PCMC Property Tax is levied by the Pimpri-Chinchwad Municipal Corporation on property owners based on the value and usage of the property. The condition includes better infrastructure, general health and well-being. Property tax is calculated using the property’s caste, size and condition. To administer your tax, use the PCMC property tax portal or PCMC mobile app to view, pay and download bills and receipts. Redemptions are usually payable by May 31; there is a penalty of 2% per month for late redemptions. For a name change, submit the required documents to the PCMC office. Service User Charge (SUC) covers municipal services.

- What is PCMC Property Tax?

- What are the Benefits of PCMC Property Tax?

- How to Calculate PCMC Property Tax?

- The PCMC Property Tax Calculator?

- PCMC Property Tax Pay?

- How To Pay PCMC Property Tax Online Payment?

- PCMC Property Tax Bill View?

- PCMC Property Tax Receipt?

- What is the Due Date of PCMC Property Tax?

- What are the Late Payment Penalties of PCMC Property Tax?

- PCMC Property Tax Name Change?

- PCMC Property Tax Search by Name?

- What is Age Factor in Property Tax?

- What is SUC in Property Tax?

- PCMC Property Tax App?

- Conclusion

- FAQ’s

- 1. What is PCMC property tax?

- 2. What are the benefits of paying PCMC property tax?

- 3. How can I pay PCMC property tax online?

- 4. What is the due date of PCMC property tax?

- 5. What is the penalty for late payment?

- 6. How can I change the name in my PCMC property tax records?

- 7. How can I check my PCMC property tax bill online?

- 8. How can I get the PCMC property tax receipt?

- 9. What is SUC in property tax?

- 10 Is there a PCMC Property Tax mobile app?

What is PCMC Property Tax?

PCMC property tax refers to property tax levied by the Pimpri-Chinchwad Municipal Corporation (PCMC), which governs the municipal corporation of Pimpri and Chinchwad in Maharashtra, India. Property owners in the PCMC area must pay the tax annually on the principal of their property’s value.

What are the Benefits of PCMC Property Tax?

PCMC property tax offers various benefits to both the taxpayers and the society as a whole. Here are some details of its main benefits

1. Civic Infrastructure Development

- The money collected from property tax is needed to develop and maintain roads, bridges, water supply systems and other existing infrastructure in the Pimpri-Chinchwad area.

- This ensures better connectivity, security and overall improvement in quality of life.

2. Public Services

- PCMC utilizes property tax revenue to finance essential services such as water supply, waste management and street lighting.

- These services enhance the quality of life by ensuring cleanliness, hygiene and hassle-free maintenance of daily utilities.

3. Healthcare and Education

- The income earned from property tax plays a role in maintaining renowned hospitals and schools within PCMC limits.

- This ensures access to better healthcare and education for residents.

4. Parks and Recreational Facilities

- This ensures access to better healthcare and education for residents.

- These facilities promote community engagement, physical activity, and a healthy environment.

5. Law and Order: This money supports local law enforcement agencies, ensuring general safety, burden control and crime prevention.

6. Rebates and Concessions: PCMC details discounts and concessions on property tax on timely payment. Apart from this, higher civil and female property owners may be eligible for additional concessions.

7. Urban Planning and Development: Property tax income is utilized for urban employment and new projects to transform the city into an innovative and sustainable urban state.

8. Legal compliance and ownership rights: Timely property tax payment makes the legal permission unambiguous and strengthens the title claims. In any property dispute, a normal tax payment record acts as a check of title.

How to Calculate PCMC Property Tax?

The following significant factors are considered to calculate PCMC property tax:

1. Annual Rateable Value (ARV): This is the price at which the property is reasonably expected to be let. It is based on the location, size, use and type (residential, commercial or industrial) of the property.

2. Property Tax Formula: PCMC generally follows this basic formula to calculate property tax:

Property Tax = Base Value × Built up Area × Age Factor × Type of Building × Usage Factor

- Base value: Market value or standard rate PCMC sets for the area.

- Built-up area: Total area of the property, including walls and spaces.

- Age factor: Adjustment based on the age of the building; older buildings may get lower rates.

- Type of building: Whether it is residential, commercial or industrial.

