The Role of Taxation in India You all know very well that it is one of the most important sources supporting the financial system of the country, which fulfills the government expenditures for its functioning, development of public utilities and social causes.

Taxes in India are mainly classified into two broad categories: They are as follows Tax Classification Taxes can be classified by the method of its collection; Direct and Indirect Taxes.

Direct taxes refer to the taxes that are paid from the earnings or income and wealth of the individual while indirect tax is a tax on the transaction of products and services.

In this all-inclusive blog post, we are going to provide you all the information about most of the types of direct taxes prevalent in India along with their importance, structure and their role in the economy which no one else has been able to provide you till now.

- What are the Direct Taxes?

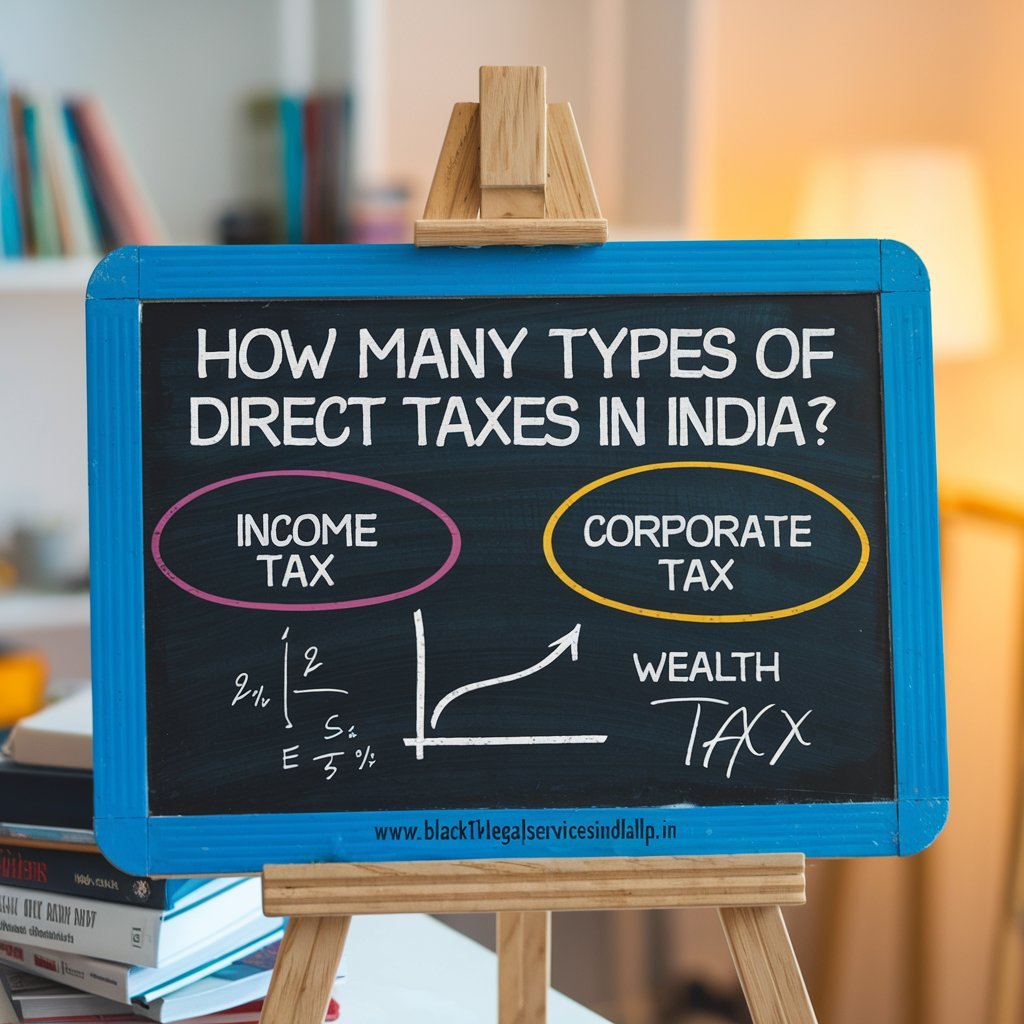

- How Many Types of Direct Taxes in India?

