Encourages Regular Compliance: By offering discounts in cases where property owners pay earlier than expected or on time, NDMC ensures that property owners always remain legally compliant. This way there is a constant source of revenue that will enable sustainable funding and improvement of these facilities.

Legal Protection for Compliant Property Owners: property owners Paying NDMC property taxes on a regular basis gives property owners legal immunity from penalties, interest charges on unpaid amounts, and legal suits by the municipal authority.

Which Regions are Covered by NDMC?

NDMC covers a specific region in the heart of New Delhi, known for its high-profile areas and government buildings. The regions covered by NDMC include:

- Connaught Place

- Chanakyapuri

- Lodhi Garden

- Rajpath Marg

- Sansad Marg

- Moti Bagh

- Sarojini Nagar

- Golf Links

- New Moti Bagh

- Sardar Patel Marg

- Diplomatic Enclave

These areas include key government offices, residential areas, commercial spaces, and diplomatic missions.

What is the NDMC Property Tax Bill Payment 2024?

NDMC property tax for 2024 can be paid online as well as offline mode. NDMC sends property tax bills every year and these are due by a certain date and any default attracts a penalty.

The tax amount is calculated as per the annual value (AV) of the property, taking into account its use, location, and size.

How to Pay NDMC Property Tax Payment?

Paying NDMC property tax payments for the year 2024 can be done through both online and offline methods. Below are the detailed steps for each option:

NDMC Property Tax Online Payment

To make the payment online, follow these steps:

Step 1: Go to the NDMC Website

- Go to the official NDMC website: http://www. ndmc. Gov. In.

Step 2: Go to the Property Tax Section

- First, access the homepage of the respective state, click on the ‘Online Services’ link, and go to the ‘Property Tax’ tab.

Step 3: Login/Register

- If you are already a registered property, enter your property ID and password to log in.

- For those who are new, they just need to create an account by providing basic information like property ID, property name, and owner details.

Step 4: Enter the Property Details

- After login, other fields like property ID or other basic details of your property are still to be input so that you can get your NDMC property tax information.

Step 5 Verification and Payment Confirmation

- The remaining balance and any costs that there are should be displayed after the property details are put out.

- On the right side of the pop-up, click on the “Pay Now” button.

Step 6: Choose Payment Method

- Choose from any other mode of online payment like credit card/debit card/net banking/UPI or digital wallet.

- Go to the end of the transaction and make sure to keep the receipts as proof.

NDMC Property Tax Offline Payment

If you prefer to pay NDMC property tax offline, follow these steps:

Step 1: Visit the NDMC Office

- The next thing to do is to visit the nearest NDMC zonal office or head office.

Step 2: Fill Out the Property Tax Form

- Go to the counter and collect the property tax challan/form.

- Write the property ID as well as the amount due on your property on the form.

Step 3: Submit the Form

- Submit the duly filled form along with all the required documents at the property tax payment counter.

Step 4: Make the Payment

- It is equally possible to make the payment via cash, cheque, or demand draft in favor of NDMC.

- Make sure you get the payment receipt once the process is successfully completed.

How to Pay NDMC Property Tax Using NoBroker Pay?

To pay NDMC property tax using NoBroker Pay: Visit the NoBroker website or app: Visit the NoBroker website and log in to your account.

- Select Property Tax Payment Option: Now that you are logged in to the MSBE website, you need to click on ‘Property Tax’.

- Select NDMC as your Municipal Corporation: Please, fill in the Property ID field and select NDMC in the Municipality drop-down list.

- Enter Property Details: Confirm your property details and collect the remaining tax amount.

- Complete Payment: Choose a payment option that is convenient and proceed to make the payment.

- Get Confirmation: NoBroker will send a confirmation about the payment made by the user(s) through their email ID and mobile number.

What are the Benefits of Online Payment of NDMC Property Tax?

- Convenience: All payments should be flexible; payments should be made either from a computer or via telephone.

- Safe and fast: Secure transactions that are effective immediately.

- Discounts and concessions: This can also lead to discounts or the opportunity to get a discount early on online payments.

- Easy record management: It is easy to document receipts as digital data and payment records.

- Avoid penalties: It saves costs incurred from penalties for late payment of bills.

How to Download NDMC Property Tax Receipt in 2024?

To download the NDMC property tax receipt:

- Visit the NDMC Website: Type: www. ndmc. Gov. in.

- Access the ‘Property Tax’ Section: Select the service known as ‘Property Tax’ from the ‘Online Services’ list.