- Use factor: Additional factor for commercial or special-use buildings.

3. Online Property Tax Calculator: PCMC provides an online calculator where property owners can enter relevant details such as property type, zoning and utility to get the tax amount. This simplifies the process and ensures accurate calculation.

4. Applicable Discounts: Discounts for timely liquidators, senior citizens and female property owners apply to the liquidation amount.

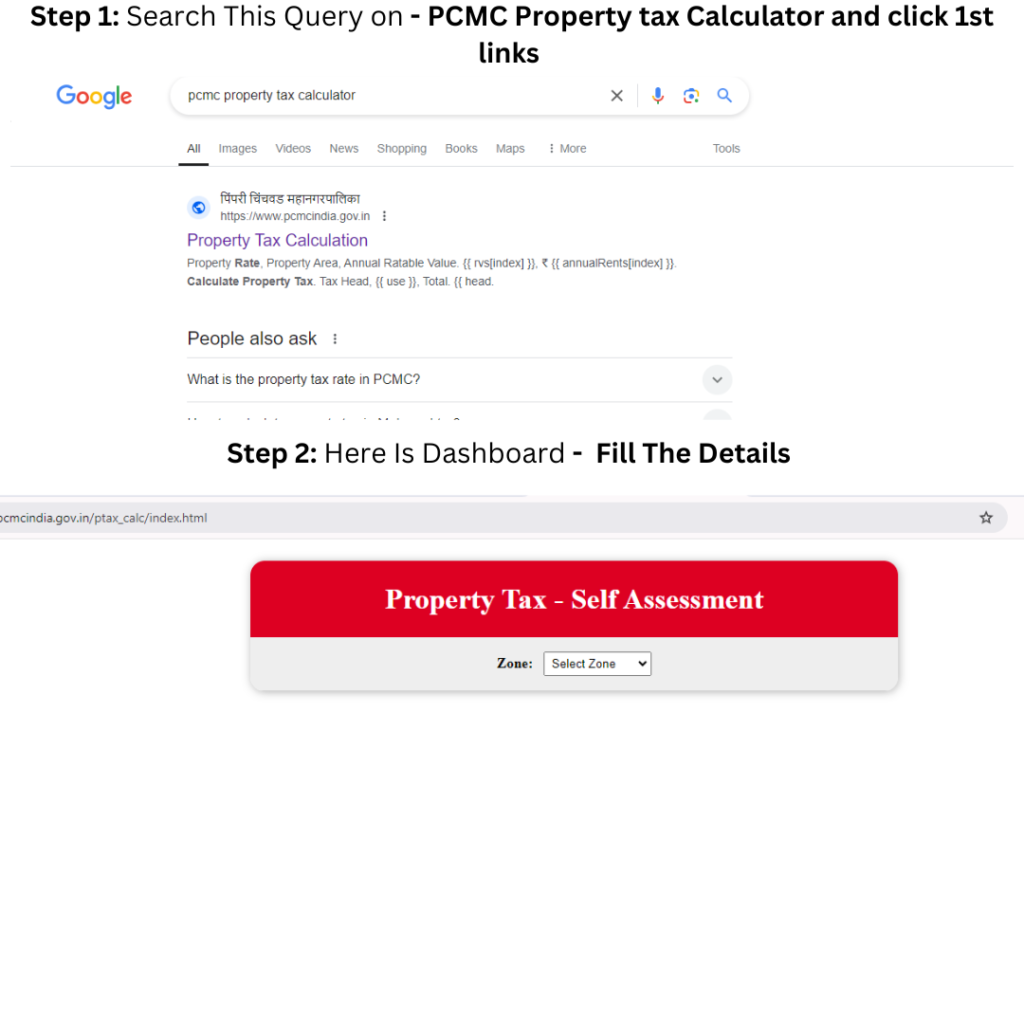

The PCMC Property Tax Calculator?

To calculate your PCMC property tax, you can use the authorized PCMC online property tax calculator provided by the Pimpri-Chinchwad Municipal Corporation. Here’s how to access and use it:

Steps to use the PCMC property tax calculator:

Step 1: Visit the PCMC Property Tax Portal: Open the official website: PCMC Property Tax Portal

Step 2: Find the Property Tax section: Look for the “Property Tax Calculator” or “Tax Payment” option on the homepage.