- What is the Concept of Income Tax?

- What is the Conception of Corporate Tax?

- What About the Capital Gains Tax?

- What is the Concept of Wealth Taxes?

- What is the Theory of Gift Taxes (Abolished and Reintroduced in a Different Form)?

- What is the Conceptualization of Securities Transaction Tax (STT)?

- What is the Explanation of Fringe Benefit Tax (FBT) (Abolished)?

- What is the Concept of Estate Duty (Abolished)?

- What is the Sales Tax?

- What is the Theory of Value-Added Tax?

- What is the Customs Duty?

- What is the Explanation of Service Tax?

- What is the Dividend Distribution Tax (DDT)?

- What is the Concept of Entitlement Tax?

- What is the Octroi Tax?

- What is the Minimum Alternate Tax (MAT)?

- What About the Estate Tax?

- In Conclusion

- FAQs

- Q1. What is the difference between direct and indirect taxes?

- Q2. How does the government use the revenue collected from direct taxes?

- Q3. Are there any direct tax incentives available for startups in India?

- Q4. What is the role of the Central Board of Direct Taxes (CBDT) in India?

- Q5. Can individuals get refunds on direct taxes?

What are the Direct Taxes?

Direct taxes are taxes that are levied directly on the income, property or capital of an individual or a company or business. These are direct taxes that are paid by the taxpayer to the government, and the tax cannot be shifted to other individuals.

The major significance of direct taxes is that they are made progressive where the taxable income is collected in proportion to the amount of income. This makes direct taxes very useful in matters related to achieving economic fairness and social justice.

How Many Types of Direct Taxes in India?

There are so many types of direct taxes in India which every taxpayer living in India should know about, so we have explained its total 16 types in detail below:

- Income Tax

- Capital gains Tax

- Corporate Tax

- Securities Transaction Tax

- Estate Tax

- Sales Tax

- Wealth Tax

- Value-Added Tax

- Customs Duty

- Gift Tax

- Service Tax

- Dividend Distribution Tax (DDT)

- Entitlement Tax

- Excise Duty

- Octroi Tax

- Minimum Alternate Tax (MAT)

What is the Concept of Income Tax?

We have described all the aspects of this income tax very well for all of you below so that you can get maximum information about it.

Definition

Income tax is the most well-known type of direct tax in India and it is paid by the income tax assessees. It is charged on the income received by the individuals, Hindu Undivided Families (HUFs), Partnerships, companies etc. It is charged on the level of income of an individual or an organization in a financial year starting from 1st of April to 31 st of March.

Categories of Income

Income is broadly categorized into five heads for taxation purposes:

- Salary: This refers to compensation which an employee receives from an employer in terms of wages, pensions and other remunerations.

- Income from House Property: This refers to income received from house property consisting of rents whether from lettable residential or business premises or from using own residence.

- Profits and Gains of Business or Profession: Production of income from operations of a business or in the practice of a profession.

- Capital Gains: Proceeds from the sale of fixed assets such as land, buildings or the disposal of securities for example, shares or debentures in the business.

- Income from Other Sources: This encompasses all other sources of income which have not been included under the above sections such as interests or dividend or winnings from a lottery.

Slabs and Rates

[As per the July 2024 budget announced by the Finance Minister of India Nirmala Sitharaman, many changes have been seen in the tax slabs. Hence, the tax slabs given below are entirely updated.]

The income tax system of India is also of a progressive nature, and there are different taxes for different income groups. For individual taxpayers below 60 years of age, the slabs for the financial year 2024-25 are as follows:

✦ 0 to 3 Lakh Rupees: NIL

✦ 3 to 7 Lakhs Rupees: 5%

✦ 7 to 10 Lakh Rupees: 10%

✦ 10 to 12 Lakh Rupees: 15%

✦ 12 to 15 Lakh Rupees: 20%

✦ 15+ Lakh Rupees: 30%

Exemptions and Deductions

It is seen that to minimize the tax burden on individuals the Income Tax Act of the country comes with several exclusions and allowances. Popular deductions include:

- Section 80C: Exemption in respect of expenditure on Provident Fund, Life Insurance, etc.