- Enter Details: Give your Property ID number or any other details asked by the software.

- View Payment History: Review payment details and make your choice to download the given receipt.

- Download Receipt: After that, click the download button and then save the receipt on the device.

What is the NDMC Property Tax Rate 2024?

The NDMC property tax rates vary depending on the type and use of the property:

- Residential properties: There are different rates depending on the size and location.

- Commercial properties: Higher tariff than residential premises.

- Vacant land and mixed-use properties: As for specific rates, it can be defined that these are special rates that are set individually for a specific type of service, operation, or product.

NDMC property tax rates for 2024 are available on the official website of NDMC or any NDMC notice released in the official public domain.

What is the NDMC Property Tax Rebate 2024?

NDMC offers discounts on property tax for making early payments or for certain categories of taxpayers, such as:

- Discount for early payment: A percentage that is returned to the customer on full payment made before a certain time period.

- Discounts for women, senior citizens, or persons with disabilities: Special concessions may be available, for example.

This means that instead of investing in these vehicles, specific discounts for 2024 can be checked from the NDMC website.

How is NDMC Property Tax Transfer Online 2024?

To transfer NDMC property tax records online in case of sale or transfer of property:

- Visit the NDMC website: Now proceed to find the ‘Property Tax’ section of the website.

- Fill out the online transfer application form: It should also contain all the required information about the new owner and the property.

- Upload required documents: Scanned copies of certain documents like sale deed, NOC, identity proof, and previous year’s tax receipt.

- Submit and wait for verification: Fill out the form and wait for verification of the form by NDMC officials.

- Confirmation of transfer: On verification, NDMC will update the records and issue a confirmation in the form of acknowledgment.

What are the NDMC Property Tax Transfer Charges 2024?

There may be transfer charges in the case of transfer of property tax records. These charges differ with the type of the property as well as the transfer value of the property. Please visit the NDMC website for more elaborate information about the transfer charges for the year 2024.

How to Use the NDMC Property Tax App in 2024?

NDMC provides a mobile app for easy property tax management:

- Download the NDMC app: For Android devices only, this app is downloadable on the Google Play Store; for Apple devices, it can be downloaded on the Apple App Store.

- Log in or Register: Sign up for an account or sign in on a social network.

- Access Property Tax Services: There is no charge to use this site, but you will have to access the ‘Property Tax’ tab to find property tax dues, payment details, receipts, or transfer details.

- Use the Payment Gateway: Finalise the transaction in a very secure manner using the app.

What are the Tax Rates and Slabs of NDMC Property Tax?

Here is a simplified table showing the typical tax rates and slabs for NDMC (New Delhi Municipal Council) property tax. Please note that these rates can vary based on property type, location, and specific regulations in effect for 2024. For the most accurate and updated information, always refer to the NDMC official website or notifications.

NDMC Property Tax Rates and Slabs (2024)

| Property Type | Annual Value (AV) Slab | Tax Rate |

|---|---|---|

| Residential Property | Up to ₹10 lakh | 7% of AV |

| ₹10 lakh to ₹20 lakh | 10% of AV | |

| ₹20 lakh to ₹50 lakh | 12% of AV | |

| Above ₹50 lakh | 15% of AV | |

| Commercial Property | Up to ₹10 lakh | 12% of AV |

| ₹10 lakh to ₹20 lakh | 15% of AV | |

| ₹20 lakh to ₹50 lakh | 18% of AV | |

| Above ₹50 lakh | 20% of AV | |

| Vacant Land | Up to ₹10 lakh | 10% of AV |

| ₹10 lakh to ₹20 lakh | 12% of AV | |

| ₹20 lakh to ₹50 lakh | 15% of AV | |

| Above ₹50 lakh | 18% of AV | |

| Mixed-Use Property | Varies based on usage | 10% to 15% of AV |

What are the Exemption and Concessions on HBMC Property Tax?

NDMC property tax is not applicable to all properties. Basically, some properties are allowed to have favorable tax treatment due to the use or the owner class.

Properties Exempted from Tax

- Government Buildings: Most of the buildings and other forms of properties owned by the central government do not pay the property tax.

- Religious Institutions: Shrine, worship place of Muslims and Christians, and other related places of worship.

- Charitable Institutions: Houses that are used for charity purposes like homes for orphans, the aged, the disabled, etc.

Concessions for Senior Citizens and Women

- Property owners specifically the elderly or the seniors may be allowed to have a concession on property tax that may be up to 30%.

