The idea of wealth taxes, which the Indian government derives from the principle of equality, has been a topic of much discussion among policymakers and intellectuals across the world.

In India, while considering the fiscal policies of the country, the idea of equity stake of the rich minority to finance the poor majority with the help of taxes has been discussed many times.

While wealth taxes in India was abolished in 2015 itself, it remains a matter of great importance whether wealth taxes was really relevant or not, what were the consequences of its removal and whether it can always be brought into practice once again.

This blog post will attempt to discuss the concept and implementation of wealth taxes in India, the debate about removing and reintroducing this instrument, and provide you all with all the information about wealth taxes that no one else has been able to provide you.

- What are the Wealth Taxes in India?

- Which Types of Assets Subject to Wealth Taxes?

- What is the Historical Context of Wealth Tax in India?

- What are the Significance Aspects of Wealth Taxes?

- What are the Challenges in Implementing Wealth Taxes?

- What is the Threshold of Wealth Tax?

- What are the Exemptions of Wealth Taxes in India?

- What are the Wealth Tax Provisions?

- What is the Method of Wealth Tax Calculation?

- Who was Liable to Pay Wealth Tax in India?

- What is the Abolition of Wealth Tax in 2015?

- What are the Alternatives to Wealth Tax?

- What are the Differences Between Income Tax and Wealth Tax?

- In Conclusion

- FAQs

- Q1. Was there any tax that replaced wealth tax in India after its abolition?

- Q2. Why was the wealth tax abolished in India?

- Q3. How do other countries handle wealth taxes?

- Q4. Could a wealth tax discourage investment?

- Q5.Is there any current movement or proposal to reintroduce wealth tax in India?

- Q6. What assets were exempt from the wealth tax when it was in place?

What are the Wealth Taxes in India?

Wealth taxes is included in the category of direct tax which means a tax that is levied on the total net worth of an individual, HUF or company.

Unlike income tax which is levied on the income generated in any financial year, wealth taxes is levied on the value of the property at the beginning of the financial year.

Wealth taxes is a principle designed to make those who have a lot of money contribute more to the development of the country thereby making the wealth distribution more proportionate.

Which Types of Assets Subject to Wealth Taxes?

Wealth taxes in India are generally levied on the market rates of specified assets. In the Indian context, before the abolition of wealth tax, wealth taxes were imposed on the property of all individuals residing in the country. We have mentioned some of the wealth types in detail below:

- Residential and commercial real estate: These include houses, flats etc. Any building that was used for residential purposes except business.

- Jewelry and valuable collectibles: This includes gold, silver, stones, or other precious metals.

- Cars and other vehicles: Except those used for commercial purposes.

- Yachts, boats, and aircraft: If used for personal purposes.

- Cash in hand: Beyond a certain limit.

- Urban land: Vacant land situated in urban areas.

[However, it is pertinent to mention here that certain assets were not subject to wealth taxes; these included agricultural land, stock-in-trade, and other immovable property used for business or profession.]

What is the Historical Context of Wealth Tax in India?

Wealth taxes was first introduced in India in 1957 under the Wealth Tax Act 1957. It was one of a series of tax bills introduced in Kenya in the early years of its independence aimed at addressing perceived economic imbalances.

It was intended to collect tax from people and companies that had sufficient wealth and reinvest it in building new rail networks, schools, hospitals and other essential public amenities.

At first, the tax rates were quite reasonable, although the structure was changed several times over the years. Property tax was another source of revenue that grew in importance for the government over time.

However, the tax was generally considered inconvenient to administer, leading to tax evasion and under-declaration of property.

What are the Significance Aspects of Wealth Taxes?

Wealth tax was a tax that was levied on the value of specified types of assets every year or on the date of any relevant event. It was applicable to all individuals, Hindu Undivided Families (HUFs), and companies alike. Its primary purpose was to achieve noble goals like redistribution of wealth to address the issue of inequality and social justice by taxing billionaires. Some of its important aspects are as follows:

- Redistribution of Wealth: Wealth taxes was always used as a means of regulating purchasing inequalities in the society. To eliminate the inequality within the population and ensure that the section of the society which has more liquid assets contributes more to the economy of the nation, it proposed to levy a direct tax on wealthy individuals and corporates to get their rich share.

- Encouragement of Productive Investment: This tax forced all wealthy people and companies to invest their money in productive capital assets like businesses or stocks rather than in illiquid assets like real estate or flashy assets.