Step 3: Enter property details:

Fill in details such as:

- Property Area/Zone.

- Property Type (residential, commercial, industrial).

- Built-up Area.

- Property Use (self-use, rented, etc.).

- Age of the Building.

Step 4: Calculate: After entering all the required information, the system will generate the estimated property tax amount for your property.

Step 5: Payment Options: You can pay the tax directly through the portal using online payment methods like net banking, credit/debit cards or UPI.

PCMC Property Tax Pay?

Step 1: Visit the PCMC Property Tax Portal: Visit the official website: PCMC Property Tax Portal.

Step 2: Login or Search Property: You can either log in using your credentials (if you have an account) or search for your property using your property ID, owner name, or survey number.

Step 3: Verify details: After searching, verify your property details and the outstanding tax amount.

Step 4: Select payment option: Choose the amount you want to pay (total or partial payment, if allowed).

Step 5: Make Payment: Select the payment method like Net Banking, Credit/Debit Card, UPI or E-Wallet.

Step 6: Download Receipt: After successful payment, you can download and print the receipt for your records.

Offline Payment Option:

If you want to pay offline, visit the PCMC ward office or authorized banks and pay at the property tax counter.

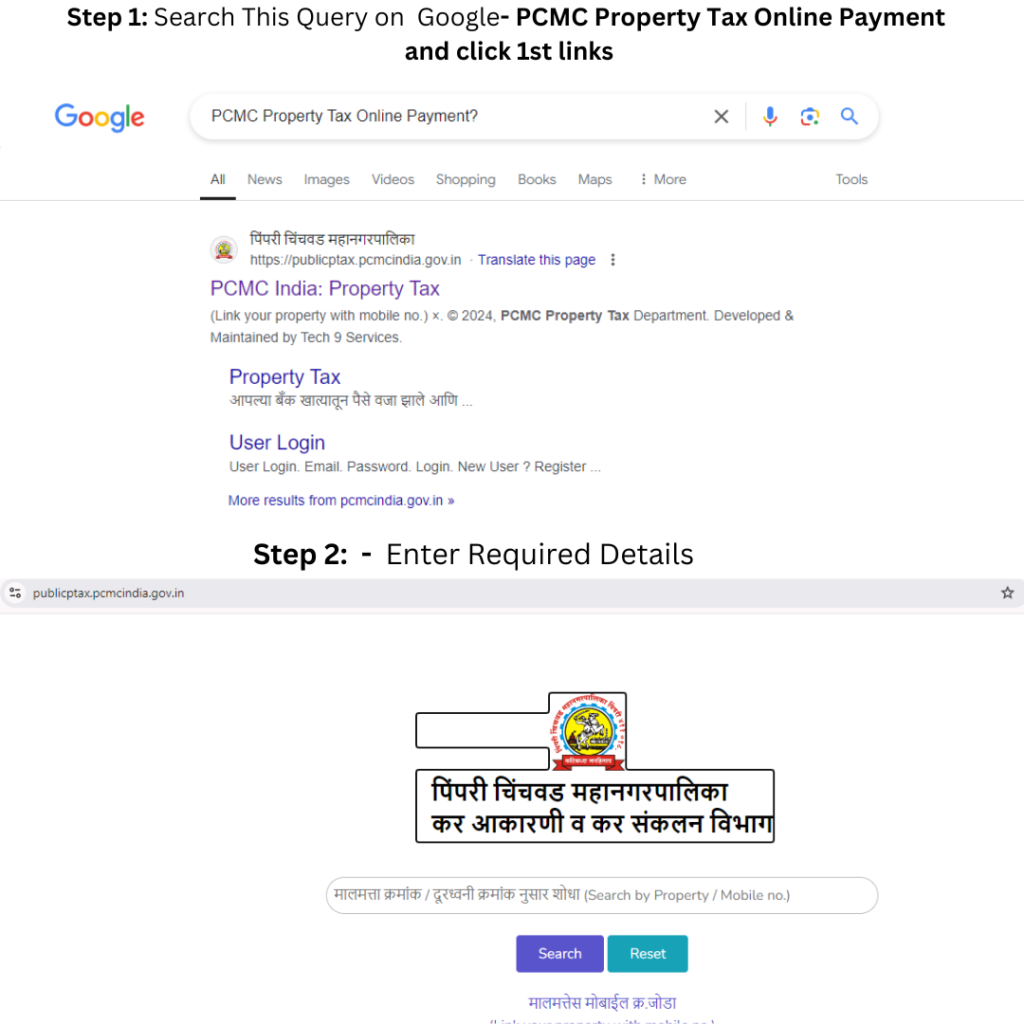

How To Pay PCMC Property Tax Online Payment?