- Women property owners may also be given rebates depending on the circumstances of the property such as if they are the sole owners of the said property.

What is the Role of GIS Mapping in NDMC Property Tax Collection?

This latest innovation is one of the latest developments adopted by NDMC for its tax collection system and involves GIS mapping. Since the properties are located on the map, it is easier for NDMC to compile the collected data as well as eliminate cases of tax evasion. This system can be used to identify properties that are unregistered and not paying the right amount of tax.

What is the Importance of Self-Assessment?

There is a self-assessment scheme under which property owners are advised to calculate their taxes through NDMC. By implementing this system, one becomes more transparent and property owners also get to know how much tax they have to pay.

Citizens of India especially property owners benefited through the NDMC online portal as it allows them to calculate and check their taxes based on the property details and see if their liabilities are correct or not.

What is the Dispute Resolution Mechanism?

In case of complaints on matters related to property tax assessment, NDMC has a mechanism to resolve the complaints. People whose property tax assessment is considered unfair or incorrect can complain on the official website of the NDMC organization or they can meet the tax authority.

NDMC also has a dispute resolution cell that works with the intention of resolving such issues through dialogue without taking legal action.

What is the Appeal Procedures and Legal Recourse?

If the issue is not resolved there is the possibility of an appeal to the Municipal Property Tax Tribunal. The above tribunal has been set up to deal with cases in which property owners think they have been over-taxed.

In extreme cases, legal action can also be taken in the Delhi High Court, this option is also provided. Yet this can only be used as a last resort when all stages of conflict resolution have been completed.

What are the Reforms and Initiatives of NDMC?

NDMC has introduced several reforms aimed at making the property tax system more efficient and taxpayer-friendly.

Digitalization of Property Tax

The digitalization of the property tax system has been one of the biggest reforms. The NDMC website allows property owners to:

- Access their tax history

- File and pay property taxes online

- Track payments and receive notifications

Citizen-Friendly Initiatives

NDMC has introduced help desks and kiosks across the city to assist taxpayers, especially senior citizens, with their tax-related queries. These initiatives have been widely appreciated and have improved the overall efficiency of tax collection.

How to Compare NDMC Property Tax with Other Municipalities?

To present a clear picture of the NDMC property tax, it would be pertinent to look at other property tax systems that exist in municipalities. The methodology for assessing the tax is chosen differently by different urban local bodies, including the NDMC, which uses the Capital Value System (CVS) to arrive at the property tax.

For instance, the MCD, which manages other areas in Delhi, uses the Unit Area System (UAS) to assess property taxes. In the cost model of UAS, the area-based tariff is also used in which properties are classified based on zone category and location, and the tariff is fixed per unit area such as per square meter, etc.

This system may seem easy, however, sometimes it provides an exaggerated estimate of the property and hence has a bias against the actual market value as compared to the CVS applied by the NDMC.

This method is also used by the Brihanmumbai Municipal Corporation (BMC) in Mumbai, where the rates and factors differ from the NDMC, but it follows the capital value system.

While assessing property taxes between NDMC and BMC, it is observed that property tax rates in BMC are comparatively higher than NDMC due to the higher market value of properties in Mumbai.

What is the NDMC Property Tax Registration?

To register for New Delhi Municipal Corporation property tax, one must first register the property in the NDMC tax system so that taxpayers can receive or pay tax and the property can also be recorded. Here is how to complete the registration process:

Online Registration

Visit the NDMC website: Open the home page of the official NDMC website www.ndmc.gov.in.

Go to the ‘Property Tax’ section: Look for ‘Online Services’ or a similar tab on the website and then select ‘Property Tax’.

Select ‘New Registration’: If you are not registered yet, select New Property Registration if you have another property you want to register. It may be labeled as ‘Register Property’ or ‘New Tax Registration’.

Fill out the registration form: The specific information that must be provided includes:

- Property ID (if available)

- Owner’s name

- Property address

- Use of the property (residential, commercial, etc.)

- The total annual income that can be earned from such property

- Contact information

Upload required documents: You may need to attach certain documents, including:

- Title deed/sale deed to prove ownership of the property.

- You will have to establish identity (e.g. Aadhaar card, PAN card).

- Utility bill or any other proof for address – Rent agreement.

- Previous tax income (if any)

Submit the form: After completing the details and uploading other documents, the registration form should be duly submitted and processed.

Get confirmation: The registration data of NDMC will be duly registered and you will be notified by a new property ID or reference number. It may also be relevant to keep this information for future purposes.