- Revenue Generation for the Government: While the revenue from wealth taxes was insignificant in comparison to income tax or corporate tax, it was one more extra stream of income for the government.

- Compliance and Reporting Requirements: The wealth taxes had a lot of compliance and reporting requirements and ensured that taxpayers disclosed their true worth. It also helped curb the activities of companies involved in shady deals in financial transactions and tax evasion.

- Support for Social Justice: The rationale for wealth taxes was based on socio-economic equality, as it was aimed at collecting a fair share of taxes from the rich. This was in line with other objectives such as poverty alleviation, social security, and coordinated structural development of the country’s economy.

What are the Challenges in Implementing Wealth Taxes?

While implementing it in our country, India, the Indian government had to face many challenges, which ultimately resulted in a huge decline in its effectiveness. Therefore, we have disclosed all its challenges in front of you all below:

- Complex Valuation Process: The market value of tangible fixed assets such as property, plant and equipment, particularly jewellery, was difficult to estimate and relative valuation standards were unattainable. Litigation over valuation of properties was common, leading to delays in collection of taxes.

- Administrative Burden: However, the administrative cost of setting up and implementing the property tax was relatively much more expensive than its revenue receipts. Due to the major drawbacks of the concept of property tax, tax officials have to use a lot of effort and time for the process of assessment, verification and collection of property tax, which is inefficient.

- Widespread Evasion: It was common for many taxpayers to undervalue their assets or even not declare them to avoid paying wealth taxes. This was because the World Trade Organization (WTO) rules needed a robuststronger enforcement system that could address these problems.

- Double Taxation: Some viewed the estate tax as a double tax because all items subject to the estate tax were purchased with income that had already been taxed. This perception made the tax unpopular among the wealthy, and they campaigned to reduce or eliminate it.

What is the Threshold of Wealth Tax?

Before 2015, wealth taxes in India was applicable to individuals, Hindu Undivided Families (HUFs), and all types of companies whose net wealth was above a specific limit. Hence, we have summarized the key details below for you all to understand in detail:

- Threshold Limit: Wealth taxes in India were levied on all net worth exceeding Rs 30 lakh (Rs 3 million). The overall calculation of net worth was done by subtracting any debts outstanding on those assets from the total value of the specified assets.

- Rate of Tax: The overall rate of Wealth Taxes was 1% of the total wealth above the limit of ₹30 lakh. To understand this, let us take an example like if a person has a total wealth of ₹50 lakh, then the wealth taxes payable will be 1% of ₹20 lakh (₹50 lakh – ₹30 lakh), which is equal to ₹20,000.

What are the Exemptions of Wealth Taxes in India?

Wealth taxes in India provides exemptions for all types of assets to encourage the productive use of assets and reduce administrative complexity to a great extent; hence, below, we have explained all the exemptions of this tax in detail:

- One Residential Property: An individual or a Hindu Undivided Family (HUF) could claim a residence in India as self-acquired property and it was exempted from wealth taxes. This exemption was introduced to allow all taxpayers to offset the tax on their main home.

- Productive Assets: This is only aimed at relieving taxpayers through excused wealth taxes on items considered as producing income or being capital assets. These included:

- Commercial properties: Properties used for business or properties that are rented out for more than 300 days in a year.

- Agricultural land: Every plot of land used for agricultural purposes in India was exempt from property tax to encourage farming and development of the country.

- Stocks, mutual funds and financial investments: Exemptions were given for shares, mutual funds, bonds, fixed deposits and other types of instruments in the financial market to encourage investments.

- Property held for business: Any property or asset that was used for business or professional purposes was excluded if it was not a guest house or office building.

- Farmhouses and Rural Land: Farmhouses falling within a specific radius of the local municipal boundary were exempted from property tax; any building located more than 25 km away from the municipal boundary that could be considered a farmhouse was eligible for exemption. Freely cultivable land outside urban areas was also excluded.

- Cash in Hand: Under the personal wealth taxes, in case of individuals and HUFs, cash up to Rs 50,000 was exempted from wealth taxes by the Government of India.

What are the Wealth Tax Provisions?

You must have read a while back that Wealth taxes in India was governed by the Wealth Tax Act, 1957. So this act had specific provisions that quite directly defined how the tax is levied, collected and administered. Hence, we have given a detailed description of some of its provisions below.