- Section 80D: Medical Premiums paid as Deductions.

- Section 24: As case in point, state as to deductions allowed on home loans, interest paid on home loans.

Impact on Individuals and Economy

Income tax is one of the major types of taxation through which the government tries to obtain its main revenue and redistribute the income.

As a result, it plans to increase the taxation rate for people with higher incomes to reduce the income gap.

If the individual understands and manages the income tax policies effectively, it can help in saving a lot of money and better income tax planning.

In lastly we would like to tell you income tax is the 1st type among of types of direct taxes in india 2024

What is the Conception of Corporate Tax?

We have described all the aspects of this corporate tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

Corporate tax is a type of direct tax that is levied on the taxable income or profits earned by a corporate body or business. Every entity operating in the territory of India, whether Indian or international, is liable to pay corporate tax on its income.

It is also important to understand that companies are taxed under a different structure than personal income tax and there are also different rates depending on the type of companies.

Tax Rates

For the financial year 2023-24, the corporate tax rates in India are as follows:

- Domestic Companies: The starting rate is 22%, and it can go up to 30% depending on the turnover and beyond. However, under Section 115BAA companies have the option to avail concessional tax at the rate of 22% without any deductions.

- Foreign Companies: Currently, foreign companies are given a tax rate of 40%, but it is adjusted depending on the type of income and DTAAs.

Impact on Business

It is an important determinant of investment, expansion and distribution of profits among corporate entities and thus has great importance in corporate income tax policy.

The government also changes the corporate tax structure and its policies from time to time to attract more foreign investments and develop indigenous businesses.

In lastly we would like to tell you corporate tax is the 2nd type among of types of direct taxes in india 2024

What About the Capital Gains Tax?

We have described all the aspects of this capital gains tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

Capital gains tax is a tax that is levied on the profit made from the sale of an asset that is held for personal use. Fixed assets include current assets such as; property, stocks, bonds, and other investments. The tax is levied only on the profit or profits that have been earned, not on the total value of the sale.

Types of Capital Gains

Capital gains are classified into two categories based on the holding period of the asset:

- Short-term Capital Gains (STCG): Others, current and non-current, investments and receivables, interest, dividends or any other gains that are held for a short period only.The holding period is different for each type of asset. For example, if we talk about equity shares, the holding period is less than one year or 12 months.

- Long-term Capital Gains (LTCG): Return on assets which are held for a more extended period of time. In the case of equity shares, the holding period is more than 12 months for a company.

Tax Rates

- Short-term Capital Gains: The gains calculated on the STCG are charged to tax at the income tax rates that apply to individuals. However, in the case of equity shares and equity-oriented mutual funds, the STCG tax rate is 15%.

- Long-term Capital Gains: Short-term capital gains arisen on the selling of equity shares or on the selling of mutual fund units where the units are of an equity oriented fund – are taxed @ 10% for the gains in excess of ₹ 1 lakh made in a financial year.For other such investments, the current Long Term Capital Gains Tax rate is 20%, along with the benefit of indexation.

Exemptions and Deductions

There are several exemptions available for capital gains under Section 54, Section 54EC and Section 54F, if the amount is to be used on purchase of new assets like buildings or bonds used for residential purposes as per the provisions of the Act.

Impact on Investors

This determines how investors transact in the real estate as well as stock markets. Investors’ buying and selling decisions are usually made in such a way that the amount of taxes payable is minimized and post-tax returns are maximized.

In lastly we would like to tell you capital gains tax is the 3rd type among of types of direct taxes in india 2024

What is the Concept of Wealth Taxes?

We have described all the aspects of this wealth taxes very well for all of you below so that you can get maximum information about it.

Overview

Article 10 was wealth taxes which was a direct tax under the head’ Net Wealth Taxes’ levied on individuals, HUFs and companies. It was applicable on the total carrying amount of all assets, tangible and intangible owned assets such as property, jewellery, vehicles, financial assets etc., less liabilities.