Offline Registration

Visit NDMC Office: Visit the nearest NDMC office or property tax office located in Delhi, India.

Get Registration Form: Visit the office to get the property tax registration form.

Fill out the Form: This form is to be filled out as per the information about the property requiring service and the person availing the service.

Submit Required Documents: Attach the duly filled form along with the following documents:

- Proof of Ownership

- Proof of Identity and Address

- Previous Tax Receipts

Get Registration Details: The management officer of NDMC will process your registration. At the last step of registration, you will get your Property ID or Reference Number.

Verify Registration: Check whether your property account has been registered properly and all the information provided is correct.

What is the NDMC Property Tax Last Due Date 2024?

NDMC property tax payment deadlines are usually provided annually, although a deadline set for March was definitely provided. For 2024, the possible deadlines are:

- First installment: 30 June 2024

- Second installment: 31 December 2024

The specific dates should be checked through the official NDMC website or notifications so that you do not have to pay a penalty.

What is the NDMC Property Tax Helpline Number 2024?

For any queries or assistance regarding NDMC property tax:

- NDMC Property Tax Helpline Number: [Contact Number provided on NDMC official website]

- Customer Service Email: [Customer support email provided on NDMC official website]

You can contact the helpline for any assistance related to property tax payments, transfers, rates, rebates, or other related services.

In Conclusion

The NDMC property tax is a vital tool in the financial framework of the administration and plays a vital role in the improvement and provision of New Delhi property infrastructure.

Whether you are a homeowner living in a residential apartment in one of the many NDMC localities or a commercial property manager in Connaught Place, knowing how property tax is calculated, collected, and used positively impacts you as a property owner.

The Capital Value System adopted by NDMC ensures that taxes are reflective of property market trends, while exemptions and concessions offer relief to specific categories of property owners, such as senior citizens, women, and charitable institutions.

The availability of online and offline payment options provides convenience to the taxpayers, making the system more accessible and user-friendly.

FAQs

1. How does NDMC notify property owners about their tax dues?

Usually, in any financial year, NDMC initiates tax notices to the property owners during the start of the financial year. Still, those involved in property ownership are advised to visit the official NDMC website to learn more and make their payments on time.

2. Can a tenant be held responsible for paying property tax in NDMC areas?

Property tax is tenancy’s legal duty to pay and this basically falls on the owner of the property unless it has been agreed otherwise by the tenant. Prospective tenants should seek to understand how much responsibility rests on them through understanding their agreements with the landlord.

3. Is there a property tax refund process in case of overpayment?

Indeed, the practice indicates that if a property owner has overpaid, NDMC also has a method of repaying. The owner has to download an application together with the documents to prove the cases of overpayment, and then the refund will be issued.

4. Does NDMC offer installment options for property tax payment?

Yes, NDMC offers the flexibility of installment payments when it comes to property taxes. Some of them include the following; Property owners can visit the official website of NDMC to get more information concerning the minutes or they can visit the NDMC offices to get more information regarding the NDMC installment plans.

5. How can I update my property details if they change during the year?

For any alteration in the property characteristics including ownership status built-up area or usage category the owner thereof is required to notify NDMC of a change of any of these parameters. This can either be accomplished online through the NDMC website or physically at NDMC with the necessary documents.

6. Are there any tax rebates for eco-friendly or Green buildings in NDMC areas?

A few municipalities provide incentives in the form of rebates for properties using green building standards. Concerning the possibilities of incentives for residents promoting green buildings, locals in the NDMC areas can check with NDMC directly to know their stand on the same.

7. How long does it take for NDMC to process property tax payments?

Usually, transactions in online payment take a few days but could take a maximum of 24 to 48 hours. Online payments may be slower than online payments since the type of payment used will determine the length of time that will be taken, along with traffic at NDMC’s office.

8. What should I do if I misplace my property tax payment receipt?

If you misplace your property tax payment receipt the receipt can be obtained from the NDMC account section of the website. In addition, you can personally go to the NDMC office in order to ask for the issuance of a duplicate receipt.

9. Can I appeal the tax rate applied to my property if I believe it’s too high?

Yes, any property owner who will be complaining that he or she is being charged higher property tax than what is expected could justify his or her case by filing a formal appeal to NDMC. That is why such evidence as a property valuation report is often attached to the appeal.

10. How does NDMC handle property tax for jointly-owned properties?

In case the property is owned by two or more people tax is recovered in proportion to the share of each person. He or she will pay his or her proportion of the property tax and as to the other terms of the payment the owners can deliberate about them.

Add a Comment