- Definition of NET Wealth: Wealth taxes was levied at the rate of 1%on the ‘net wealth’ of an individual, Hindu Undivided Family, or company on a notional amount assessed as of March 31 of the year following the previous assessment year.

- Net wealth was calculated as the sum of all the specific assets owned on a particular valuation date minus any outstanding liabilities on each of these assets.

- Valuation Date: Wealth tax was computed by reference to the value of the assets owned by a taxpayer as on the valuation date which was the end of the immediately preceding financial year i.e. 31 st March.

- Filing of Wealth Tax Returns: A person whose net wealth exceeded the specified limit had to file a wealth tax return. This return had to be filed annually along with the income tax return; in the prescribed form, called ‘Form BA’.

- Assessment and Payment: The territorial formations included the wealth tax department, which was appointed to assess wealth tax returns. If discrepancies were found or the taxpayer did not file the return, the department could issue a notice for reassessment or impose a penalty.

- Penalties and Interest: If a taxpayer failed to pay wealth tax or filed a wrong return, he was charged a penalty. Such penalties were fines for not filing returns or under-declaration of assets or for not filing returns within the specified time. They also charged interest on payments which were not made in time.

- Powers of Wealth Tax Authorities: Wealth tax officers were given certain powers under the provisions of the Wealth Tax Act; such as power to call for information, power to summon taxpayer, power to inspect accounts and power to make and revise assessment/reassessment.

- Powers of Wealth Tax Authorities: Appeals and Disputes: Taxpayers had the exclusive right to appeal against the assessment or penalty imposed before the Commissioner of Wealth Tax (Appeals) or the higher appellate authorities, which were Income Tax Appellate Tribuna (ITAT)s.

What is the Method of Wealth Tax Calculation?

Wealth tax in India was based solely on the net wealth of all individuals, HUFs, or companies who have the net wealth mentioned below. Here is a simplified description of wealth tax calculation:

- Determine net wealth: Net wealth means the total value of all taxable assets owned on the valuation date, usually March 31, less the amount of any outstanding liabilities relating to the assets.

- Identify taxable assets: Assets subject to tax were houses, not self-occupied, motor cars, jewelry, jewelry, yachts, boats, aircraft (except when used for business), urban land, and cash over ₹50000 for individuals and HUFs.

- Apply for exemptions: The following assets were not admissible as wealth tax:

- One self-occupied residential house, agricultural land, commercial building, financial securities such as shares and debentures, business premises and stocks, and Jewellery for business.

- Calculate the Value of taxable assets: The market value of individual taxable assets was then ascertained, often as per government regulations or from a recognized professional valuer.

- Deduct Debts: Here, debts included all taxes and other dues that were directly reduced from the taxable Value, such as loans taken against cars, etc., which were deducted from the net worth to get the net wealth.

- Applicable Limit and Rate: When the net wealth was more than ₹ 30 Lakh (30,000,00 INR), the wealth tax was one percent. In other words, there was no minimum lower limit, but if the net wealth was less than this figure, no wealth tax was payable.

Here is an Example of Wealth Tax Calculation

A self-occupied residential property (₹ 70 lakhs exempt), the second residential property (₹ 50 lakhs), motor car (₹ 10 lakhs), jewelry (₹ 15 lakhs) and cash in hand (₹ 60 Thousands). Some of the liabilities present are home loans on the second property worth ₹20 lakhs:

- Taxable Assets: Property 2 – ₹ 50 lakhs, motorcar – ₹ 10 lakhs, Jewellery – ₹ 15 lakhs, cash– upto ₹ 50000 exempted and for ₹ 50001 to ₹ 100000, 20% of the amount over ₹ 50000 shall be paid.

- Total Value: ₹75,10,000.

Net Wealth After Liabilities: ₹ 55,10,000/- (after deducting ₹ 20 lakhs loan). - Taxable Amount Above Threshold: ₹25 10 000 (applicable where a person’s net wealth is over ₹30 lakhs).

- Wealth Tax Payable: With reference to the above examples, 1% of the amount ₹25 10 000 = ₹25 100.

Who was Liable to Pay Wealth Tax in India?

We have written in detail below about who can pay property tax in India:

Who was liable to pay wealth tax in India?

- Individuals: In our country, wealth tax was payable by all those who had assets above the threshold limit. Non-residents were required to pay tax only on assets located in India, although it included both residents and non-residents.