Abolition of Wealth Tax

This structure is too underwent changes and the major change was made in 2015 when wealth taxes was discontinued and replaced with a surcharge for the super-rich. This happened because of the need to abolish wealth taxes or streamline the tax system.

Impact of Abolition

The abolition of wealth taxes was applauded by taxpayers because of the eradication of costs that come with its implementation. But, for those who were earning very much, the implementation of a higher surcharge meant that such people were still able to pay their fair share to the government’s coffers.\

In lastly we would like to tell you wealth tax is the 4th type among of types of direct taxes in india 2024

What is the Theory of Gift Taxes (Abolished and Reintroduced in a Different Form)?

We have described all the aspects of this gift taxes very well for all of you below so that you can get maximum information about it.

Overview

Gift taxes in India was first introduced in 1958 and was levied on the value of gifts received by an individual. But this tax was abolished in 1998 because of bureaucracy and difficulties in implementing this tax.

Reintroduction in a Different Form

While the original gift taxeswas repealed, the Income Tax Act was supplemented to tax gifts in some instances.

Section 56(2)(x) was intended to tax any receipt which is in the nature of a gift and the value of which exceeds ₹50,000 within a financial year, but such receipt does not arise from a specified relative or on a specified occasion, including marriage.

Impact on Taxpayers

The current provisions make sure that there is taxation of wealth transfer through gifts hence eradicating issues to do with tax avoidance. People must understand these rules so that they would not be trapped in having additional tax obligations.

In lastly we would like to tell you gift tax is the 5th type among of types of direct taxes in india 2024

What is the Conceptualization of Securities Transaction Tax (STT)?

We have described all the aspects of this Securities Transaction Tax (STT) very well for all of you below so that you can get maximum information about it.

Definition and Scope

Securities Transaction Tax (STT) is a major piece of direct tax that is levied on the acquisition and disposal of securities listed on the stock exchanges of India.

This includes equity shares, derivatives and equity-oriented mutual funds. STT was proposed to establish efficiency in the taxation process of the financial market and to fight tax evasion.

Tax Rates

These rates depend on the type of security and transaction involved in the transfer process. For example: Delivery-based equity transactions: 0.0.1% on purchases and 0.1% on sales of goods in specified jurisdictions.

- Equity futures: 0.01% on sales.

- Equity options: 0.017% on sales.

Impact on Investors

Turbo charging has been adopted to simplify the taxation of the flows in the stock market as the tax is charged at the source by STT. Yet, it also raises the trading cost thus depressing the net returns in trading for investors.

In lastly we would like to tell you Securities Transaction Tax (STT) is the 6th type among of types of direct taxes in india 2024

What is the Explanation of Fringe Benefit Tax (FBT) (Abolished)?

We have described all the aspects of this Fringe Benefit Tax (FBT) very well for all of you below so that you can get maximum information about it.

Overview

The Fringe Benefit Tax (FBT) was formulated in India in the year 2005 with an intention to tax numerous benefits and privillege offered by employers to its employees. Some of the perks that were involved included entertainment, portion of share in the company, travel, and anything which was considered as an extra expense.

Abolition of FBT

The Fringe Beneficiary Tax (FBT) was abolished from the tax system in the 2009 Budget because it was described as costly and impractical for businesses, and there was difficulty in determining the value of benefits. Tax on fringe benefits now falls under the head of income tax salaries where it applies.

Impact of Abolition

The removal of FBT led to the rationalization of the tax system and a consequent decrease in compliance costs. This also made it the duty of the employees to declare the value of the fringe benefits in their income tax returns.

In lastly we would like to tell you Fringe Benefit Tax (FBT) is the 7th type among of types of direct taxes in india 2024

What is the Concept of Estate Duty (Abolished)?

We have described all the aspects of this Estate Duty very well for all of you below so that you can get maximum information about it.

Overview

The estate duty was a direct tax levied on the total wealth of a person at the time of his death, thereafter distributed among the beneficiaries. Its purpose was to avoid the accumulation of wealth and also to ensure that wealth transferred from one generation to the next was taxed.