To pay PCMC property tax online, follow these simple steps:

Step 1: Visit the official PCMC website: Visit the PCMC property tax portal.

Step 2: Find your property:

- On the homepage, you will see the option “Find your property”.

- Enter your property ID, owner name or plot number to locate your property.

Step 3: Verify Property Clarification: Once your property clarification is displayed, verify the information such as owner name, property address and balance tax.

Step 4: View the remaining tax: The portal will show all the tax due. It may also show any discounts or penalties for late settlement, if applicable.

Step 5: Choose the payment preference: Select the amount you wish to redeem (full or partial) and click “Pay Now”.

Step 6: Select the payment method:

- Choose from the available payment options like Net Banking, Credit/Debit Card, UPI or E-Wallet.

- Complete the payment process by following the on-screen instructions.

Step 7: Receive payment confirmation: After completing the transaction, you will receive a payment notification and a digital receipt. Make sure to download and print the receipt for future reference.

Step 8: Check Payment Status: You can check the status of your payment in the “Repayment History” section of the portal.

PCMC Property Tax Bill View?

To view your PCMC property tax bill online:

Step 1: Visit the PCMC property tax portal.

Step 2: Search for your property using the property ID, owner name or survey number.

Step 3: View your outstanding tax and bill details.

Step 4: Download or print the bill for your records.

PCMC Property Tax Receipt?

To get your PCMC property tax receipt online, follow these steps:

Step 1: Go to PCMC property tax portal: Visit the PCMC property tax portal.

Step 2: Search your Property: Enter your Property ID, Owner Name or Survey Number to find your property.

Step 3: Check Payment History: Go to the Payment History section, where you can view your past payments.

Step 4: Download the receipt:

- Find the relevant payment, and click the “Download Receipt” option.

- Save or print the receipt for your records.

What is the Due Date of PCMC Property Tax?

The due date of PCMC property tax is usually 31st May of each year. If you pay the dues before or on this date, you can avail of the exemptions and facilities offered by Pimpri-Chinchwad Municipal Corporation (PCMC) for payment. If there is a delay in payment, a penalty or interest may be levied on the outstanding amount to avoide due date and pay property tax on time Contact our Expert Legal Adviser.

What are the Late Payment Penalties of PCMC Property Tax?

The following penalties are usually applicable for late payment of PCMC property tax:

1. Penalty Rate: A half penalty of 2% per month is charged on the outstanding amount for every month of delay.

2. Interest on arrears: In addition to the penalty, interest may also be levied on the unpaid dues, increasing the total amount payable further.

To avoid these penalties, it is necessary to pay the tax on or before the due date, which is usually May 31st of every year.

PCMC Property Tax Name Change?

To change the name on your PCMC property tax records, follow these steps:

Step 1: Visit PCMC Office: Visit the adjacent PCMC ward office or Property Tax Ministry for the name variation form.

Step 2: Submit required documents:

You need to provide the following documents:

- Proof of identity (Aadhaar card, passport, etc.).

- Proof of property ownership (sale deed, property registration document).

- Proof of name change (marriage certificate, court order, etc.).

- Current property tax receipt (if applicable).

Step 3: Fill out the application form: Fill out the name change application form with accurate details.

Step 4: Submit the form: Submit the filled form and documents to the PCMC office.

Step 5: Verification and update: The PCMC office will verify your documents and process the name change. You will be notified when the update is complete.

PCMC Property Tax Search by Name?

To find PCMC property tax details by name, follow these steps:

Step 1: Go to the PCMC property tax Website: Visit the PCMC property tax portal.

Step 2: Access the search function: Look for the “Search Property” or “Search Property Tax” option on the homepage.