- Hindu Undivided Families (HUFs): HUFs were required to pay wealth tax based on the net wealth of the family residing in India. To determine the taxable wealth, they were required to take into account the wealth of the entire family.

- Companies: Wealth tax was payable on net wealth, which included a large number of non-productive assets, for all companies, both Indian and foreign (for properties located in India).

What is the Abolition of Wealth Tax in 2015?

Due to these various drawbacks of wealth tax, the Indian government decided to abolish this tax system in its Union Budget for the financial year 2015-2016.

This move was announced by the then Finance Minister Arun Jaitley, who said that the existing wealth tax has become a burden for both the taxpayer and the tax administration and is not generating much revenue.

Introduction of a Surcharge

To cover the cost of abolishing the wealth tax, the government introduced a surcharge of 2% on people with taxable income above ₹ 1 crore.

This surcharge was added to the income tax amount, which was supposed to generate more revenue than the earlier wealth tax.

Impact of Abolition

The proposed law to repeal the wealth tax was received positively by most business organisations and wealthy people who complained that this method of taxation reduces the number of working-class tax compliant.

However, critics pointed out that it eliminated a major way of tackling inequality, and hence, the income supplement was not enough to make up for the wealth tax.

What are the Alternatives to Wealth Tax?

The government of our country has presented many alternatives to wealth taxes; we have mentioned them in detail below:

- Capital Gains Tax: One way to tax wealth without imposing a wealth tax is to increase the capital gains tax already in place, particularly when it relates to long-term investments in real estate and financial equities.

- Inheritance Tax: The restoration of the inheritance tax in India, abolished in 1985, is another potential way to tax wealth transfer and achieve the goal of reducing inter-generational inequality.

- Luxury Taxes: For example, taxes on luxury goods and services, imported cars, expatriate housing, expensive land, and buildings, Jewellery, foreign wines, and spirits, etc., can create a gap between the consumption of the rich and the poor without addressing the issue of wealth.

- Property Taxes: Another method of wealth taxation that may require advanced construction at the state and local levels is through property taxes, with a focus on properties in urban centers given their potential for higher valuations.