Abolition of Estate Duty

Estate duty was abolished in India in 1985 because this type of taxation generated less revenue and was also very difficult to assess the tax. Since then, no direct tax has been levied on inheritance in India.

Impact of Abolition

The abolition of estate duty made it less complicated to transfer estates upon people’s death. However, it also reduced one of the primary sources of fiscal revenue for the government, and this tax has sparked debate about reintroducing it in a similar way.

In lastly we would like to tell you Estate Duty is the 8th type among of types of direct taxes in india 2024

What is the Sales Tax?

We have described all the aspects of this sales tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

Sales tax was a type of direct tax in the past that state governments levied on individuals who sold their goods within a given state. It was levied at the time of sale, and it was the seller’s responsibility to pay the tax, the burden of which was shifted to the buyer in most cases.

Tax Rates and Variability

Sales tax rates were generally very high and heavily dependent on the state, hence leading to a highly fragmented sales tax system. The same item has different prices in different states and some of these states include surcharge amounts on certain items.

Transition to Value-Added Tax (VAT)

In 2005 the Sales tax was eradicated and replaced by Most States with Value-Added Tax because of problems associated with evasion of tax and reduction of the complexities of taxation. VAT is also a Direct tax, but it is more systematic, and it helps to eliminate the tax on-tax problem.

Impact on Businesses and Consumers

The introduction of Value-Added Tax (VAT) eliminated the sales tax system, making the tax structure more transparent and straightforward. It also helped reduce the total amount of taxes paid by consumers, as there was no problem of ‘tax on tax’ associated with the sales tax system.

In lastly we would like to tell you sales tax is the 9th type among of types of direct taxes in india 2024

What is the Theory of Value-Added Tax?

We have described all the aspects of this value-added tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

Value-Added Tax is a form of direct tax that is levied on the value addition of goods at various processing stages. Though implemented in most Indian states in 2005, VAT was intended to replace the old sales tax structure that was considered to be full of loopholes in the new and tax evasion in the old days.

Tax Rates and Implementation

VAT is a state level tax and hence its rates vary from state to state. Some of the standard VAT rates are; 5%, 12%. In case of export of imported goods the rates range from 5%, 10% and 20% depending on the type of goods.

VAT rates are low on basic goods and services which are related to essential goods while VAT rates are high on luxury goods and services.

Transition to GST

Notably, VAT was integrated into GST in 2017, one of the largest indirect tax reforms worldwide, which eliminated federal, state and local taxes, such as VAT as well as excise duty and service tax. GST aims to constitute a common concept of taxation within the territory of India.

Impact on Buisinesses

VAT removed the problem that arose under sales tax, where there were multiple taxes on one product, and made the taxation system more clear. However, this has led to GST which has made the taxation process even more efficient for businesses due to the ease of tax compliance.

In lastly we would like to tell you Value-Added Tax is the 10th type among of types of direct taxes in india 2024

What is the Customs Duty?

We have described all the aspects of this Customs Duty very well for all of you below so that you can get maximum information about it.

Definition and Scope

On the other hand, customs duty is a direct tax that is levied on imports into India. The revenue generated by levying duty is also huge and another aspect through which domestic industries are protected is by making imported goods expensive.

Types of Customs Duty

On the other hand, customs duty is a direct tax that is levied on imports into India. The revenue generated by levying duty is also huge and another aspect through which domestic industries are protected is by making imported goods expensive.

- Basic Customs Duty (BCD): The amount of external customs duty levied on imported goods.

- Countervailing Duty (CVD): As far as the tendency of taxpayers to avoid tax is concerned, they make up for it by purchasing similar domestic products at a lower price by levying excise duty.

- Anti-Dumping Duty: It is imposed to protect local industries against below-average export prices of goods coming from other countries.

- Social Welfare Surcharge: An additional duty will be levied on customs duty to raise funds for social welfare programmes.

Impact on Trade and Economy

Among the many factors that affect trade relations, customs duty is central to formulating India’s trade policies. One way to control imports and exports is by changing customs duty rates which also helps protect domestic industries and obtain the necessary revenue.