Step 3: Select Search by Name: Choose the option to search by owner name.

Step 4: Enter details: Enter the owner’s name and all other required information, like property ID or document number (if available).

Step 5: View Result: The portal will display the search result containing the property details and outstanding tax details associated with the given name.

What is Age Factor in Property Tax?

Age status in property tax calculations determines the condition of a building or property. This usually affects the rateable value (RV) and, consequently, the property tax amount. Here’s how it usually works:

1. Depreciation: Old buildings may be subject to depreciation charges, which reduces their rateable value. This is because old property may lose value due to wear and tear.

2. Tax reduction: The condition of an old building can lead to a decrease in property tax. For example, a property several decades old can be taxed less than a newly constructed property.

3. Calculation: The exact result of age assessment varies from municipality to municipality. Generally, it is calculated as a percentage reduction in the introductory rate or rateable value, depending on the property’s condition.

4. Updating records: It is essential to ensure that the age of the building is correctly reflected in the property records so that the correct condition status can be applied.

What is SUC in Property Tax?

SUC in the context of property tax stands for “Service User Fee”. It is an additional fee levied on municipal authorities for unusual services rendered to the property.

1. Objective: SUC covers the value of water supply, sewage treatment, waste management and other municipal services.

2. Calculation: It is usually calculated based on the property type (residential, commercial, industrial) and size.

3. Billing: SUC is included in the overall property tax bill and should be paid along with the property tax.

4. Variations: The rate and applicability of SUC may vary by municipality and are defined by local regulations.

PCMC Property Tax App?

PCMC has launched a mobile app to make property tax administration more manageable. Here is how you can use it:

1. Download the App: Search for the “PCMC Property Tax” app on the Google Play Store or Apple App Store and download it.

2. Register or Login: Open the app and register as a new user, or log in with your existing credentials.

3. Access to Property Tax Services: Use the app to view your property tax bill, explore balance amounts, make payments and download receipts.

4. Additional Features: The app may also have features like looking up asset clarifications, tracking redemption history, and earning notifications about payable dates and updates.

Conclusion

PCMC property tax involves knowing the ins and outs of tax accounting, payment choices, penalties for late payment, and utilizing available resources like online calculators and mobile apps. By keeping track of payment dates, penalties and name changes or viewing bill progress, property owners can ensure timely and accurate tax payments. Using resources like the PCMC Property Tax Portal and mobile app can simplify the management of your property tax, providing easy access to correction choices, bill clarifications and receipts. Staying proactive and informed helps maintain permits and avoid unnecessary penalties, thereby contributing to the smooth functioning of municipal services in the Pimpri-Chinchwad area.

FAQ’s

1. What is PCMC property tax?

Answer. PCMC property tax is a tax levied by the Pimpri-Chinchwad Municipal Corporation on property owners based on the value and usage of their property.

2. What are the benefits of paying PCMC property tax?

Answer. The benefits include better infrastructure, modern services, health care and wellness amenities, parks, discounts for timely payment and legal permissions.

3. How can I pay PCMC property tax online?

Answer. Visit the PCMC property tax portal, search for your property, select the payment preference and make the payment using methods like net banking, credit/debit cards or UPI.

4. What is the due date of PCMC property tax?

Answer. The usual due date is May 31 every year.

5. What is the penalty for late payment?

Answer. A penalty of 2% per month is charged on the outstanding amount, along with interest on the balance.

6. How can I change the name in my PCMC property tax records?

Answer. Visit the PCMC office, submit the required documents and name change application form, and expect verification and updates.

7. How can I check my PCMC property tax bill online?

Answer. Visit the PCMC property tax portal, search for your property and view or download your bill.

8. How can I get the PCMC property tax receipt?

Answer. After clearing online, download or print the receipt from the payment support form or check the payment history section on the portal.

9. What is SUC in property tax?

Answer. SUC stands for Service User Charge, which covers the cost of municipal services such as water supply, sewage treatment and, waste management.

10 Is there a PCMC Property Tax mobile app?

Answer. Yes, the PCMC Property Tax app is available for download on the Google Play Store and Apple App Store, allowing you to view bills, make payments and manage property tax services with ease.

Add a Comment