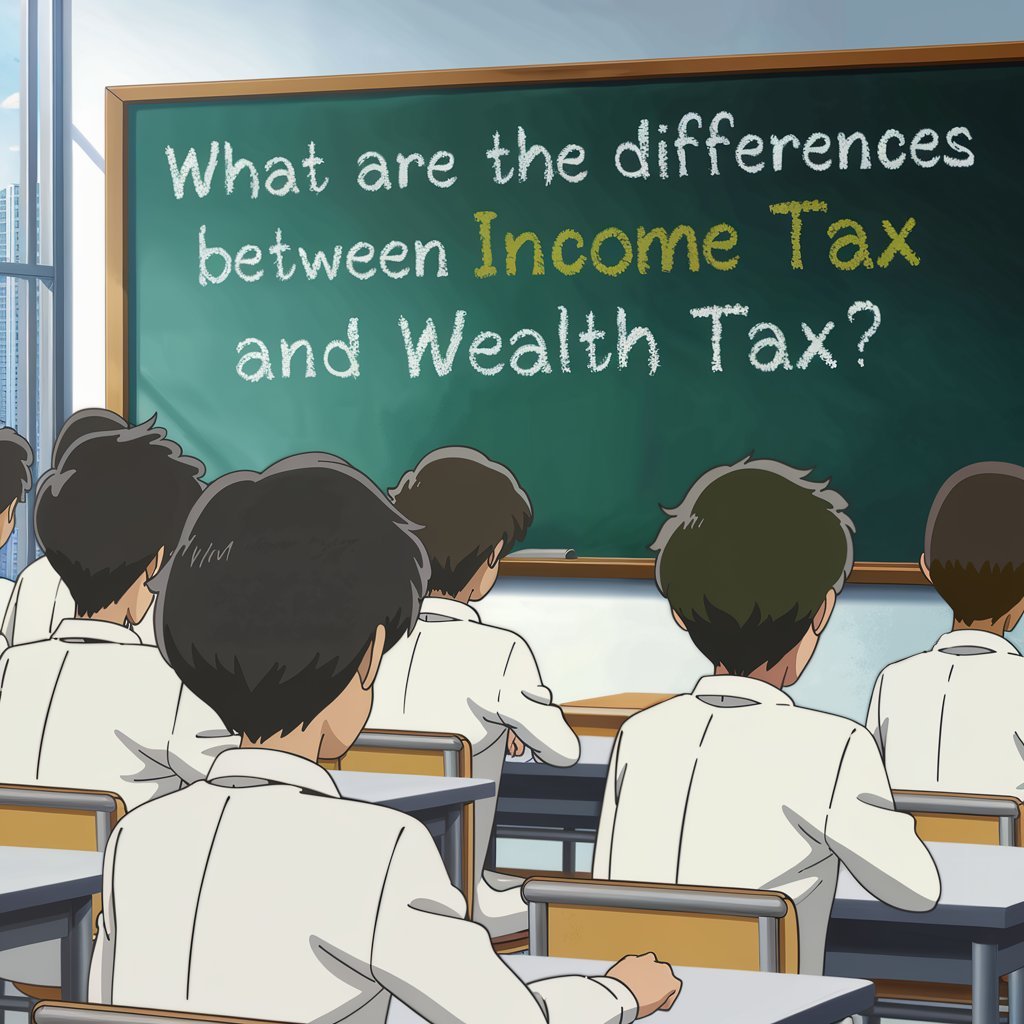

What are the Differences Between Income Tax and Wealth Tax?

There are lots of differences between income tax and wealth tax which we explained below in detailed table:

| Aspect | Wealth Tax | Income Tax |

|---|---|---|

| Basis of Taxation | Levied on the market value of owned assets | Levied on the income earned during a financial year |

| Taxed on | Net wealth (total assets minus liabilities) | Earnings such as salary, business profits, interest |

| Frequency | Annual tax based on assets owned at the end of the year | Annual tax based on income earned throughout the year |

| Applicability | Applied to individuals, HUFs, and companies | Applied to individuals, HUFs, companies, and other entities |

| Primary Goal | To tax accumulated wealth and reduce inequality | To tax earned income and generate government revenue |

| Exemptions | Certain assets like agricultural land were exempt | Various exemptions like deductions under Section 80C |

| Tax Rates | Usually lower and could be progressive | Can be progressive, with higher rates for higher incomes |

| Current Status in India | Abolished in 2015 | Still in effect and a major source of government revenue |

| Challenges | Complex asset valuation, high administrative costs | Tax evasion, complex filing requirements |

| Common Criticisms | Viewed as double taxation and discouraged investment | Perceived as burdensome, particularly for higher income brackets |

In Conclusion

Issues relating to wealth tax, in particular, are at the center of a huge global discussion on the use of taxes to address inequality, equality, and development objectives, especially in the diverse welfare models of different countries.

Although the government abolished wealth tax in the year 2015 with the aim of simplifying the tax structure with fewer administrative complexities, the growing inequality in the country has kept the debate on wealth tax alive.

If the Indian government decides to reintroduce a wealth tax, it must first design the tax in such a way that it serves the dual goals of equity and efficiency;

it must also immediately focus on how to implement this tax effectively and finally how to publicise the benefits of this tax. Instead, the government can consider other ways to increase the wealth gap and get the necessary funds.

In the end, we hope that everyone will not face any kind of complexity while reading this blog, because we have written this blog of wealth taxes in very simple words with very good research and analysis.

FAQs

Q1. Was there any tax that replaced wealth tax in India after its abolition?

A1. Yes, a surcharge on the income of the super-rich was introduced to compensate for the revenue loss after wealth tax was abolished.

Q2. Why was the wealth tax abolished in India?

A2. Wealth tax was abolished due to its limited revenue generation, high administrative costs, and widespread evasion.

Q3. How do other countries handle wealth taxes?

A3. Countries like Switzerland and France have had wealth taxes, but their experiences vary. Switzerland has had more success due to its lower rates and efficient administration, while France faced challenges like tax evasion.

Q4. Could a wealth tax discourage investment?

A4. Some argue that a wealth tax might lead to capital flight, where wealthy individuals move their assets to countries with more favorable tax laws.

Q5.Is there any current movement or proposal to reintroduce wealth tax in India?

A5. While not officially proposed, the reintroduction of wealth tax is a topic of ongoing debate among economists and policymakers in India.

Q6. What assets were exempt from the wealth tax when it was in place?

A6. Exemptions included agricultural land, stock-in-trade, and property used for business purposes, among others.

Add a Comment