In lastly we would like to tell you customs duty is the 11th type among of types of direct taxes in india 2024

What is the Explanation of Service Tax?

We have described all the aspects of this service tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

In our country, India, a direct tax known as “Service Tax” was imposed on service providers, which was quite prevalent in the past.

When it was first implemented by the Government of India in 1994, it was applicable on many different services like banking, telecommunications and hotels. Which was very useful in increasing the government revenue.

Tax Rates

Over time, the rate of service tax in India has been increased from 5%. Then, with the introduction of Swachh Bharat and Krishi Kalyan Cess, the rate of service tax was increased to 15% by the Indian Government by 2016.stries and obtain the necessary revenue.

Transition to GST

In our country India, in 2017, service tax was included in the Goods and Services Tax (GST). Under this, all services coming within the country are subject to GST taxes, which vary depending on the type of service and range from an average 5% to 28%.

Impact on the Service Industry

The implementation of service tax in our country India has seen a substantial increase in the government revenue of the country as it has completely included a very large part of the service industry in the tax net.

Due to the complete simplification of the overall taxation process with the implementation of GST, now equal tax rates are applicable on all types of goods and services.

In lastly we would like to tell you services tax is the 12th type among of types of direct taxes in india 2024

What is the Dividend Distribution Tax (DDT)?

We have described all the aspects of this Dividend Distribution Tax (DDT) very well for all of you below so that you can get maximum information about it.

Definition and Scope

Dividend Distribution Tax (DDT) is considered to be a type of direct tax that is imposed on certain dividends paid by a business to its owners.

The primary purpose of introducing it was to ensure that a business is entitled to pay tax on the entire profit paid to its owners so that the government revenue can be increased.

Tax Rates

In our country India, DDT was implemented at a fixed rate of 15% on the gross amount of all types of dividends declared, paid or distributed by the corporation of the country. At that time, keeping in mind the surcharge and cess, the effective DDT rate was maintained at around 20.56% only.

Abolition of DDT

DDT was abolished in India and the responsibility of paying dividend tax was completely transferred to the shareholders in the Union Budget 2020. Therefore, now tax is levied on dividends in the hands of the beneficiaries at the applicable income tax slab rates.

Impact on Shareholders and Companies

The abolition of the Dividend Distribution Tax (DDT) has dramatically simplified corporate taxation, but it has also significantly increased tax obligations for all types of owners with high incomes. However, now double taxation on business income has also been completely eliminated.

In lastly we would like to tell you Dividend Distribution Tax (DDT) is the 13th type among of types of direct taxes in india 2024

What is the Concept of Entitlement Tax?

We have described all the aspects of this entitlement Tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

An entitlement tax is a direct tax imposed on specific benefits or rights enjoyed by people or organizations, whether or not commonly applied in India.

While its application and extent may vary depending on the particular legal framework created by the Indian government, it can now be extended to certain categories of assets or income.

Impact and Relevance

If implemented, entitlement taxes would likely target all types of sources of income or benefits that are currently wholly exempt from taxation under other tax categories.

This could also include many types of business or social benefits. With the aim of assuring equitable taxation of all income and benefits, the adoption of such a tax could potentially result in a significant increment in the tax base.

In lastly we would like to tell you Entitlement Tax is the 14th type among of types of direct taxes in india 2024

What is the Octroi Tax?

We have described all the aspects of this Octroi Tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

A local government’s direct tax on commodities entering a city or municipal bounds was called an octroi. In order to raise money for municipal organizations, it was a type of local taxation.

Abolition and Transition

With the enactment of the Goods and Services Tax (GST) in 2017 in India, most states in the country abolished octroi completely. Then, with the creation of a single tax structure, GST implemented by the Indian government has essentially eliminated many types of municipal and state taxes, including octroi.

Impact on Trade and Transportation

By removing barriers to the unrestricted flow of products across multiple countries, the repeal of octroi has created a much more streamlined and consistent marketplace. Both businesses and consumers have benefited from reduced logistics and transportation costs.

In lastly we would like to tell you Octroi Tax is the 15th type among of types of direct taxes in india 2024

What is the Minimum Alternate Tax (MAT)?

We have described all the aspects of this Minimum Alternate Tax (MAT) very well for all of you below so that you can get maximum information about it.

Definition and Scope

All types of companies that can reduce their tax liabilities to zero or near zero by using the exclusions, deductions and incentives of the Income Tax Act are subject to Minimum Alternate Tax (MAT), which is considered a direct tax. MAT mandates certain entities to pay a minimum tax to the Government of India.

Tax Rate

The Government of India has made a provision to assess MAT at 15% of the overall book profit of the entire company. As per the Companies Act, book profit is the net profit after specific adjustments which is fully reflected in the profit and loss statement of a business.

Credit for MAT

All types of businesses paying MAT have a grace period of up to 15 years to carry forward and deduct MAT credit from average taxes. If a company’s tax liability increases significantly in the future, this guarantees that the tax paid as MAT will be fully available for use.

Impact on Businesses

By fully utilizing proactive tax planning, MAT completely prevents businesses from evading tax liabilities. It promotes tax justice by guaranteeing that all types of companies pay their fair share into our public coffers.

In lastly we would like to tell you Minimum Alternate Tax (MAT) is the 16th type among of types of direct taxes in india 2024

What About the Estate Tax?

We have described all the aspects of this Estate Tax very well for all of you below so that you can get maximum information about it.

Definition and Scope

This tax, also known as estate tax, inheritance tax or death duty, is levied on the entire value of the overall property of a deceased person before it is transferred to his heirs.

The primary purpose of this tax was to ensure that all property transfers between generations were taxed and to prevent wealth from being wholly concentrated in the hands of a limited number of people.

Abolition of Estate Tax

Our country India decided to completely abolish estate tax in 1985 itself as a result of its inefficient use and difficult management. And India has never imposed a direct inheritance tax since that time.

Impact of Abolition

The process of transferring property after death was greatly simplified by eliminating estate taxes. But the tax completely eliminated a potential revenue source for the state, leading to ongoing debate over whether such a tax should be reintroduced.

In lastly we would like to tell you Estate Tax is the 17th type among of types of direct taxes in india 2024

In Conclusion

Direct taxes are the most critical factor in determining India’s economy. They not only give the government the money it needs to finance most public services and other infrastructure, but they are also actively used in the fight against inequality by distributing most of the wealth.

Information about the various forms of direct taxes and their consequences is very helpful in assisting the general public and especially corporate entities to coordinate their actions in a way that does not violate the country’s tax laws.

Therefore, one can anticipate that with the further development of the Indian economy and its progressive integration into the world economy, the Indian tax system will also undergo constant changes and face new challenges in the world economy.

FAQs

Q1. What is the difference between direct and indirect taxes?

A1. Direct taxes are levied directly on the income or wealth of individuals or organizations, such as income tax and wealth tax. Indirect taxes, like GST, are imposed on goods and services and are collected by intermediaries (like retailers) from consumers.

Q2. How does the government use the revenue collected from direct taxes?

A2. Revenue from direct taxes is mainly used to finance public services such as infrastructure, education, healthcare, and defense. It also supports welfare programs and helps reduce the fiscal deficit.

Q3. Are there any direct tax incentives available for startups in India?

A3. Yes, the Government of India offers various direct tax incentives to startups, including tax holidays, lower corporate tax rates, and exemption from certain types of income taxes, especially for startups recognized under the Startup India initiative.

Q4. What is the role of the Central Board of Direct Taxes (CBDT) in India?

A4. The CBDT is responsible for administering direct tax laws in India, including the formulation of policies, supervision of tax collection, and ensuring compliance with tax regulations.

Q5. Can individuals get refunds on direct taxes?

A5. Yes, if a person has paid more tax than their actual liability (for example, through advance tax or TDS), they can claim a refund. Refunds are processed by the Income Tax Department after verifying the tax returns filed by the taxpayer.

Add a Comment